Macro 2 Summary#

Table of Contents:

Labour Market#

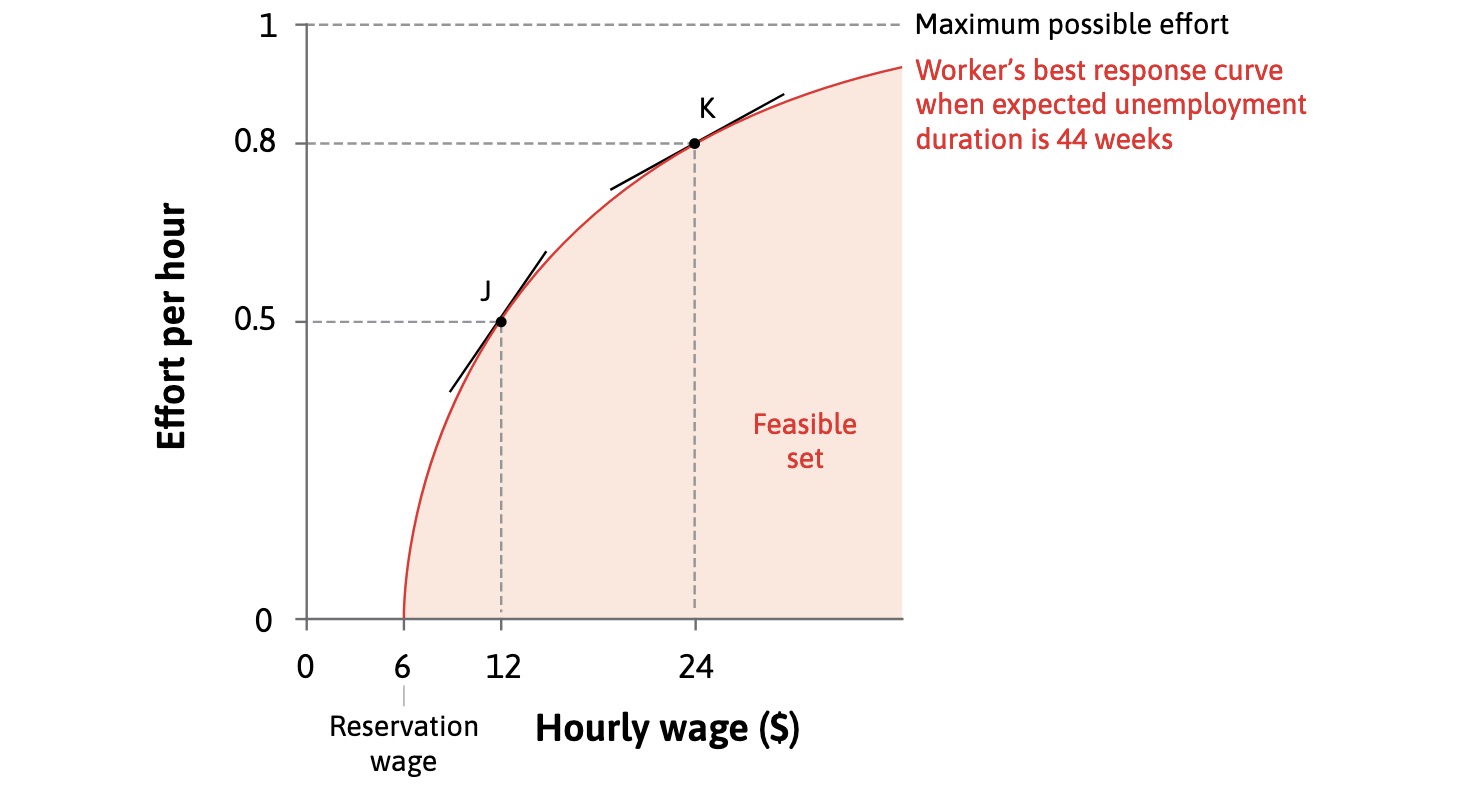

Wage and Effort#

= individual worker

wage set in contract, depends on

reservation wage = outside option

disutility of effort

employment rent

=> firms set wage based on effort level needed (HR Department)

