International Economics Zusammenfassung#

Definitions#

Global Trade: Sum of trade activities both within and between countries

Types of Trade:

intraregional Trade |

interregional Trade |

|---|---|

between members of economic integration space (EU, USA, country) |

between different economic spaces |

Foreign Trade: trade relations across borders

Foreign Trade Theory: explanation of occurence / impacts of foreign trade

Reasons for trade:

cost benefits

expansion of range

More availibility of goods

Gravity Model#

Amount of Trade between two countries

other Factors

Geography

cultural affinity

borders

multinational corp

Ricardo Model#

Assumptions#

one factor: labor

differing productivity across countries

supply = constant

two goods (e.g cheese and wine)

wage = price of output

Definitions#

amount of labor to produce a good: \(a_{LGood}\)

wage = \(\frac{ P_C }{a_{LC}}\)

Production Possibility Frontier = line

maximum amount of goods, producible by fixed input of factors

\(a_{LC}Q_C + a_{LW}Q_W\)

opportunity costs: \(\frac{ a_{LC} }{a_{LW}}\) = O.C of cheese

relative price: \(\frac{ P_C }{P_W}\) of cheese

Trade#

absolute advantage: country produces good with lower factor inputs

comparative advantage: country produces good with lower opportunity cost

Trade = possible when country has comp. advantage, not just absolute advantage!

O.C and Relative prices |

who produces cheese? |

|---|---|

\(\frac{ P_C }{P_W} < \frac{ a_{LC} }{a_{LW}}< \frac{ a_{LC}^* }{a_{LW}}^*\) |

Nobody |

\(\frac{ a_{LC} }{a_{LW}} \le \frac{ P_C }{P_W}< \frac{ a_{LC}^* }{a_{LW}}^*\) |

Home Country |

\(\frac{ a_{LC} }{a_{LW}}\le \frac{ P_C }{P_W}= \frac{ a_{LC}^* }{a_{LW}}^*\) |

Home Country + partly foreign country |

\(\frac{ a_{LC} }{a_{LW}}< \frac{ a_{LC}^* }{a_{LW}}^* < \frac{ P_C }{P_W}\) |

both countries completely |

Results of Trade#

Misconception |

Reality (in this Model) |

|---|---|

Trade only good for productive countries |

unproductive countries = lower wage = advantage |

Trade exploits less productive countries |

better than without, cheaper goods |

trade only good for low wage countries, not high wage |

increase wage in efficient industry in high wage country |

Specific Factors Model#

Assumptions#

3 factors (land, capital, labor)

labor = mobile

capital / land = specific to good

two goods / industries

Food = labor + land

Cloth = labor + capital

perfect competition + full employment

countries differ by many things (productivity, endowments etc.)

