26.05.2023 Business Cycle#

Business Cycle: fluctuations found in the aggregate economic activity, consists of contractions and expansions

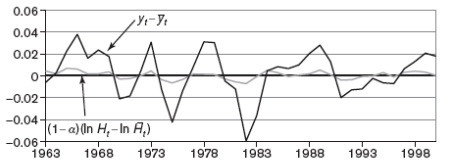

let \(y_t = \ln Y_t\), \(\bar{y}_t = \ln \bar{Y}_t\), \(c_t = Y_t^c\)

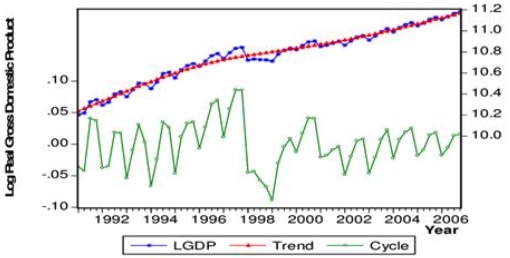

sorted with: Hodrick-Prescott-Filter $$ HP = \underbrace{\sum_{t=1}^T (y_t-\bar{y_t}^2)}_{\text{change in trend}}

\lambda \cdot \underbrace{\sum_{t=2}^{T-1} [(\bar{y}_{t+1} - \bar{y_t}) - (\bar{y}t - \bar{y}{t+1})]} _{\text{cyclical component}} $\( \)\lambda$ = weight of cyclical vs. trend

note: Trend is not always Regression, but fluctuates too! (not single straigt line!)

Stylized Facts#

Volatility#

empirical standard deviation

Stylized Facts of the BC

Real GDP moves up and down over business cycle

Investment is more volative than GDP (most unstable)

aboslute volatility of Inflation = 1/3 of GDP volatility

Correlation#

Remember:

Correlation can be negative / positive

Variables can be leading and lagging

Facts:

Consumption / Investment = positive corr. with GDP

Employment = procyclical (and unempl. vice-versa)

Inflation = positively corr. with GPD (altough not strong!)

Employment / Nominal Interest = lagging variable

Persistence#

Persistence: \(x_t\) is not independent from \(x_{t-n}\)

Variables stay at point, even after others have already changed

Facts:

GDP, Consumption, Investemennt = considerable persistence

Employment = even more pers.

Output Gap#

Difference between real GDP and trend value

negative = recession

Positive = boom

How to calculate? Insane Math…

Facts:

Total Labor Input is procyclical, and so is TFP

variation in labor is due to unemployment, not working hours