Public Economics: Summary#

Table of Contents

Study of Government in our Economy

Main Questions

When should Government intervene?

How?

What is the Effect?

Why do politicians intervene the way they do?

Government Expenditure#

Wagners Law: Government expenditure grows not only in absolute terms, but also in relative to overall economy

Reasons:

Fiscal Illusions

Urbanization

superior goods by Gov

Baumol

Demographic

Baumol Effect: Services = more expensive than goods, Gov provides many services

Theory of Welfare Economics#

Demand#

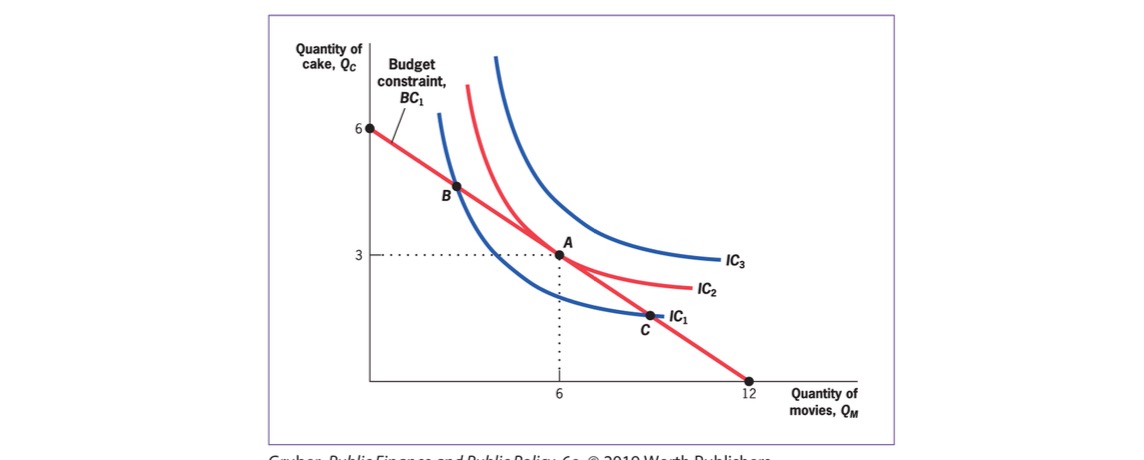

with indifference curves of Utility Levels

and budget constraint

Marginal Utility: increment in utility with one additional unit of good (diminishing)

Marginal Rate of Substitution: Willingness to trade one good for another = Slope of IDC

Price Change Effects: Substitution / Income Effect

Elasticity of Demand: % change in demand due to 1% increase in price

often negative

if infinite = perfectly elastic demand (horizontal)

if 0 = perfectly unelastic (vertical)

Demand for Good at Price: derived from multiple Budget Constraints

Supply#

Supply Curve = outcome of profit maximization

Production Function \(q = \sqrt{K * L}\)

Profit maximization at short term: \(p = MC\)

Equilibrium#

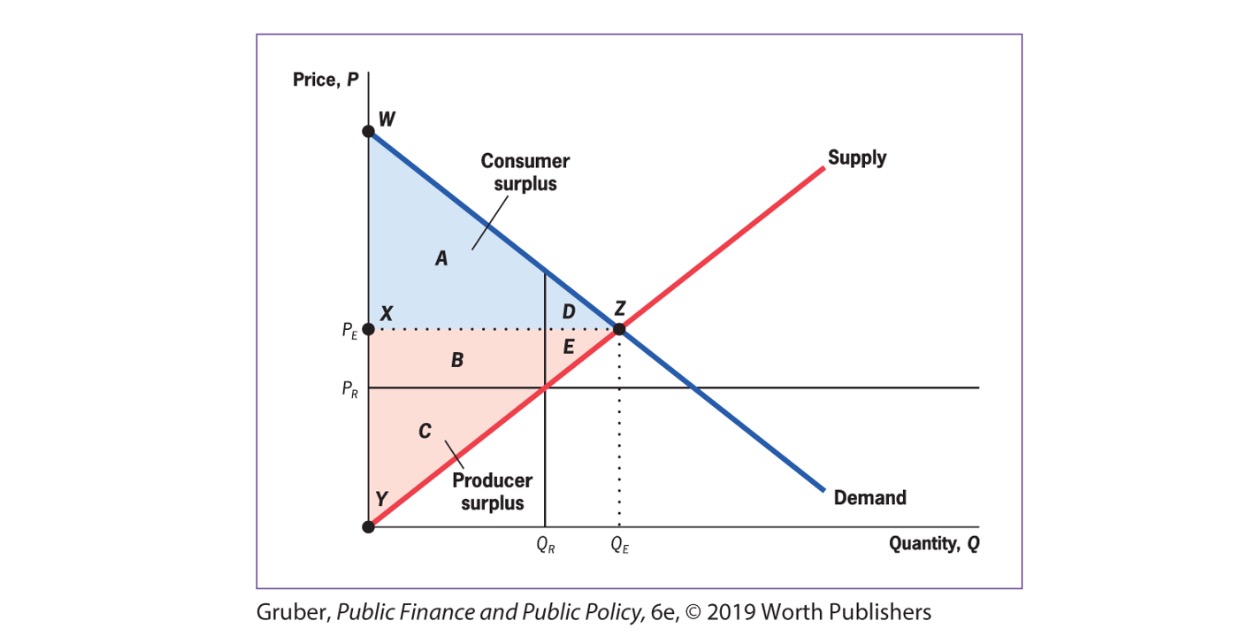

Social Surplus = net gains from trade in society

Consumer Surplus = \(\Delta\) Utility and Price

Producer Surplus = \(\Delta\) Production Cost and Price

Theorems of Welfare Economics

Theorem 1: competetive Equilibrium (where supply = demand) maximizes social efficiency