Definitions#

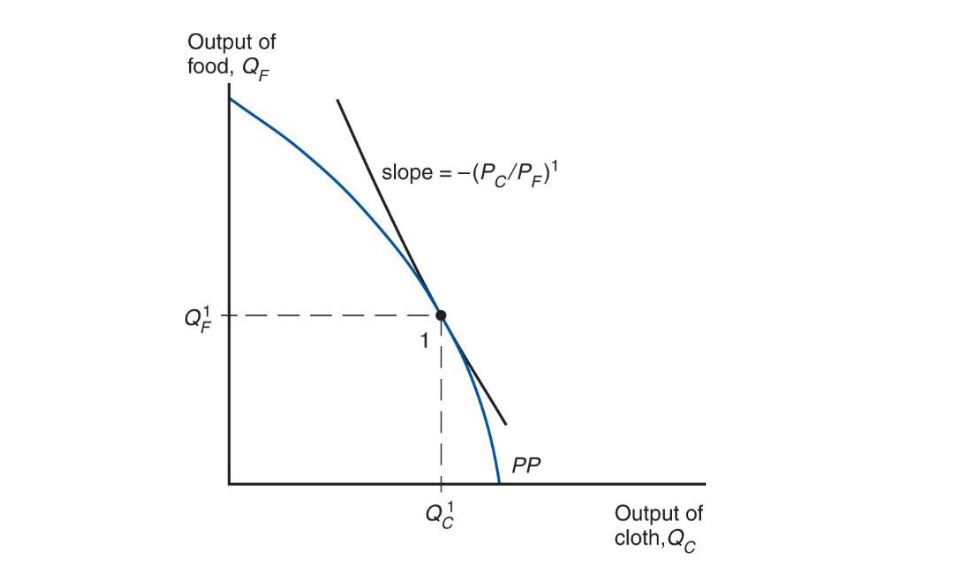

PPF = curve

diminishing returns when concentration in one industry

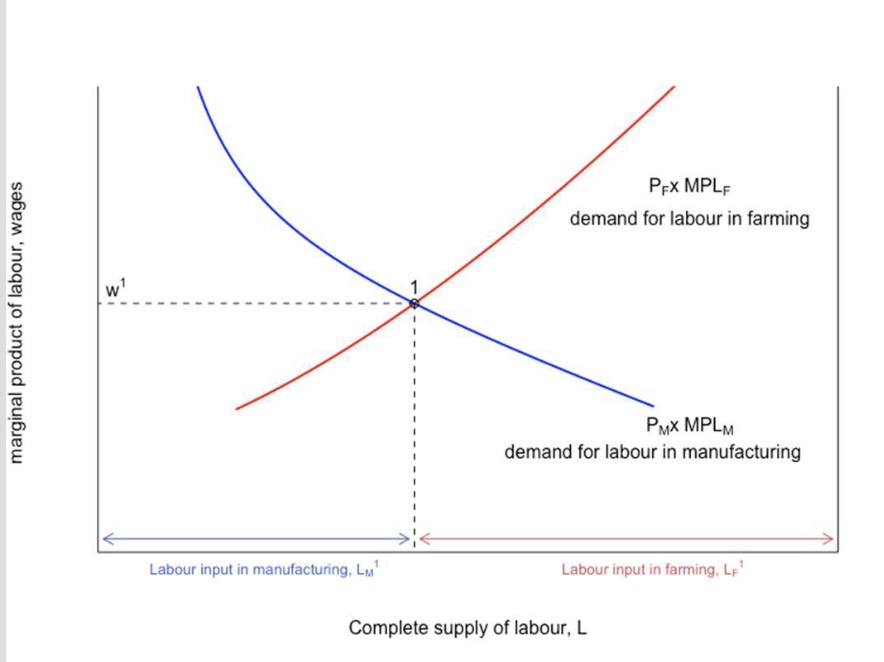

Marginal Product of Labor \(MPL\) = diminishing

Marginal value = wage = \(P_F \times MPL_F\)

