07.06.2023 Budget Deficits and Debt#

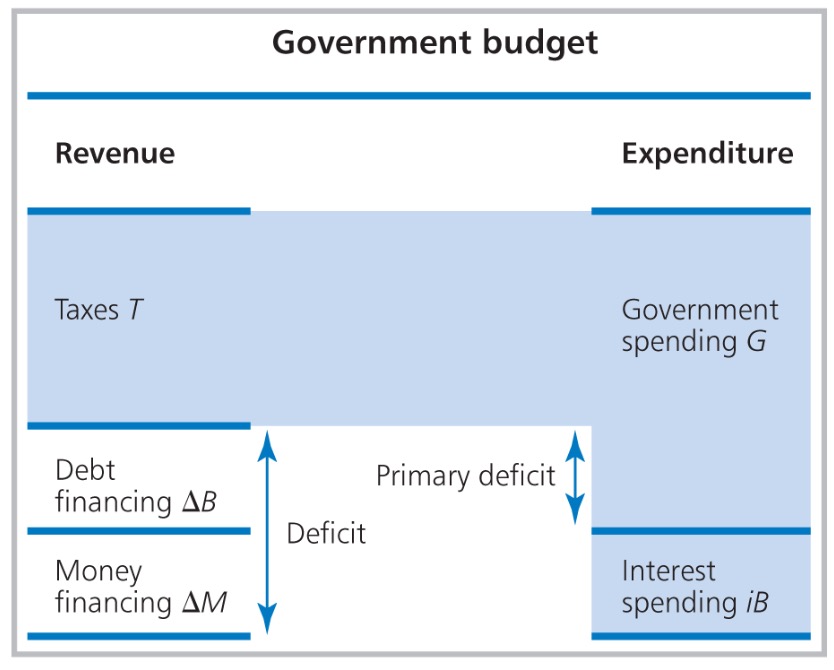

Government Budget#

Budget Deficit: \(\Delta B = G + iB - T\)

Primary Deficit: \(G-T\)

Budget Constraint: \(T + \Delta B = G+iB\)

Financing Options

Bonds Issuing: \(\Delta B \uparrow\)

Money Printing: \(\Delta M \uparrow\)

sell assets / privatise (bah)

Maastricht Treaty EU

Debt to GDP Ratio: \(b = \frac{ B }{Y} \le 60\)

all government entities (local etc.)

Deficit Ratio: \(\frac{ \Delta B }{Y} \le 3\%\)

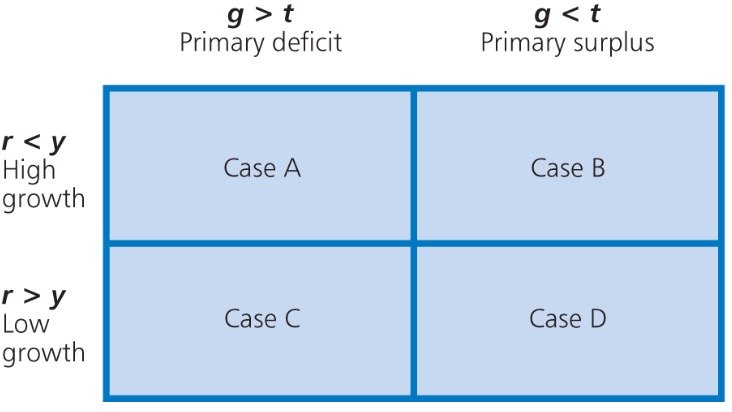

Equilibrium Debt Ratio: \(b^* = \frac{ g-t }{y-r}\)

Scenarios:

Debtor: A + D

Creditor: B + C

=> Debt is also dependent on Economic Growth, nut just deficits

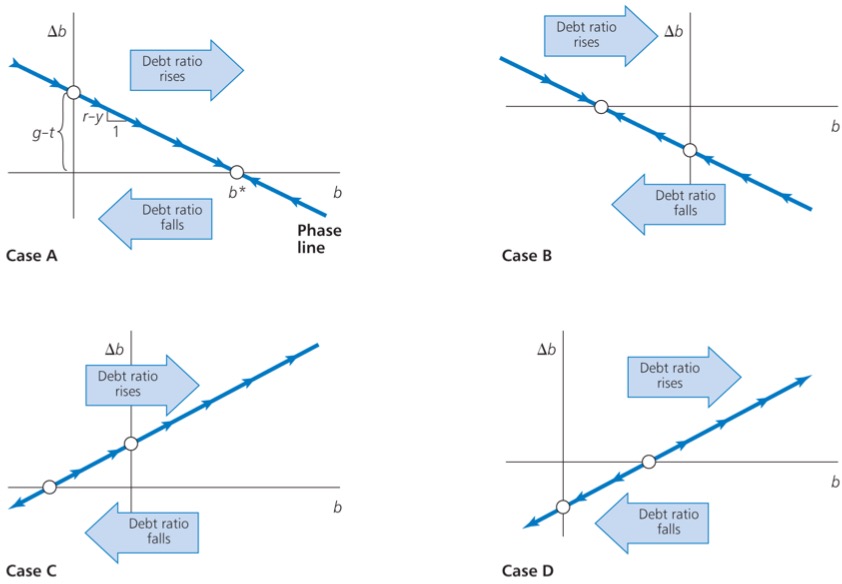

Phase Line#

Movement of Debt over Time,

depends on \(\Delta b\) (Neuverschuldung)

and level of \(b\) (Grad der Verschuldung)