Theorem 2: society can attain efficient outcome by suitably redistributing resources among individuals + free trade

only under specific conditions!

Empirical Tools#

Correlation vs possible flows of causation

A -> B

B -> A

C -> A & B (third factor)

Bias: source of difference between groups, that is correlated with treatment but not due to t

solved with random assignment in groups

Randomized Control Trials#

2 random groups (treatment & placebo)

Problems

external validity: to other contexts

attrition: reduction of sample size over time (threat to internal validity)

Expense

Observational Data#

Time Series Analysis: Correlation over Time

no spearation of correlation / causation

excluded variables

Cross Sectional Regression: statistical magic

add control variables for better results

regression line for showing

quasi-experiments: change in economic environment create nearly identical groups

often used in Difference in Difference (DiD) Models

have to argument that bias is not relevant in this context

structural modelling: Estimation of Policy Effect on individual decisions (e.g income effects)

structural estimation

reduced form estimates

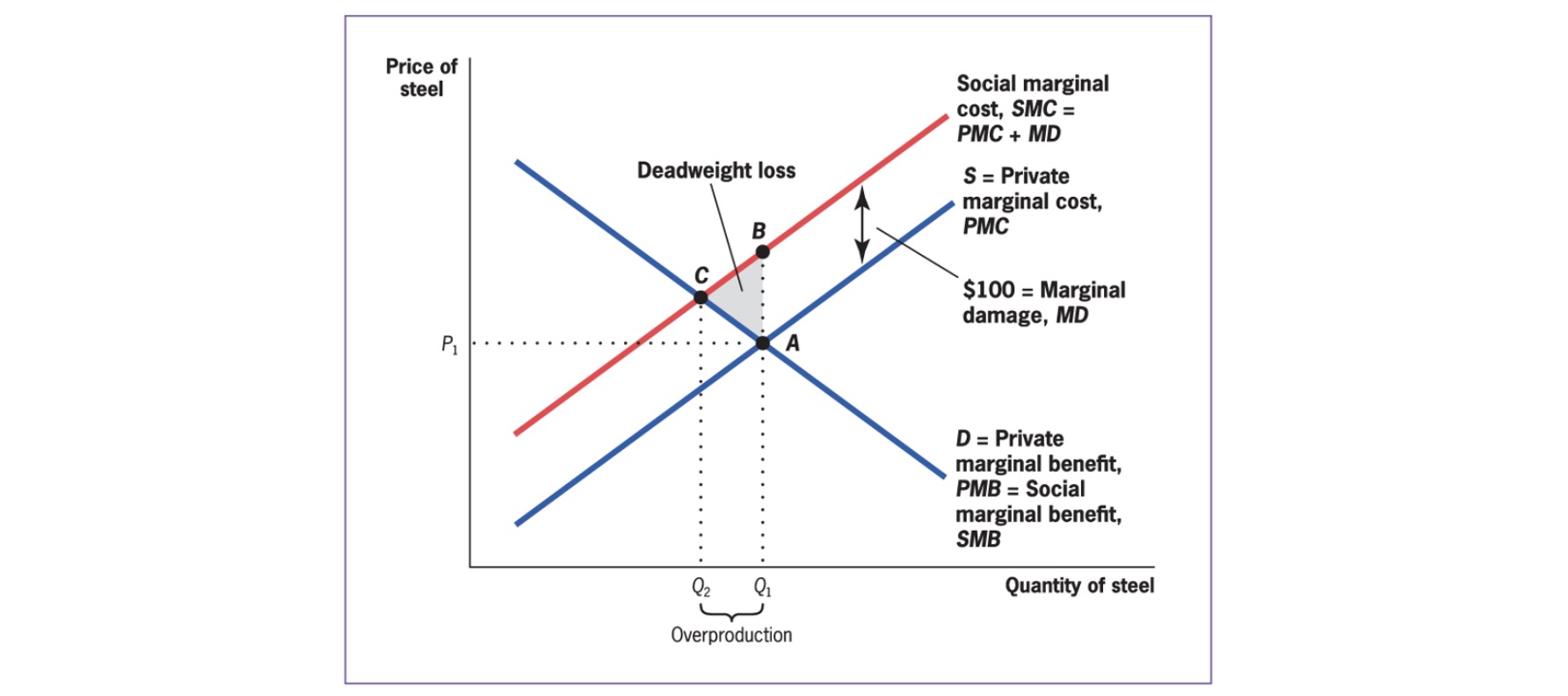

Externalities#

externality: indirect cost / benefit to uninvolved third party

type of market failure

positive / negative

production / consumption based

consumption: individuals consumptions harms others

production: firms production harms others

= create difference between Social Marginal Cost and Private Marginal Cost

Private Marginal Cost (PMC): direct cost to produce one good

Social Marginal Cost (SMC): PMC + costs imposed on others

Example:

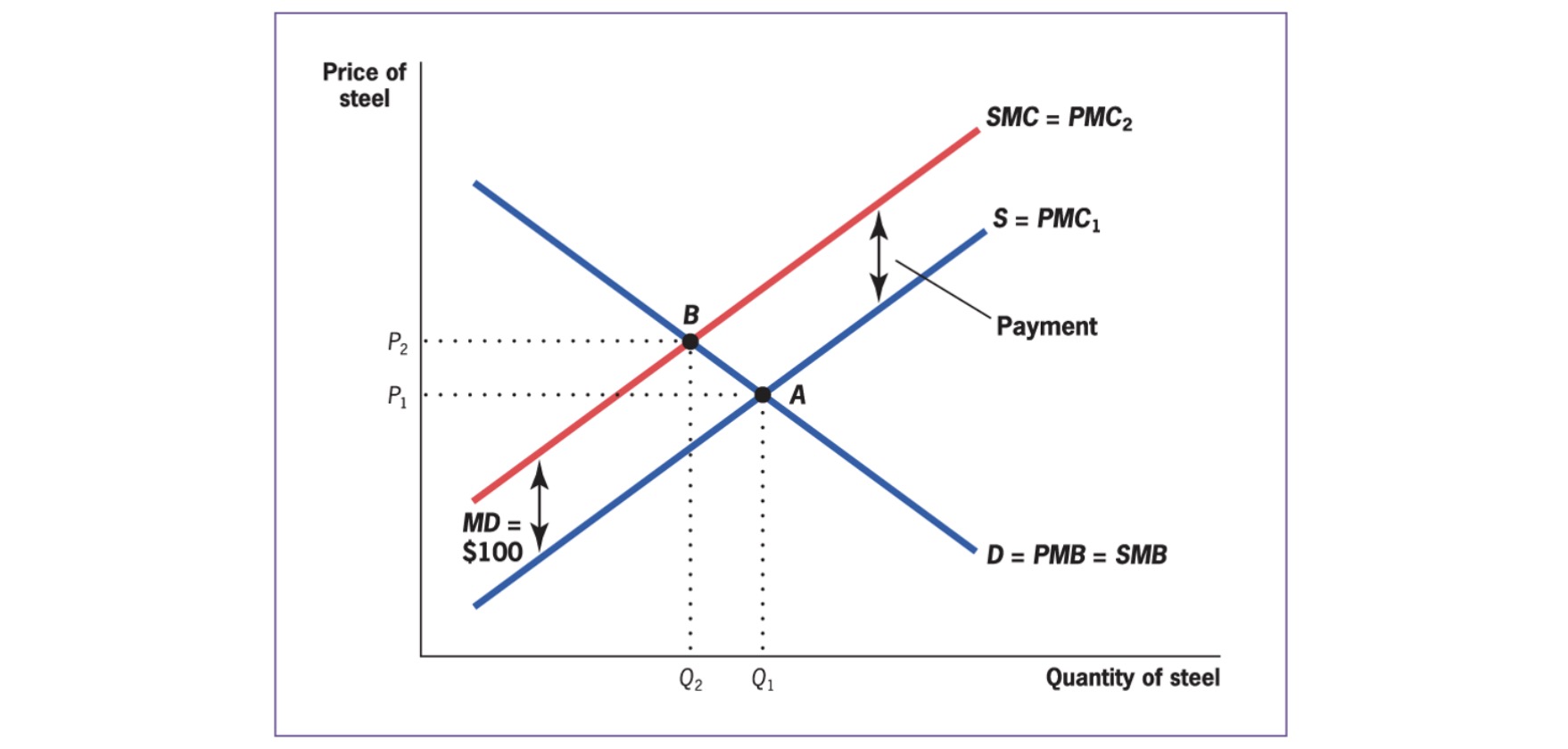

Solution => internalize Externalities

Private Sector Solution#

Coase Theorem: well defined property rights + negotiations => socially optimal market quantity

damaged can demand compensation from damager

does not depend on who owns rights (either damage payment or payment for not damaging)

Problems:

Assignment

Free Rider

Holdouts

Transaction Costs

=> only for specific problems!