PPF |

Allocation of Labor |

|---|---|

|

|

Trade#

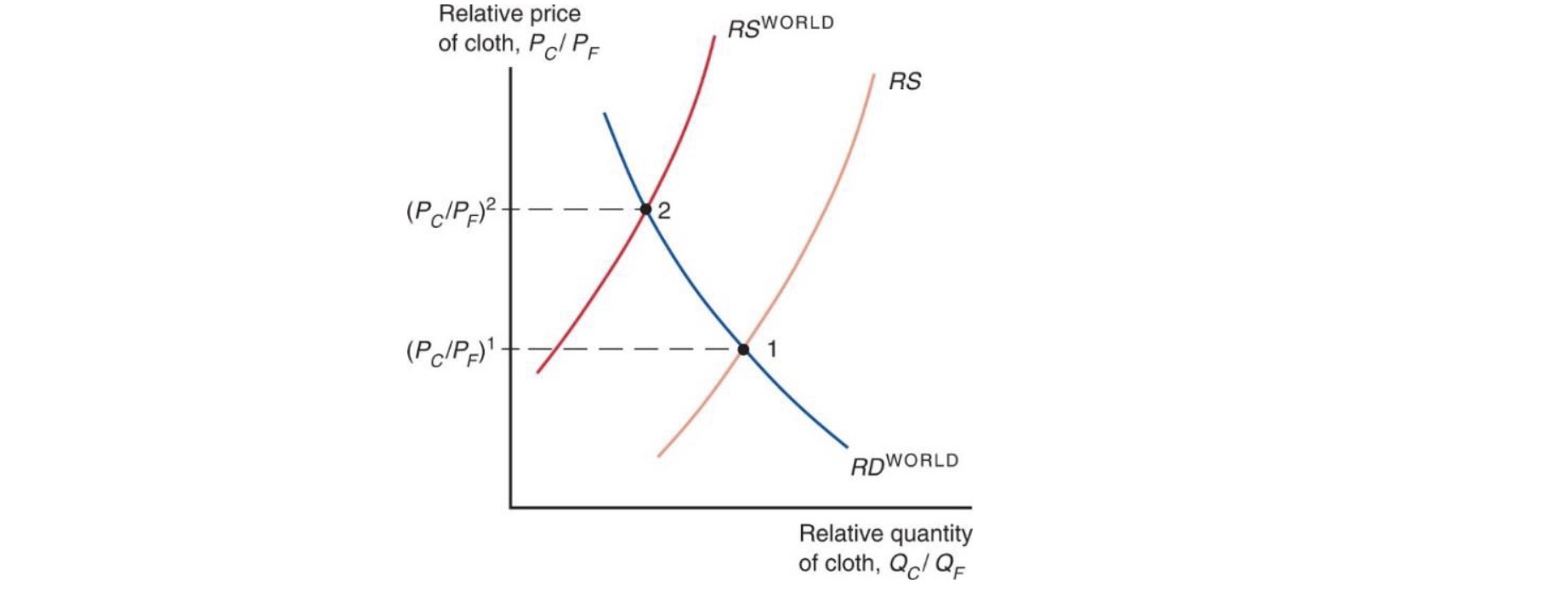

Amount of Goods traded depends on relative Supply supplied: \(RS = \frac{ Q_C * Q_C^* }{Q_F* Q_F^*}\)

Situations:

relative quantities |

Result |

|---|---|

\(RS_{home} < RS_{world}\) |

\(\implies P \uparrow, Q \downarrow\) |

\(RS_{home} > RS_{world}\) |

\(\implies P \downarrow, Q\uparrow\) |

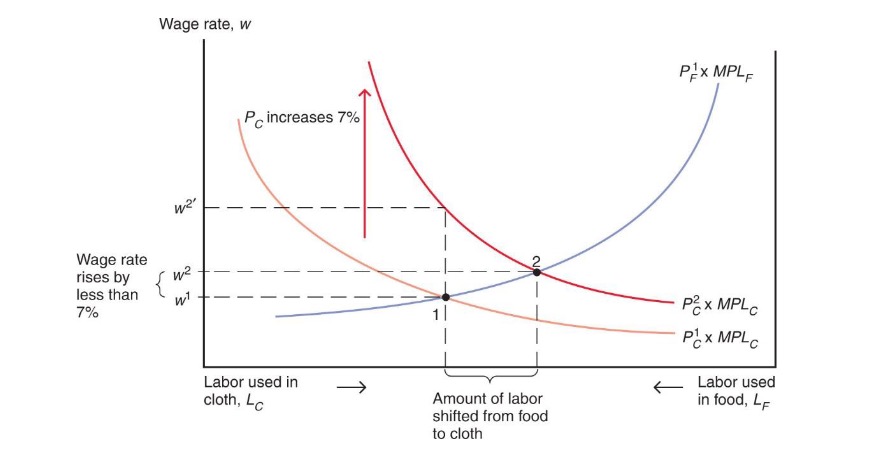

Results of Trade#

Example: Price rises of Cloth

Output rises

capital owners profit

labor shifts from food to cloth

wage does not rise as much as price (%)

worker profit = depends on preferences

Results depend on if sector is export or import sector

Budget Constraint above PPF = achievable

Heckscher-Ohlin Model#

Assumptions#

two goods (food and clothing)

two factors = mixed across goods

free capital / labor mobility

countries only differ by endowments

Definitions#

Production of Good depends on Production Function \(Q_C = f(K,L)\)

