21.06.2023 Inflation and monetary policy#

Inflation and Philipps Curve#

Inflation: Increase in general price level, measured by CPI

Real interest Rate \(r = i - \pi^e_{t+1}\) (Fisher Equation)

also measured with differnce between inflation indexed bonds and market bonds

rational expectations formulation:

no systematic forecast errors

use all relevant info (esp. expert forecasts)

problem: incomplete models and experts

Problems

volatile / high = detrimental

investment unsafe

income declines

Benefits

effective monetary policy (no deflation)

redistribution (creditor to debtor)

Wage as Inflation Driver#

also: Demand Pull Inflation

Owners Power rises (e.g lower comp.)

employees power rises (e.g. more people join union)

Unempl. falls

Situation |

Graphic |

|---|---|

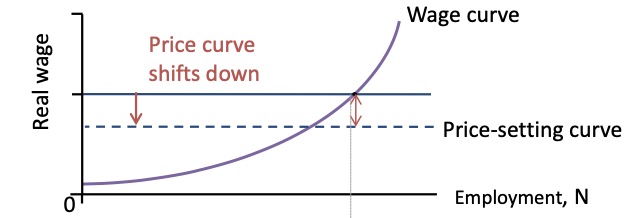

Owners Power rises (e.g lower comp.) |

|

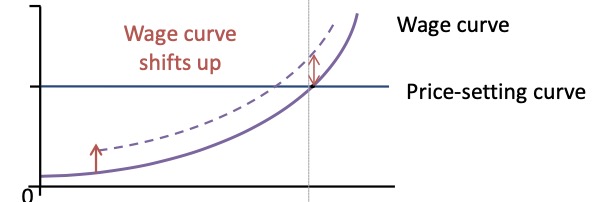

employees power rises (e.g. more people join union) |

|

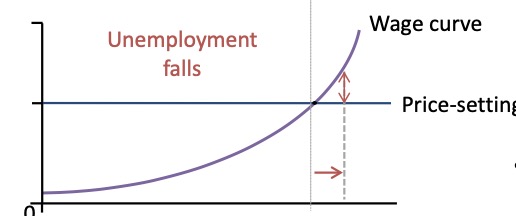

less unemployment (more power) |

|

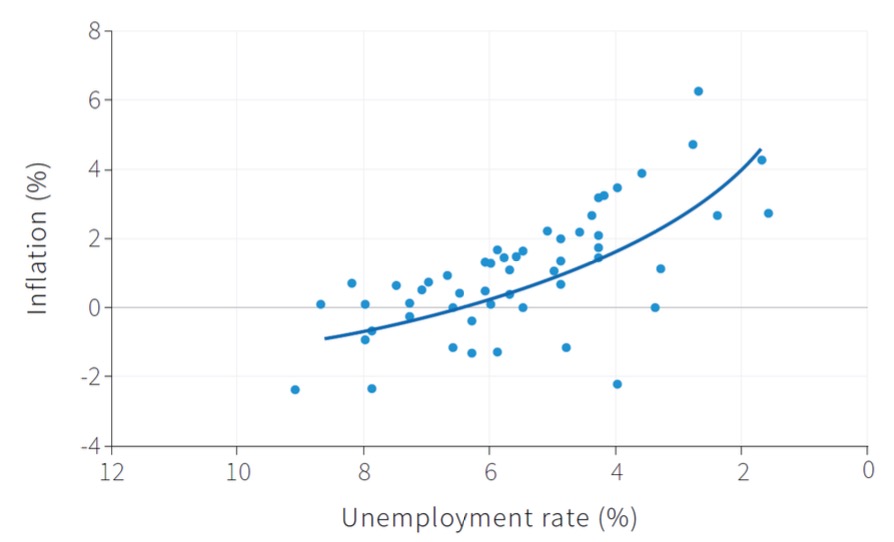

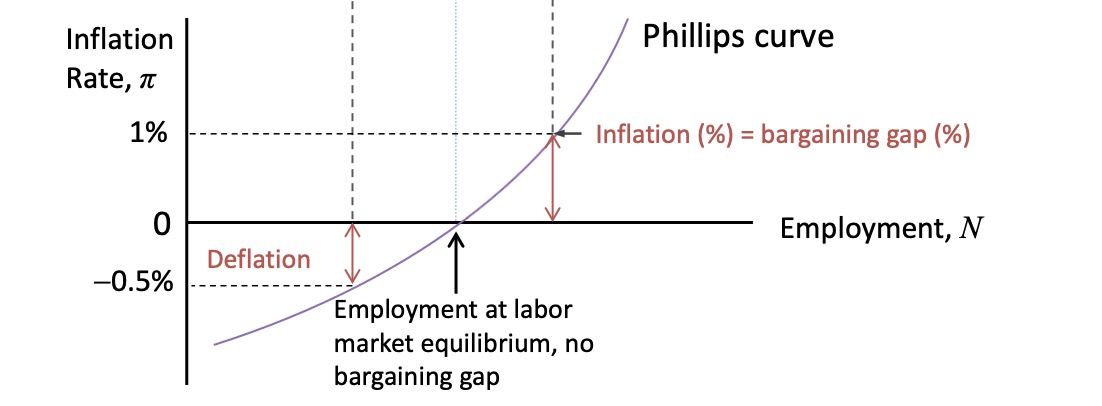

Philipps Curve: Unemployment and Inflation

=> curve can shift over time (stagflation)

other reasons: Capacity Constraints (in the short run)

AD, Unemployment and Inflation#

Labor Equilibrium shocks#

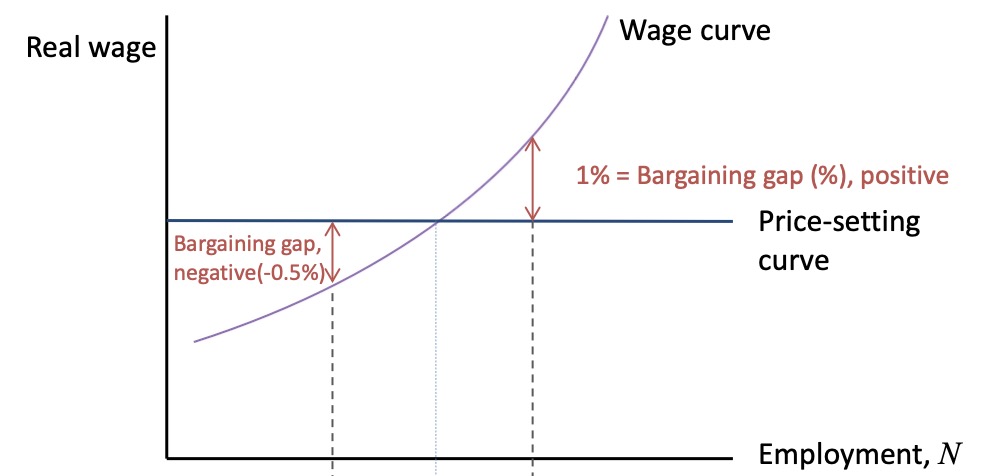

Bargaining Gap: Difference between real wage with highest incentive and real wage with highest profit

Calculated:

translates to

Medium-Run:

Boom (higher AD)

less unempl.