Public Solutions#

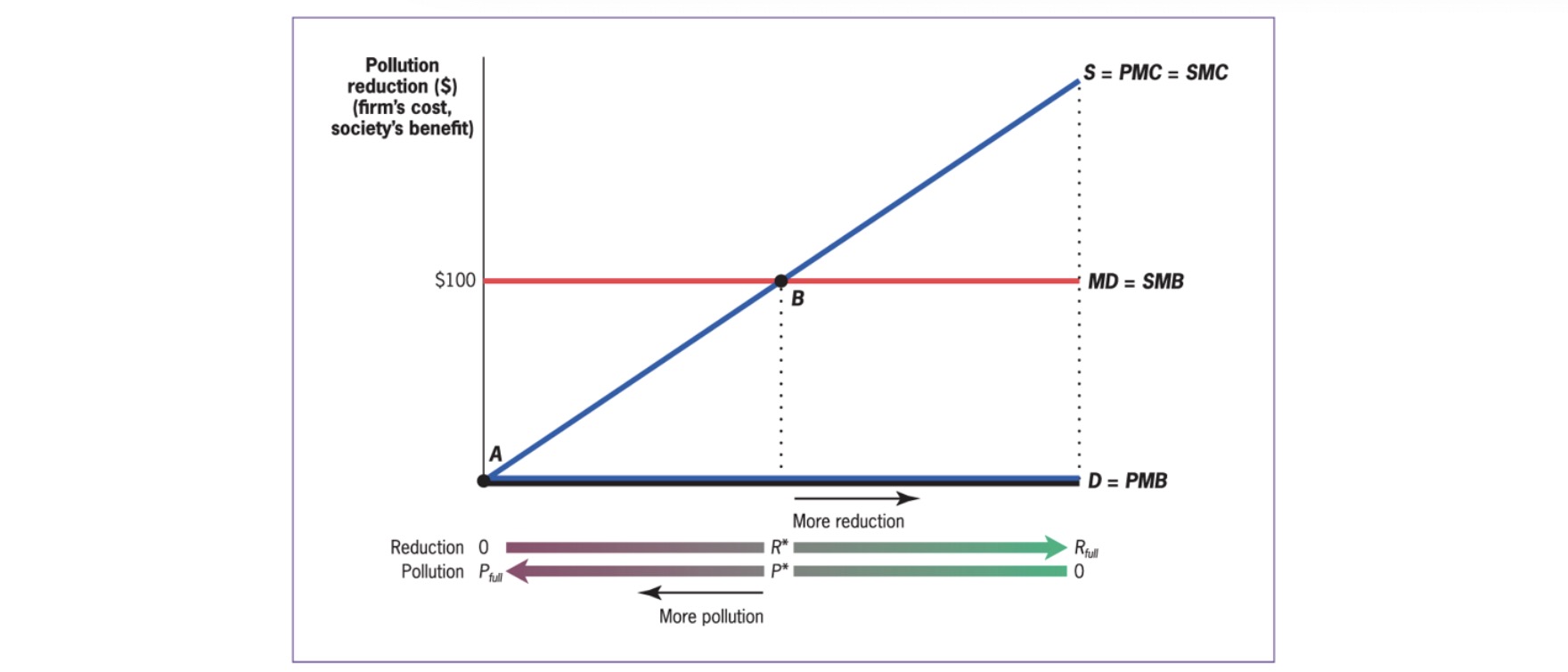

Taxation / Subsidies = price Based approach

pigouvian taxes

align PMC and SMC

for low SMB of Reduction (Co2)

Regulation = quantity based approach

can be complicated

and inefficient

for high SMB of Reduction (nuclear leakage)

right amount of pollution:

Public Goods#

Types of Goods |

Excludable |

Non-excludable |

|---|---|---|

rival |

private good |

club good |

non-rival |

common good |

public good |

Example: atmosphere as a sink for emissions

Provision: aggregate demands (vertically)