Capital-intensive industry (cloth): \(\frac{ a_{KC} }{a_{LC}} > \frac{ a_{KF} }{a_{LF}}\)

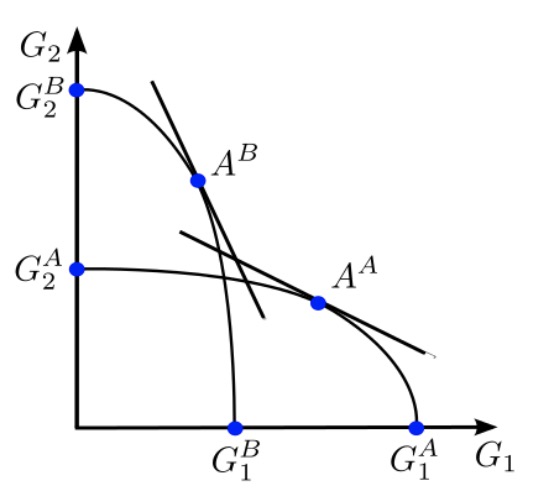

PPF

\(V = P_C*Q_C+P_F*Q_F\)

\(K \ge a_{LF} Q_{LF}+a_{LC}Q_{LC}\) (Capital allocation across sectors)

smooth curve!

Producers: choose factors based on wage and r (interest)

higher wage = offset by more capital input

Trade#

Countries produce goods intensive with their abundant factor

e.g USA = capital abundant = produce computer

Bangladesh = labor abundant = produce clothes

moves Relative Supply (like in Specific Factor)

same preferences = same consumption after trade

Autarky |

Trade |

|---|---|

|

|

shows two different countries (A & B) with factors (\(G_1\) & \(G_2\))

Results of Trade#

prices converge

countries specialise

Owners of abundant factor profit (capitalists in US, workers in Bangladesh)

other factors = less produced = diminishing returns

redistribution across owners, not industries!

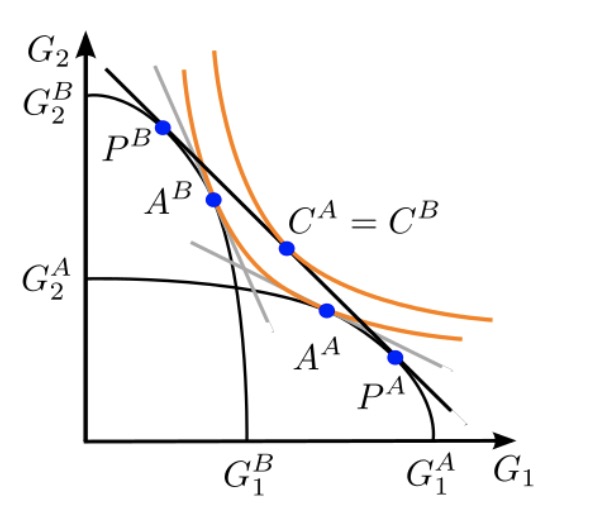

Standard Model#

generalizes all models (with others as special cases)