positive bargaining gap

positive wage-price spiral

Inflation

Recession (lower AD): vice versa

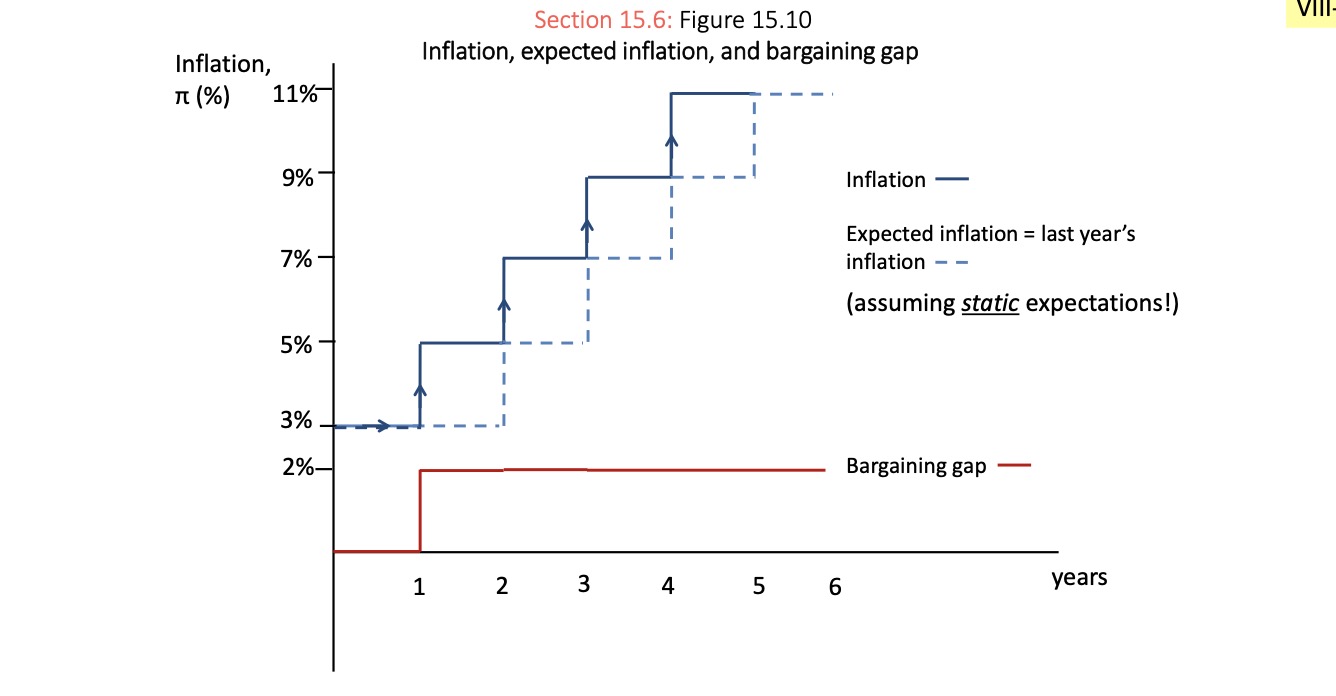

in Boom:

workers want real wage rise and inflation combat rise

these rises oush next years inflation etc…

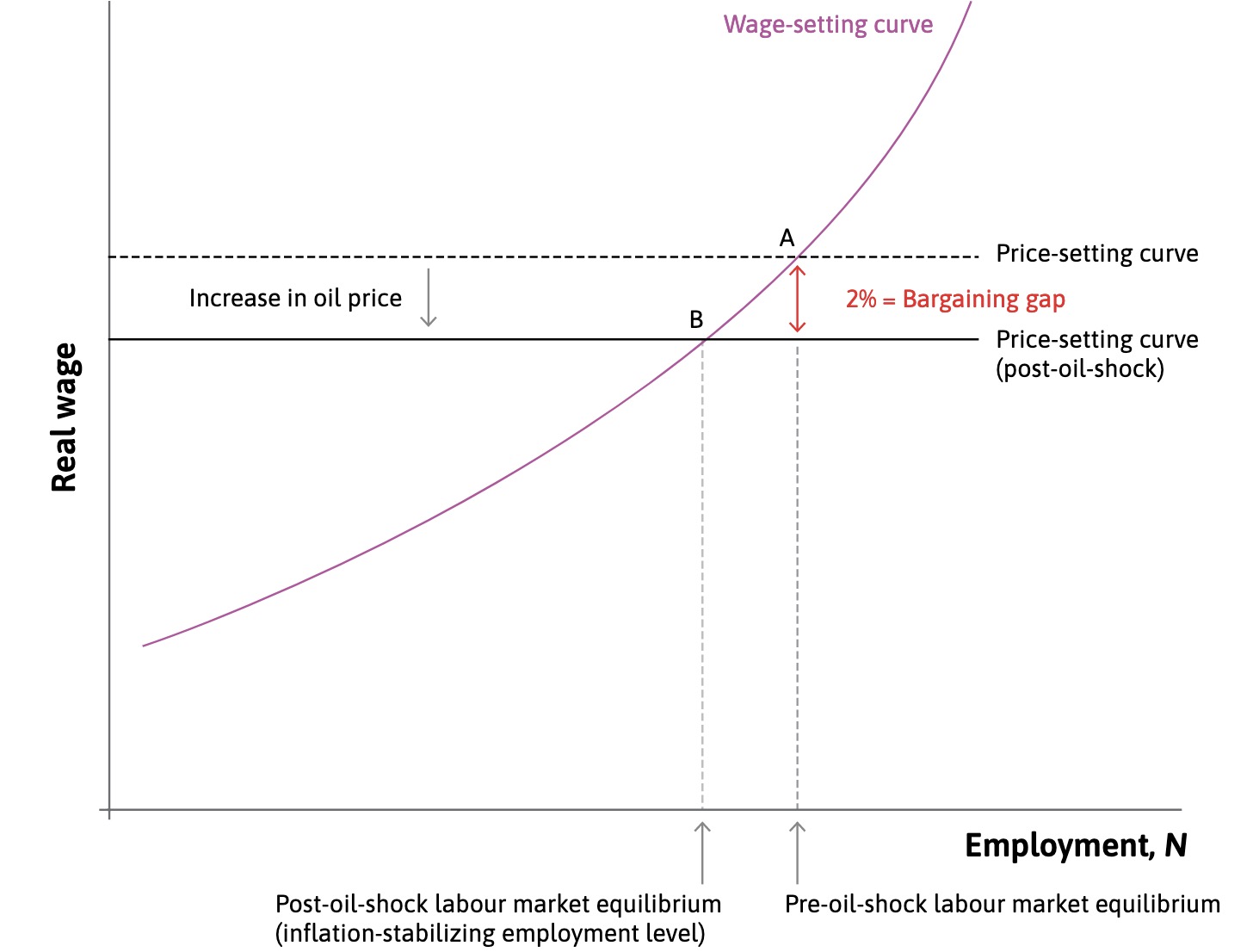

Supply Shocks#

Price Shocks to the material supply:

Firms rise prices to protect profits

workers lose real purchasing power

=> bargaining gap

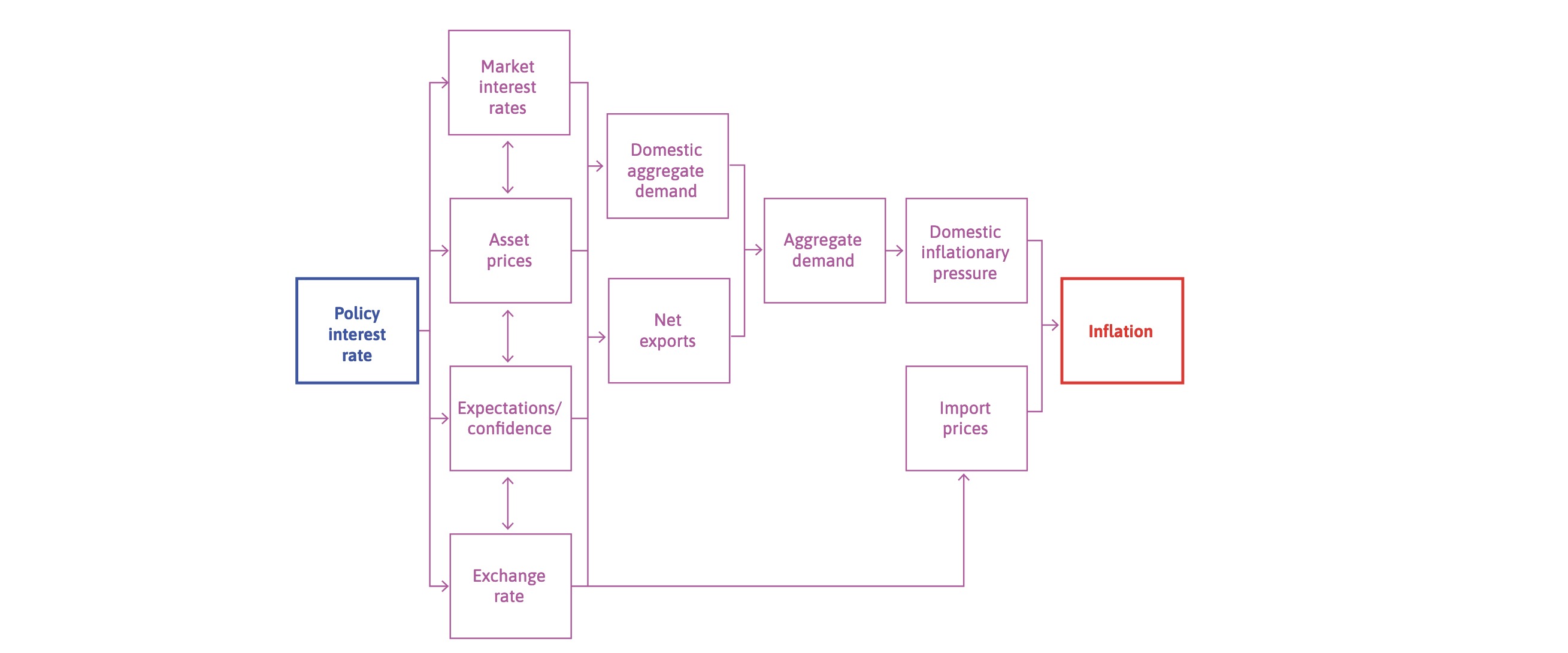

Monetary Policy#

Transmission channels on Inflation

market interest rates

value of assets

expectations

exchange rate

Limitations:

zero lower bound

long maturities

=> alternative Quantitative Easing

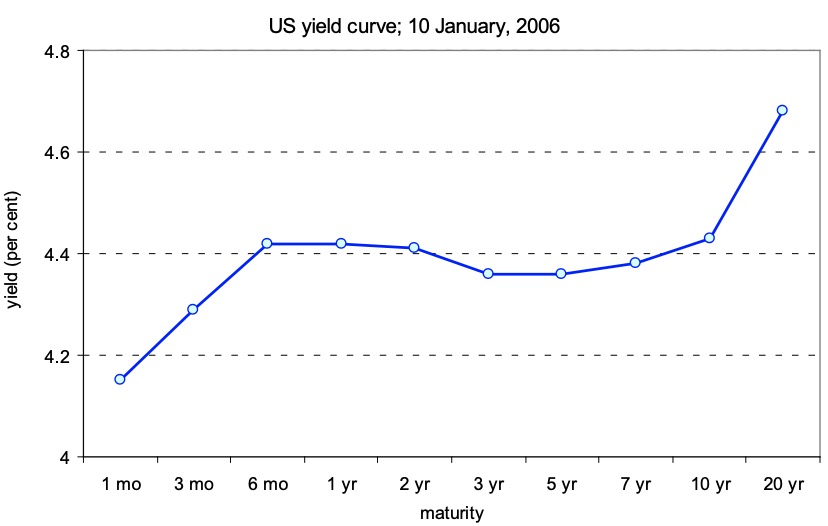

Interest rate Yield curve#

different interest rates depending on maturity

Reason: rational expectations because of higher risks for investors

=> investors arbitrage the interest differences based on the expectations for future interest rates

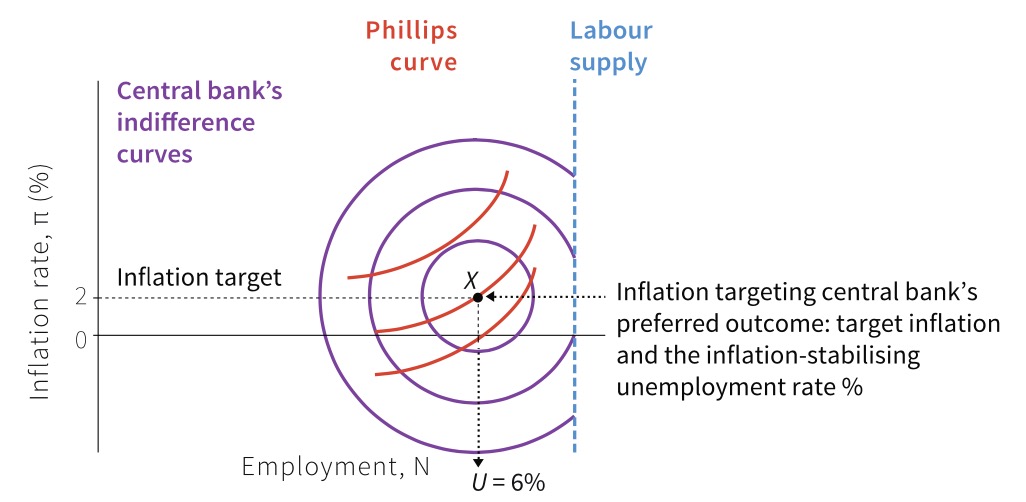

Barro-Gordon Model#

Model about Central Bank actions with inflation targeting

Loss Function of CB:

\(U / U^*\) = unemployment / target rate for unempl.