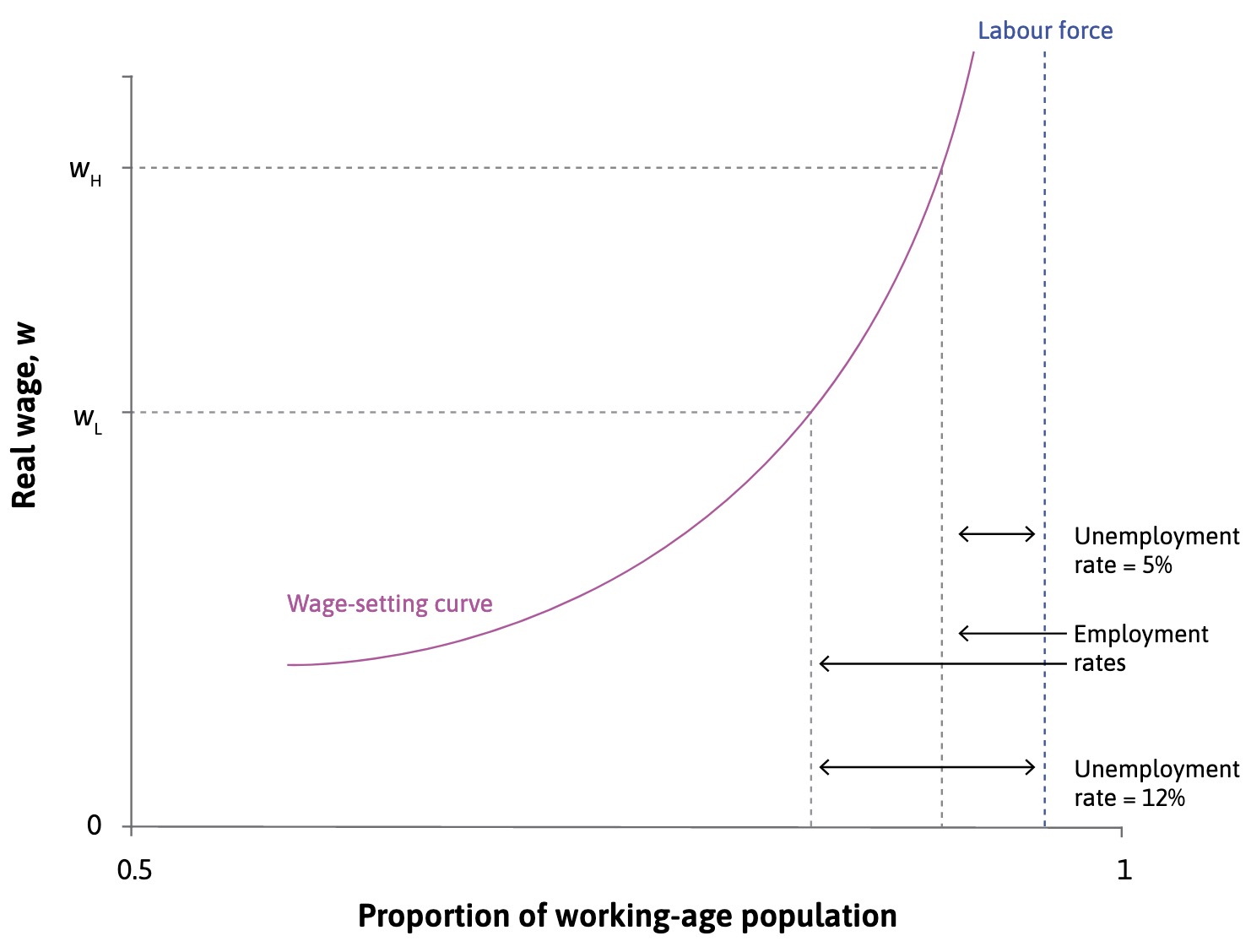

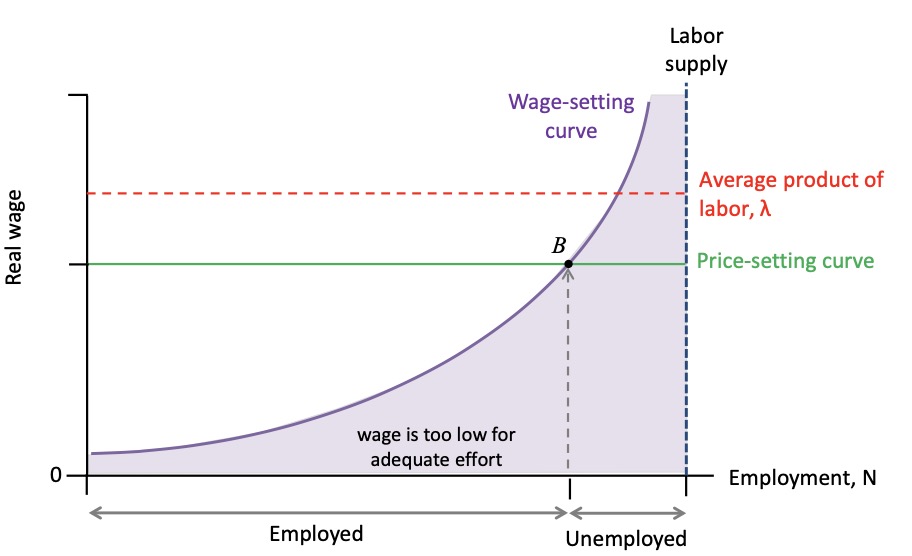

Wage Setting#

= whole economy

based on unemployment in economy

gives general wage level (nominal)