Cases:

A = Debtor (\(\Delta b>0 \ \&\ b > 0\))

B = Creditor (\(\Delta b<0 \ \&\ b < 0\))

C = short run debtor

D = short run creditor

European Central Bank#

can do Seigniorage (Münzgewinn) = Profit from creating money

Profits are shared by the national banks

and given to finance ministers

even Non-Euro members have to contribute

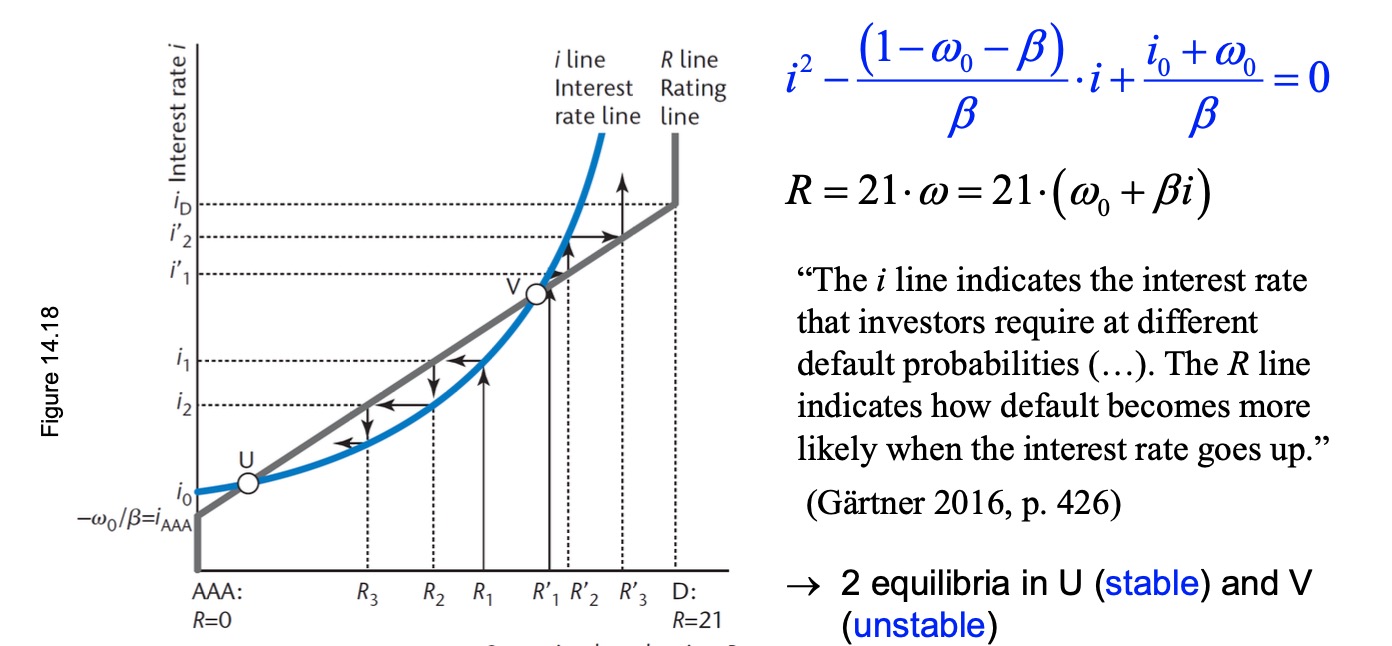

Interest Rate and Debt#

Interest Rate i on Debt fluctuates wildly

dependent on Default Probability \(\omega\)

and riskless interest rate \(i_0\)

judged by credit rating agencies with rating R (AAA -> D)

European Debt Crisis#

Policy Options:

Austerity (Fiscal Compact 2013)

rules similiar to Maastricht

aggavates recession

makes investments difficult

=> bad idea! doesnt work

Bailout (European Stability Mechanism)

Help from other european insitutions

debt refinancing, but cuts to programmes

also newer in NextGenEU (Covid)

Quantitative Easing (PSPP)

ECB buys Bonds with fresh money

lowers interest rate for deficits