Assumptions#

two goods

each country individual PFF, differences between

factor endowment

technology / productivity

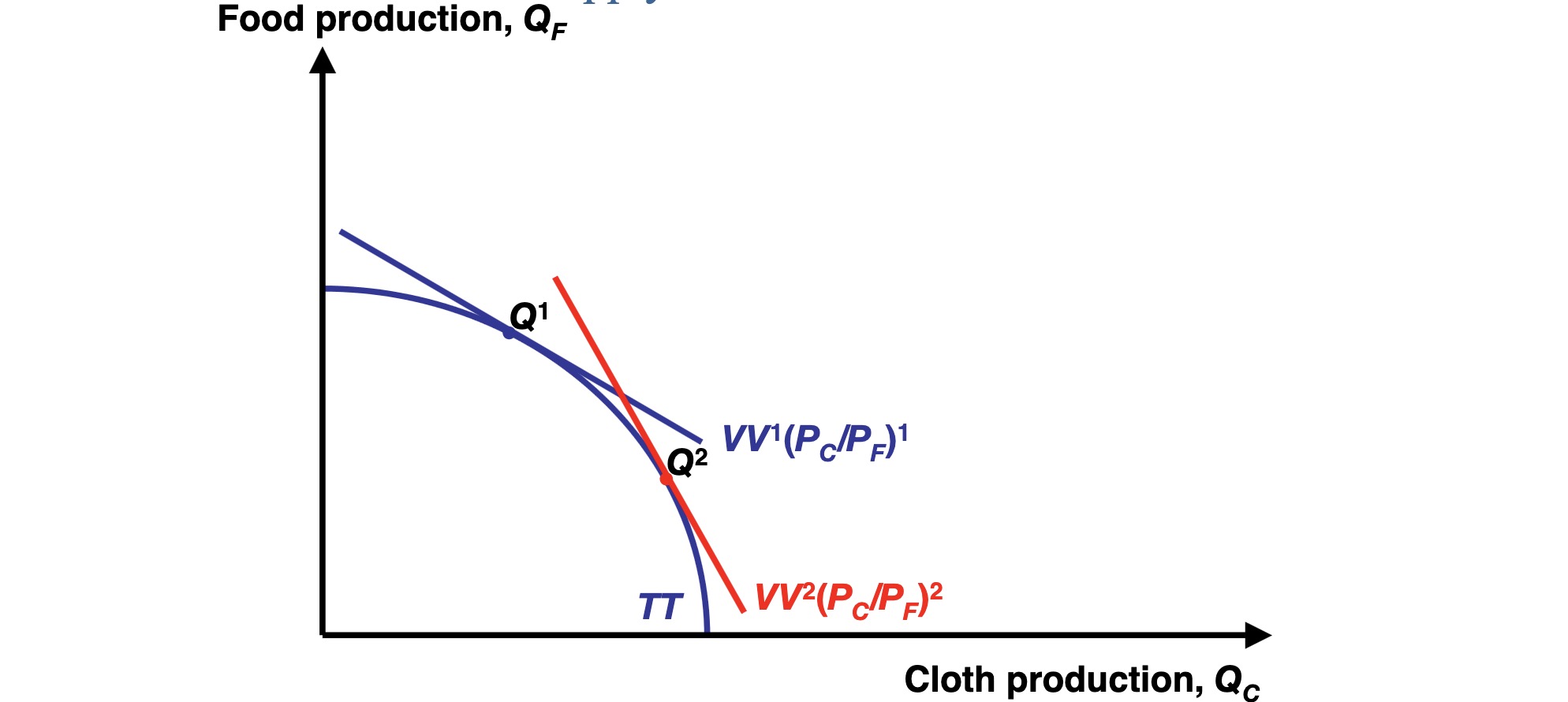

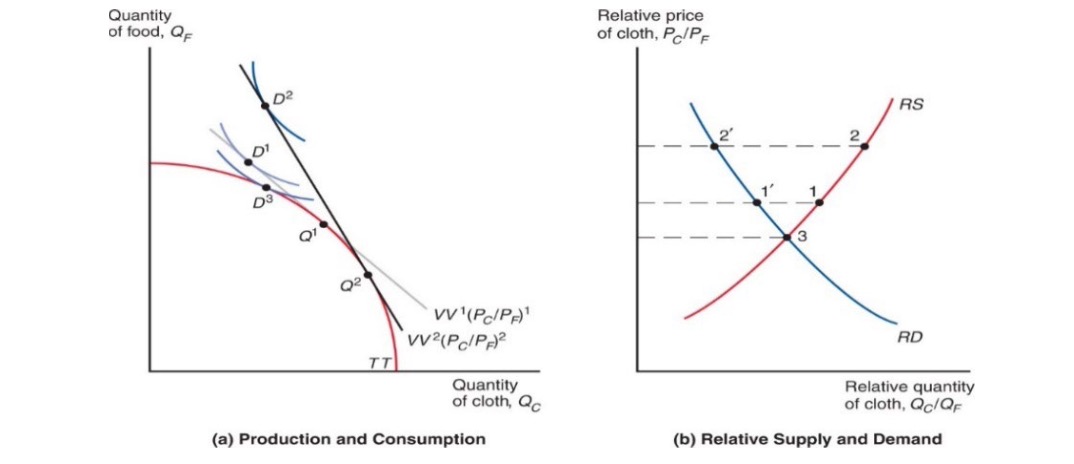

Definitions#

PFF = smooth curve

production depends on relative price \(\frac{ P_F }{P_C}\) and

Indifference Curve of Consumers

different isovalue lines and PPF

Trade#

depends on relative prices

and Terms of Trade \(= \frac{ Price_{exports} }{Price_{imports}}\)

rise = good for welfare of country

Allows higher IDK than without

Results of Trade#

grows economy (mostly biased growth)

depends if growth in export or import sector

import biased growth = higher ToT = welfare gain

export biased growth = lower ToT = welfare loss

Model Comparison#

Model |

Assumptions |

differences between countries |

Time perspective |

winners of trade |

|---|---|---|---|---|

Ricardo |

one factor, 2 goods |

labor productivity |

short run |

everybody |

Specific Factor |

3 factor, 2 goods |

Productivity / factors |

medium run |

export industries and their factors |

Heckscher Ohlin |

2 factor, 2 goods |

Endowment of Factors |

long run |

owners of abundant factors |

Standard |

2 factor, 2 goods |

Everything |

Depends |

3 models = 3 time frames of factor mobility

ricardo = immobile = short run

specific factor = partly mobile = medium run

heckscher = very mobile = long run

shock is dynamic over time frame

Theorems#

all in the Heckscher Ohlin Model

Heckscher-Ohlin Theorem: countries specialize in goods that use its abundant factor intensively

e.g Bangladesh labor-abundant = clothes production

Stolper-Samuelson Theorem: Rise in relative price of good => higher return to factor used intensively & lower returns for factors of other good

e.g higher price for clothes => higher wages for clothes workers & lower returns for land owners in food production

Rybczynski-Theorem: if prices constant and amount of one factor rises => Quantity of good using factor intensively increases & other goods quantity decreases

e.g population rise in Bangladesh => more clothes produced & even less food production