=> higher unemployment = lower nominal wage

individual |

whole economy |

|---|---|

|

|

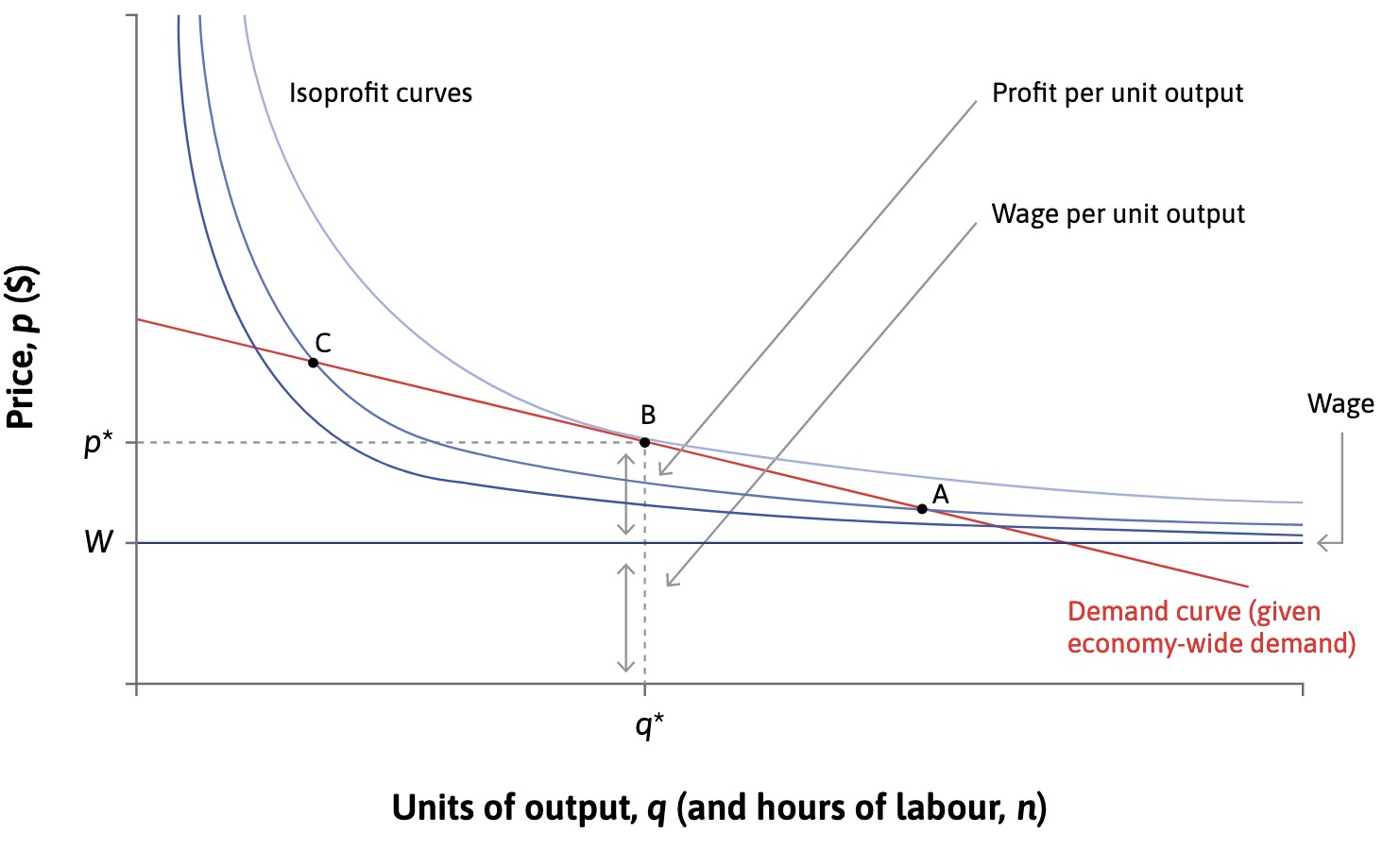

Prices#

= at individual firms

Firms Decision at given Wage based on

Demand

Competition

Markup needed for shareholders

=> prices / level of output and number of needed workers

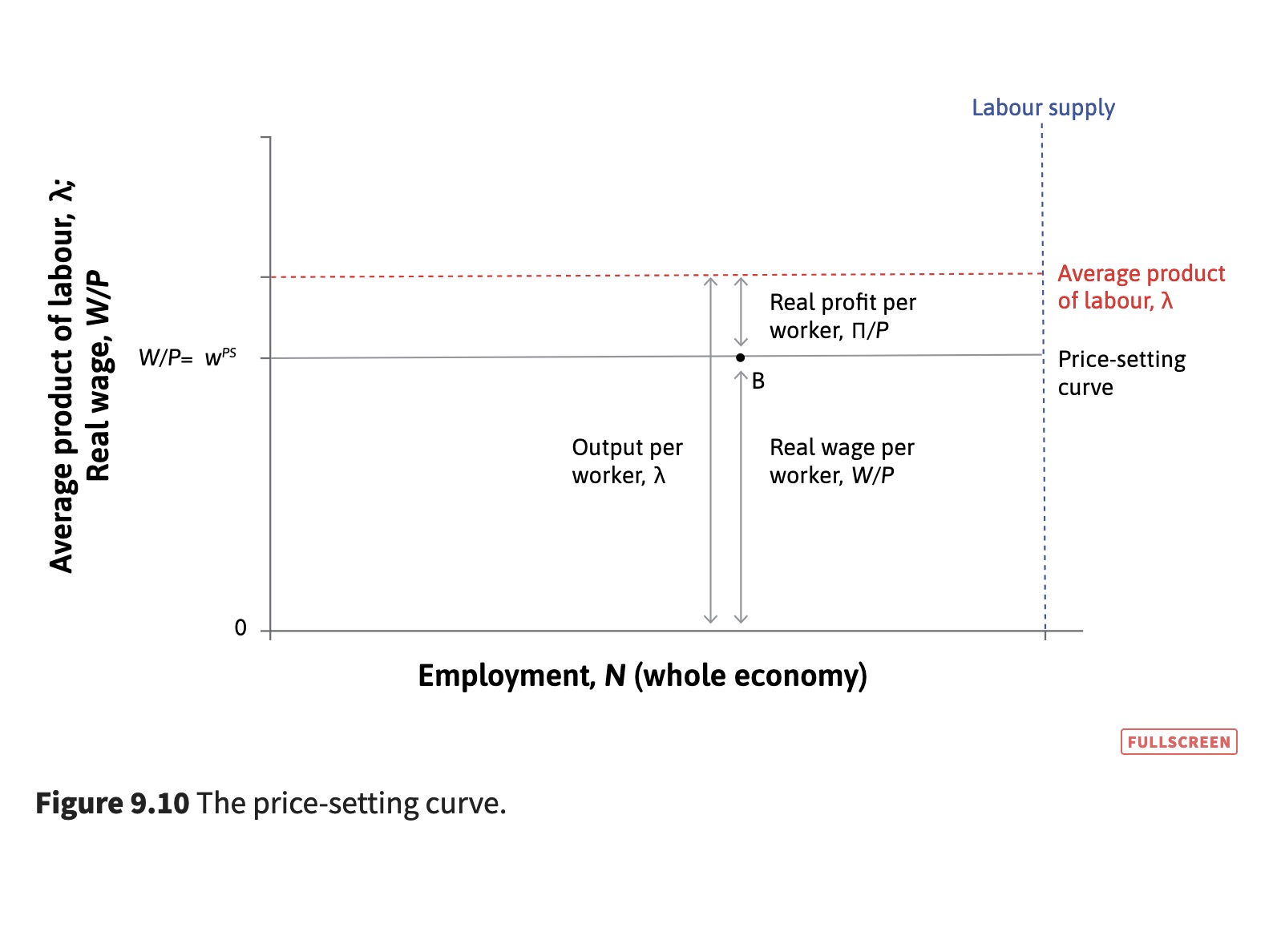

Price Setting#

= whole economy

all prices combined lead to price level

real profit per worker (\(\Pi/P\))

real wage per worker (\(W/P\))

=> only depends on competition

indivudual firm |

whole economy |

|---|---|

|

|

Equilibrium#

Wage Setting: Wage at given Effort

Price Setting: Prices at given Markup

leads to

least wage for effort

maximum employment

Involuntary unemployment (due to incomplete contracts!)