Problems with Public Provision of Goods

Crowd Out

Provision Mechanism

Measuring Costs / Benefites

Measuring Preferences

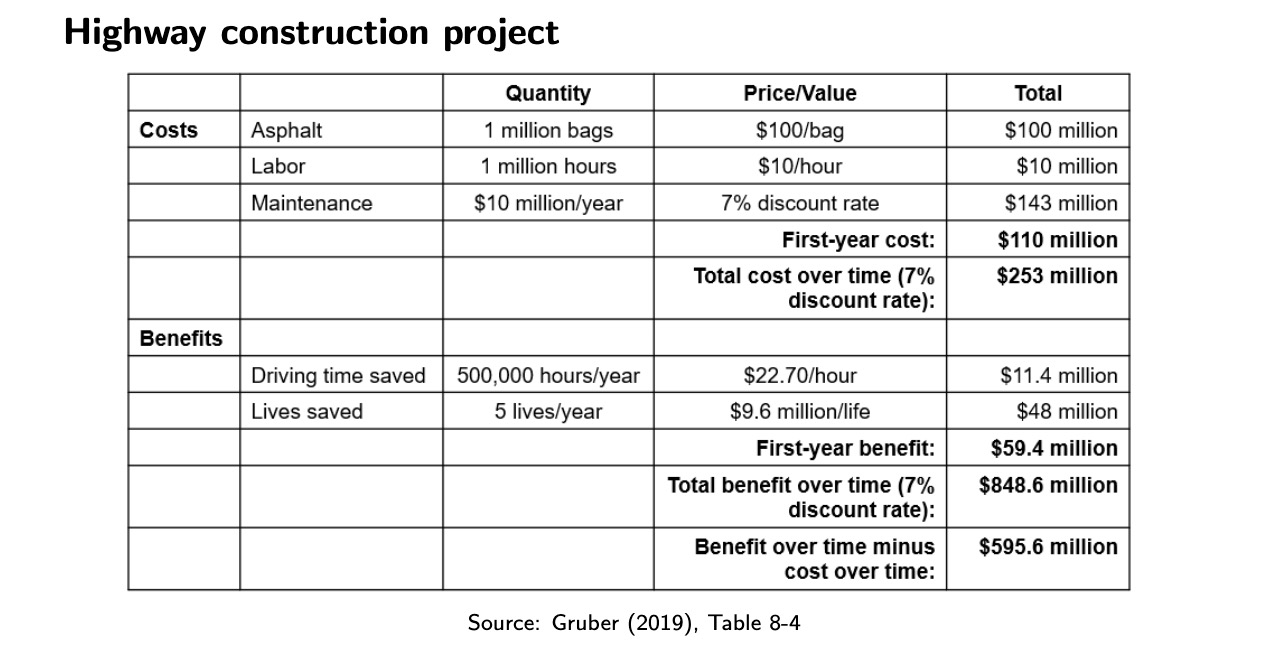

Cost-Benefit Analysis#

Measuring Costs#

Normal Costs (Capital, Operation, Maintenance)

Opportunity Costs (in imperfect markets)

Disocunting Future Costs to Present Discount Value $\( PDV = \frac{ F_1 }{1+r}+\frac{ F_2 }{(1+r)^2}+\frac{ F_3 }{(1+r)^3}+... \)\( for infinite: \)\frac{ cost_{per year} }{r}$

Measuring Benefits#

Time Savings Measuring

Live Saved Valuation

Methods:

Market Based = wages

survey based

revealed preferences

Example

Issues#

Counting Mistakes

Menschenwürde

Uncertainty

Distribution Effects

Alternative: Cost Effectiveness Analysis

Asymmetric Information#

asymmetric Information: different actors have differing levels of information in market

Example: Insurance Market with low risk / high risk people

average price of insurance = too high for low risk, to cheap for others

low risk cannot proof they are low risk

=> market failure and adverse selection

market based solution: pooling equilibrium, separating equilibrium

Problems#

Adverse Selection: market situation where buyers and sellers have different information => unequal distribution of benefits to both parties

=> public insurance with mandatory (e.g Krankenkassen)

Moral Hazard: Adverse actions taben by individuals or producers in response to insurance against adverse outcomes

ex ante: changes in behavior that affect insured risk (smoking => lung cancer)

ex post: after risk has materialized (cancer => want every possible treatment)

=> only partial insurance, not full (e.g Arbeitslosengeld 1)

Inequality#

measureable in Income and Wealth

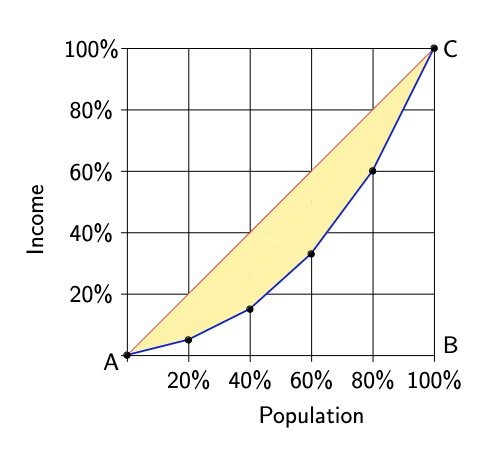

Graphical Representation:

Lorenz Curve |

Gini Coefficient |

|---|---|

|

|

Equity Effiency Tradeoff: Societal Decision between these two

Pareto Efficiency: one person better off without making other person worse off

Problem: tyranny of status quo

Welfare Redistribution#

Program Characteristics:

Eligibility

Categorical: restricted to some demographic (e.g Kindergeld)

means-tested: restricted by income (e.g Wohngeld)

many are both: (e.g Bürgergeld)

Type

Cash Welfare

In-Kind (e,g freie Kita)

Leakage in Welfare Programs (Okuns Leaky Bucket)

Administrative Costs

Deadweight Loss of Taxation

moral hazard (of the poor)