Trade Policy Instruments#

Policy |

Producer Surplus |

Consumer Surplus |

Government revenue |

national Welfare |

|---|---|---|---|---|

Tariff |

+ (increase) |

– (decrease) |

+ |

~ (Depends on country size) |

Export Subsidy |

+ |

– |

– |

– |

Import Quote |

+ |

– |

= |

~ |

Voluntary Export Restraint |

+ |

– |

= |

– |

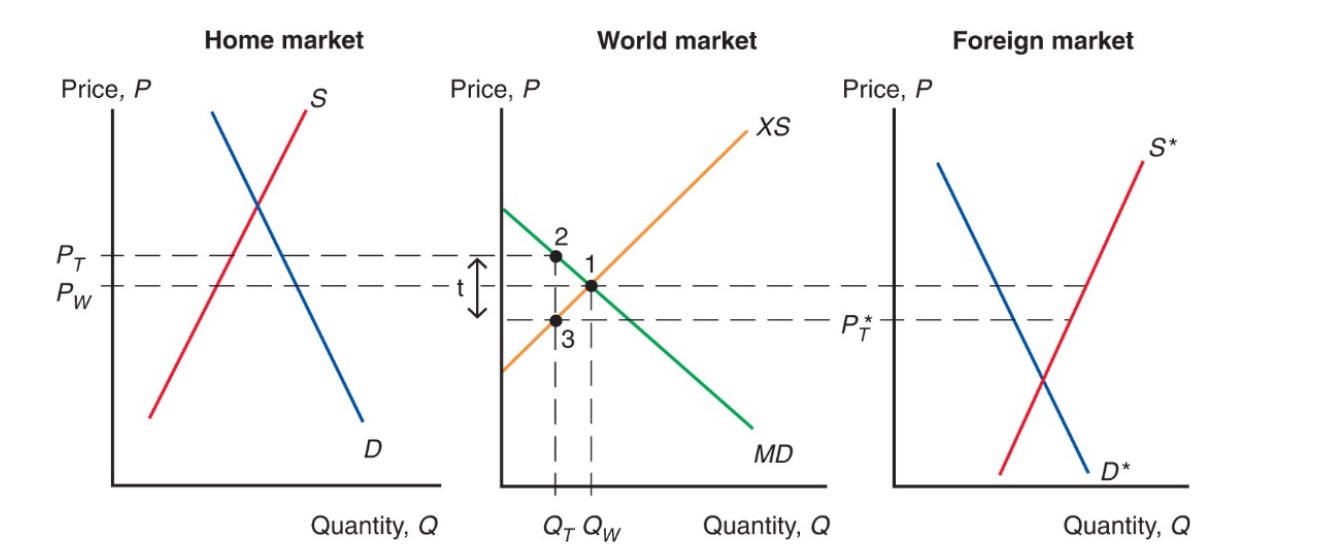

Tariff#

Tariff: tax imposed by government on imports, either per unit (specific) or as % of value (ad valorem)

similar to transportation cost

higher price at home

lowers world market price (if country big enough)

decreases quantity traded

producers profit, government gains revenue, consumers have to pay higher prices

Export Subsidy#

Export Subsidy: policy to encourage export of goods and discourage sale of goods on the domestic market through direct payments

lowers price in importing countries

higher price for home consumers

Import Quota#

Import Quota: Restriction of Quantity of Good that may be imported

no government revenue

quota rents to license holders

Voluntary Export Restriction#

Voluntary Export Restraint (VER): quota imposed by exporting country on its exporting industry

due to pressure by Importing Country

Example: Japanese Cars in US Market

Price rose of japanese fuel efficient cars

rent to japanese firms

Local Content Requirement#

Local Content Requirement: regulation, that fraction of end product domestically produced

no revenues

home producers of inputs like import quota

home producers of outputs not as strict

price diff average between no quota and import quota

Political Economy of Trade#

International Trade & Globalisation = highly debated topic

Case for Protection#

Presence of imperfect markets

No prefect competition

market distortions

Examples:

tariff on foreign monopoly firm = shift profit to domestic

subsidy on domestic firm = compete against oligopolies

Brender Spencer Analysis

capture world market = higher profit than subsidy costs

Example: Airbus - Boeing

pollution = negative externality

tariff = shift to less polluting domestic industry

less world pollution overall

Case against Protection#

Retaliation

possibility of retaliation of other countries

less welfare overall

Superior Policies to raise efficiency

if goal is to stop unemployment

use fiscal policy e.g than trade policy

Trade policy = Second Best Option

Information Deficiencies

perfect tariff rate = difficult to set

unintended consequences in other industries

Lobbying / Rent Seeking

concentrated interest groups = more power than less concentrated consumers

captured by special interests