Model reaction to lower AD:

higher unemployment

lower wages along the WS-curve

lower prices for goods

higher demand for goods = higher labor demand

more employment back at equilibrium

Problem: Sticky Wages! and savings

Solution: Government Intervention to expand Demand (Monetary or Fiscal)

Banks#

lets just hope that banks dont play a big role in the exam…

Business Cycle#

Definitions#

Type of Fluctuations in capitalist economies of aggregate economic activity between contraction and expansion

Okuns Law: Connection between Cycle and Unemployment

Recession: Significant decline in economy-wide activity

GDP: Gross Domestic Product, calculated in different ways:

Income

Spending

Value added in Production

Spending: \(Y = C+I+G+X-M\)

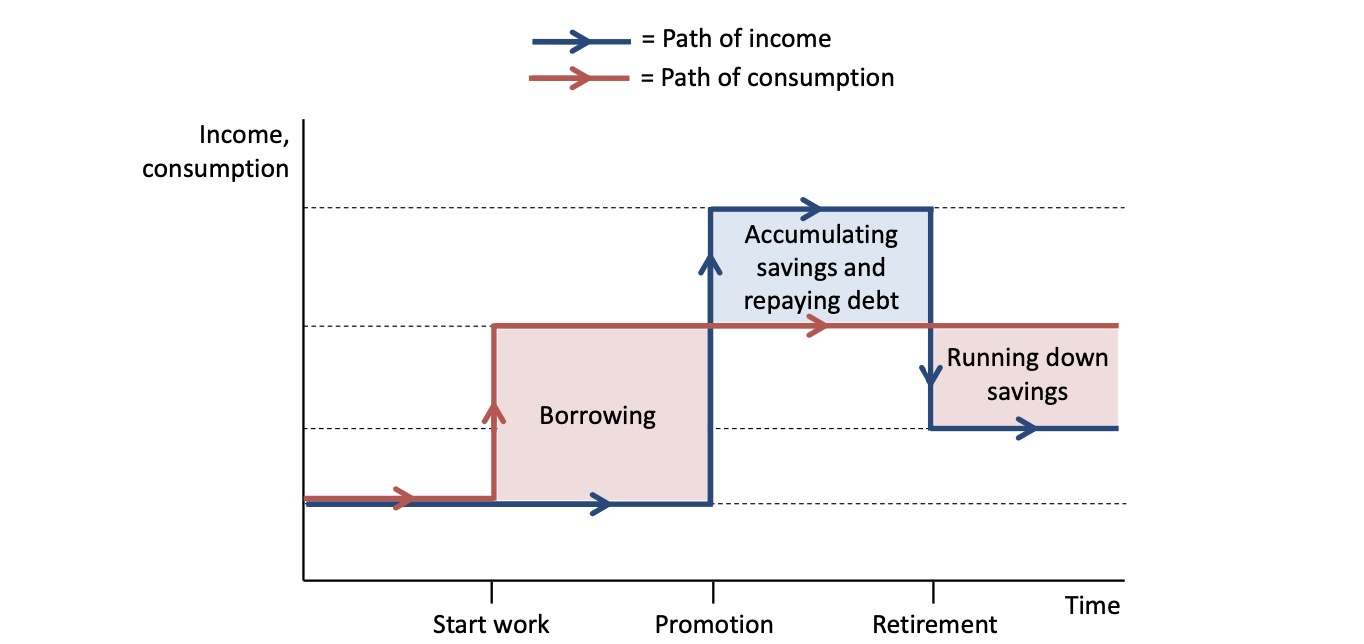

Smooth Consumption#

individuals smooth consumption (to have higher quality of life)