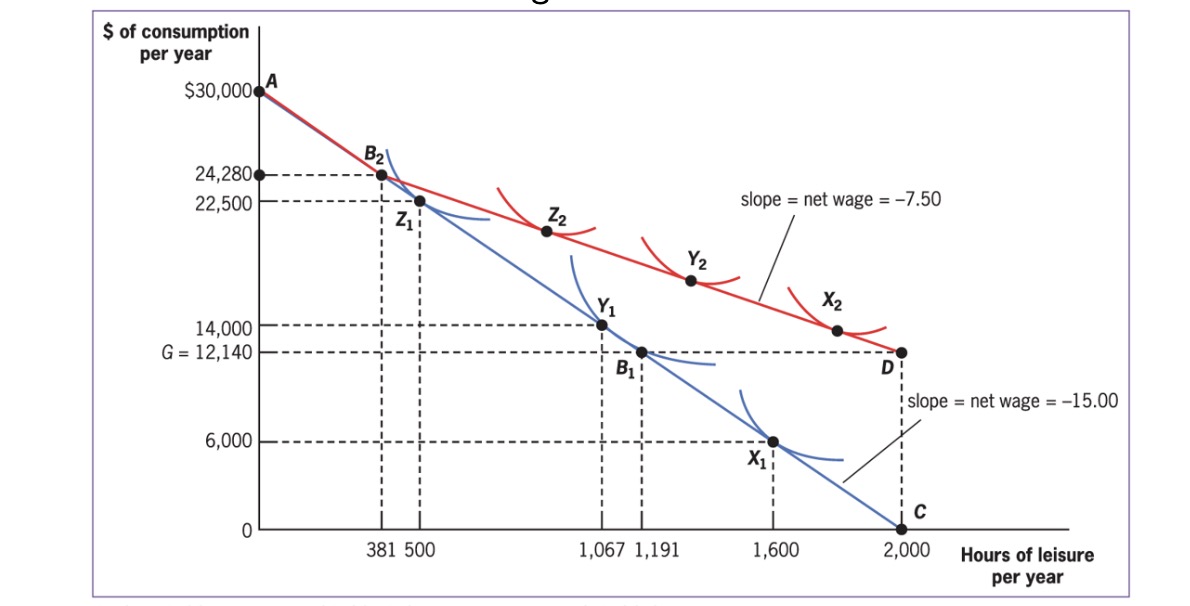

Benefit Example $\( B = G-(\tau \times w \times h) \)$

G = maximum benefit

\(\tau\) = reduction rate

\(w\) = wage

\(h\) = hours worked

at \(\tau=0.5\)

Iron Triangle of Welfare (choose only 2)

encourage work

resdistribute more

lowe costs

Solutions (only partly)

Categorical welfare Systems (compensate for lack of earnings capacity, e.g disabled)

ordeal mechanisms (work requirements etc.)

outside option (higher minimum wage)

Taxation#

General#

Tax (German Law): cash payment without a specific return, mandatory for all

Tax (economics): compulsory levy without a (individual or group-specific) service in return

Goals:

generate Revenue

increase equity

change individual behavior

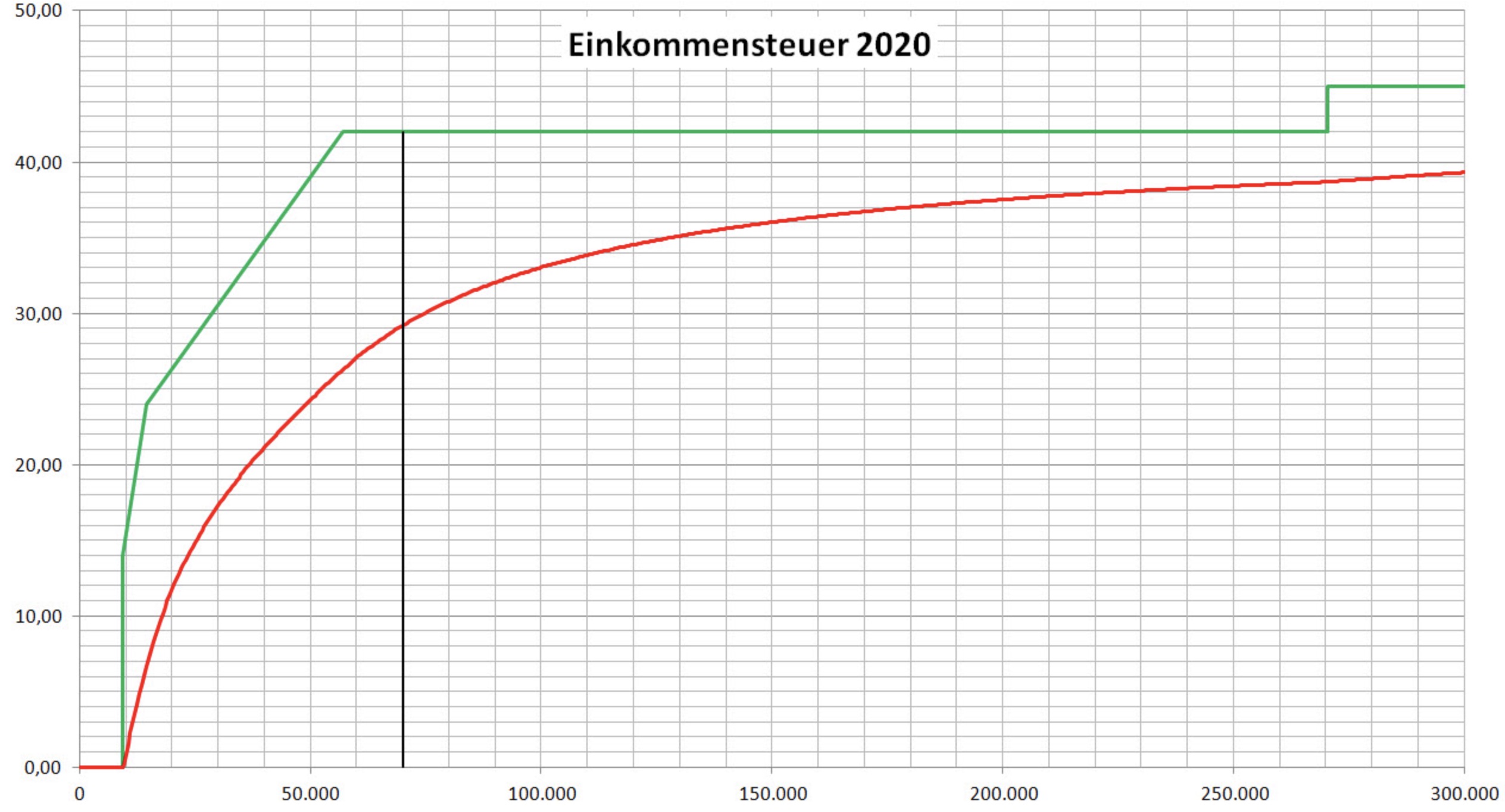

Effective Tax Rates on Income

Red = effective Tax, green = marginal tax

marginal tax rate: percentage of the next euro of taxable income paid

effective tax rate: percentage of total income paid

Fairness in Tax System:

Vertical equity: Strong shoulders pay more

Horizontal equity: similar individuals pay equal amounts

Haig Simons Principle#

taxable income = reflect ability to pay

=> deductions for life situations, e.g Pendlerpauschale

but deviations also existent, e.g deduction for charitable giving

to induce crowd in and consumer sovereignty

cost = lost gov revenue

Unit of Taxation#

on what income should taxes be levied? (Family, Marriage, Individual)

Individual

no equity across couples (with same aggregated income, but different shares)