\(\pi / pi^*\) = inflation / target rate of inflation

b = vaulation of other goals beside inflation, here Unemployment

higher b = more flexible inflation target

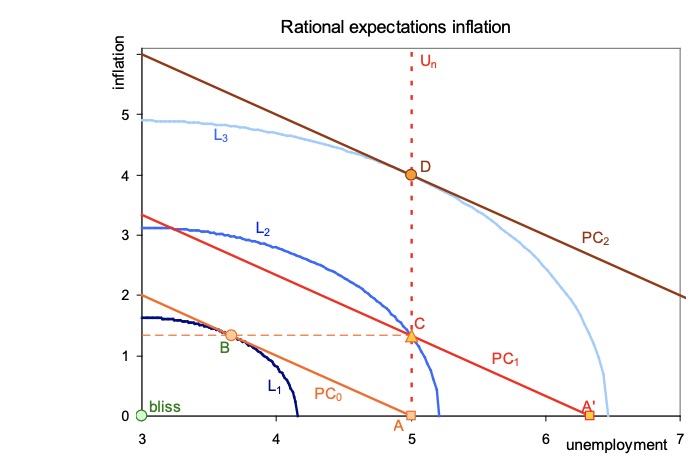

Barro Gordon Model#

Expectations-augmented Philipps Curve:

\(U_n\) = natural rate of unemployment

when inflation differs from it, then another U possible

Optimal Point (bliss point):

\(U^* = k * U_n; 0 < k < 1\)

\(\pi^* = 0\)

Combination of L and U Formula and Bliss point

Explanation of this calcukation an graph: what if the central bank is not independent and has the will to lower unemployment? then they will create a surprise inflation:

Starting in Point A: expecations = 0, full power to CB

Goal is Point B with lower unemployment

but Result is D, due to actors incorporating the expected inflation

=> Credibility needed

Central bank works with expectations

higher credibility = easier policy

no expected surprise inflation

with policy rule = 2% = rational expectation

CB stays at Point A

Taylor Rule#

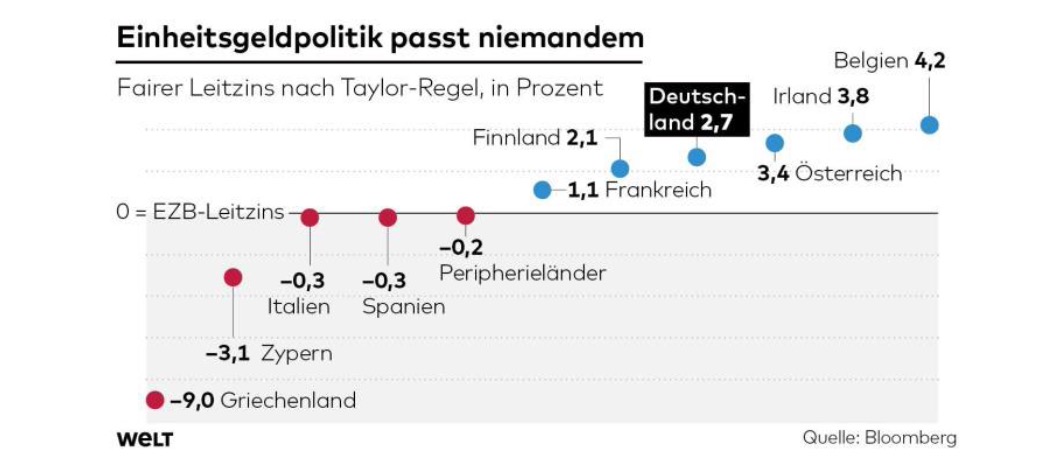

Rule of John Taylor for central banks short term rate $\( i_t-\pi_t = r+a(\pi_t-\pi^*)+\beta x_t \\ with \ x=\frac{ Y -\bar{Y}}{\bar{Y}} = output \ gap \)$ CB should adjust short term rate based on heating of the economy

in Euroarea: not possible, due to unified monetary policy

and output gap estimation difficult

From the typical euro critics at Axel-Springer:

better version of this: Orphanides Rule