but fair taxation for everybody

Family

income aggregated on family level and taxed

= marriage tax, because shared filing = more expensive

Marriage Splitting

income splitted on 2 members of marriage

and then taxed

disincentivizes work for poorer member of HH

Tax Incidence#

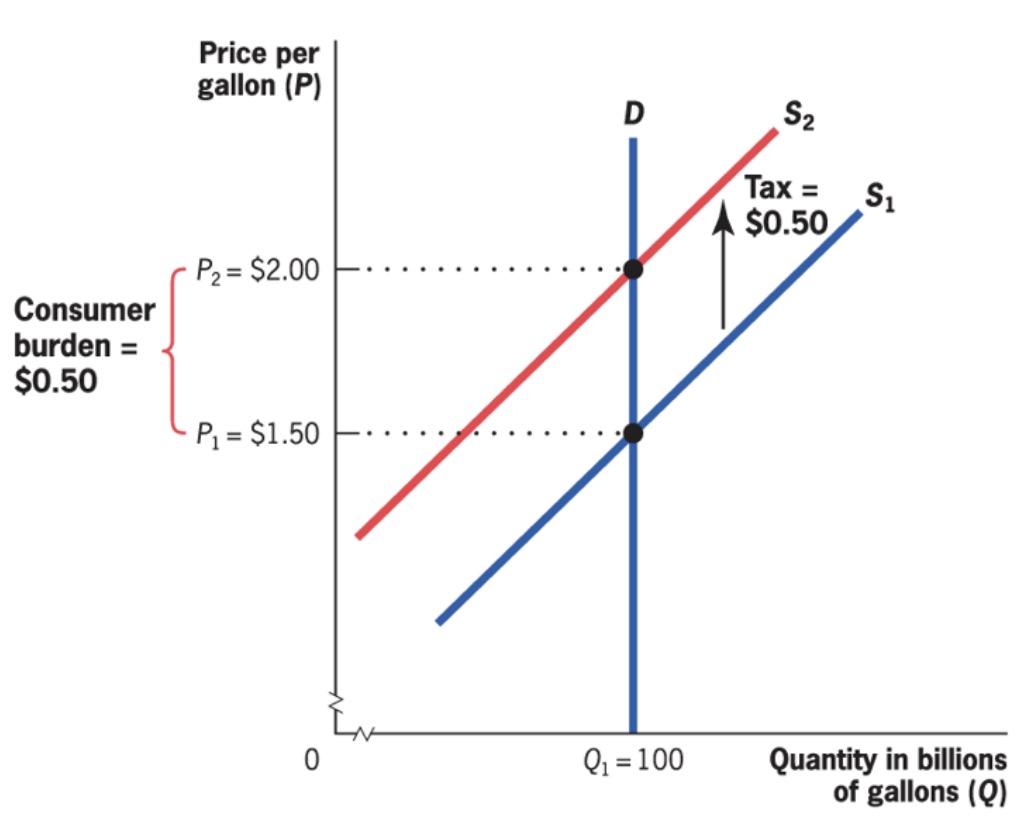

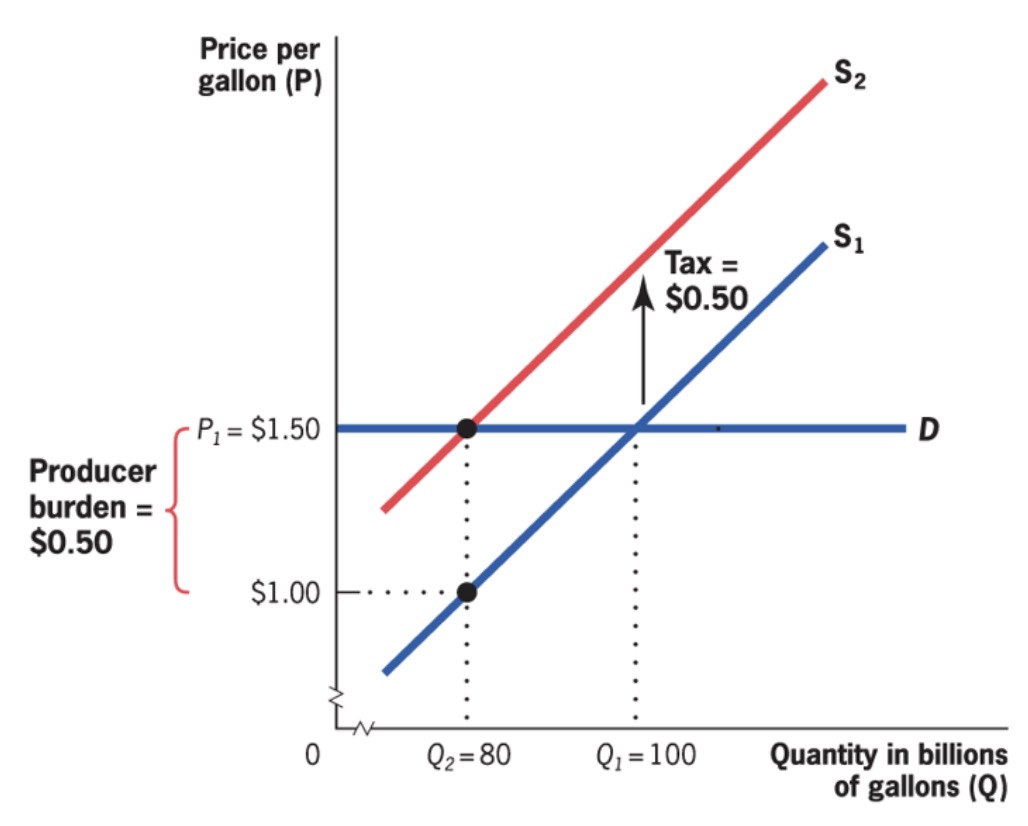

Three Rules

Statutory Burden \(\neq\) economic burden

side of the market = irrelevant

party with inelastic supply = bear taxes

Economic Incidence: burden of taxation measured by change in resources available

statutory incidence: burden borne by party that sends check to gov.

inelastic demand |

elastic demand |

|---|---|

|

|

burden at consumers |

burden at producers |

gross price: market price

after-tax price: gross price - tax (if producer tax) or + tax (if consumer side)

General Equilibrium Tax Incidence#

until now: only partial equilibrium tax incidence (impact on one market)

General equilibrium tax incidence: Analysis that considers the effects on related markets of a tax imposed on one marke

depends on

long run / short run = shifting elasticities

capital in short run = fixed, bears burden

in long run = more volatile

tax scope = non-taxed substitutes

spill-over effects

income effect = lower real income

substitution effect

complementary effect = reduce consumption of complementary goods (e.g beer tax and snacknuts consumption)

Tax Inefficiency#

Tax System: Trade off between Equity & effiency

Tax = creates Deadweight Loss (DWL), depends on

Elasticities (higher elasticity = higher DWL)

Tax height

marginal DWL: increase in DWL per unit of taxation

Implications for Efficiency:

depends on preexisting distortions

progressive tax = higher DWL

smooth taxes > high short taxes

Optimal Taxation#

for Commodities: by Frank Ramsay: ratio of marginal DWL = marginal Revenue

Formula:

ratio \(\lambda\) = should besame for all goods

Example

increase taxation on B

lower on A

-> elasticity rule: good with higher elast. = lower tax

but not good for equity (caviar = high elast, wheat = low)

for Income:

total income in society = fixed

same utility function

After = everyone same income

Formula: \(\frac{ MU }{MR} = \lambda\) same for all (MR = marginal Revenue)

Debt#

Governemtn Debt: amount gov. borrowed on financial markets

government deficits / surplus: yearly increase / decrease

Types of gov. debt:

Explicit: official debt given out by the financial ministry

implicit: explicit + promised payouts in the future (e.g pensions etc.)

Calculation of implicit debt:

Present Discounted Value:

but:

very hard to calculate

(heroic) assumptions about r and F

=> focus on explict debt!

Effects#

Short Run: Stabilization

Automatic stabilization: automaitc policies e.g unemployment insurance

Discretionary stabilisation: policy actions taken in response (e.g Gaspreisbremse)

= good for the economy

Long Run: Negative?

limited private capital investment

less economic growth due to less private investment

Reality:

depends on capital markets

and what the debt is used for…

=> evidence is inconclusive

Social Welfare Function#

Aggregation of indivudal utilities in Society

Requirements:

indidividualistic

pareto criterion (higher W for pareto-superior distributions)

inequality aversion

=> no correct SWF!