Borrowing from future income

saving / repaying in high-income times

limited by:

credit constraint

weakness of will

limited insurance

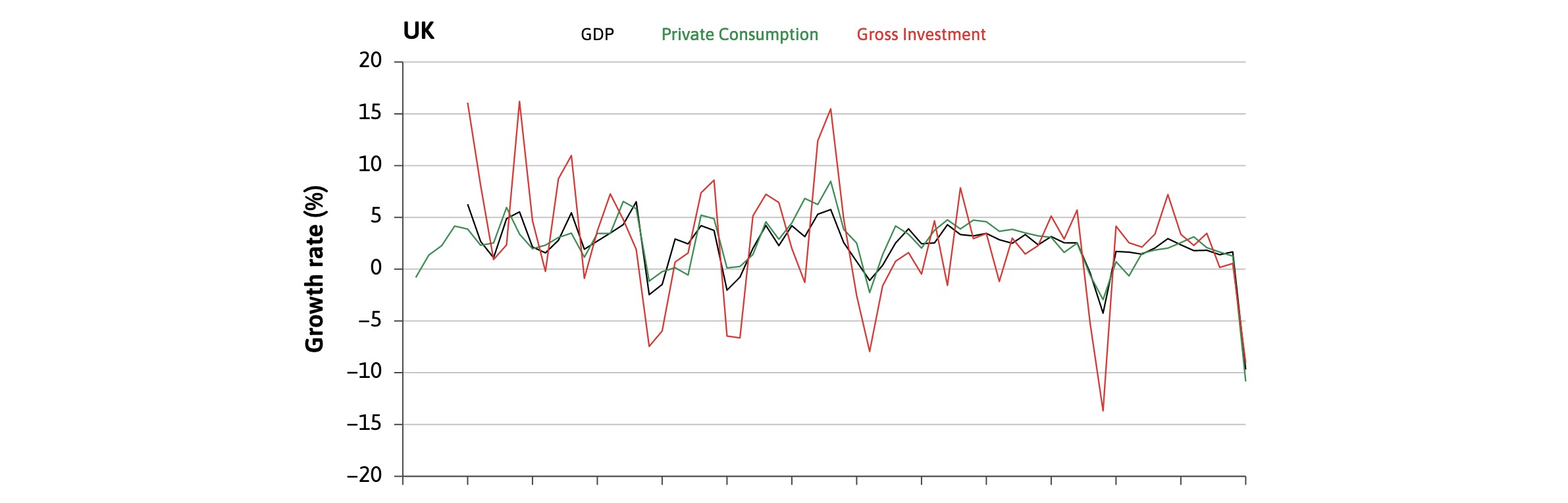

Consumption: lagging GDP, highly correlated

Volatile Investment#

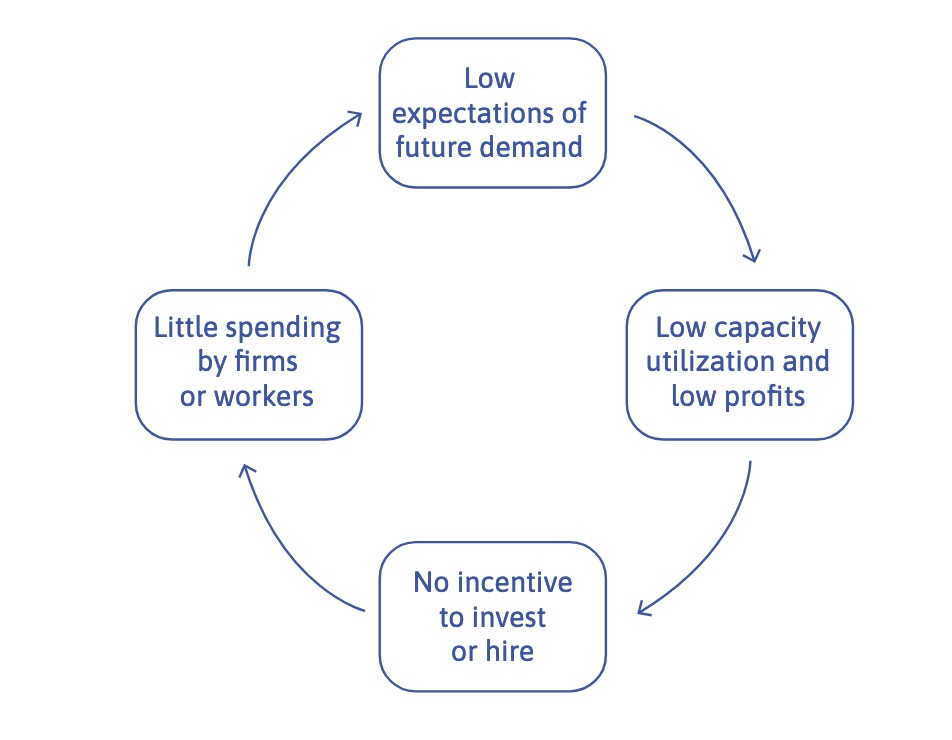

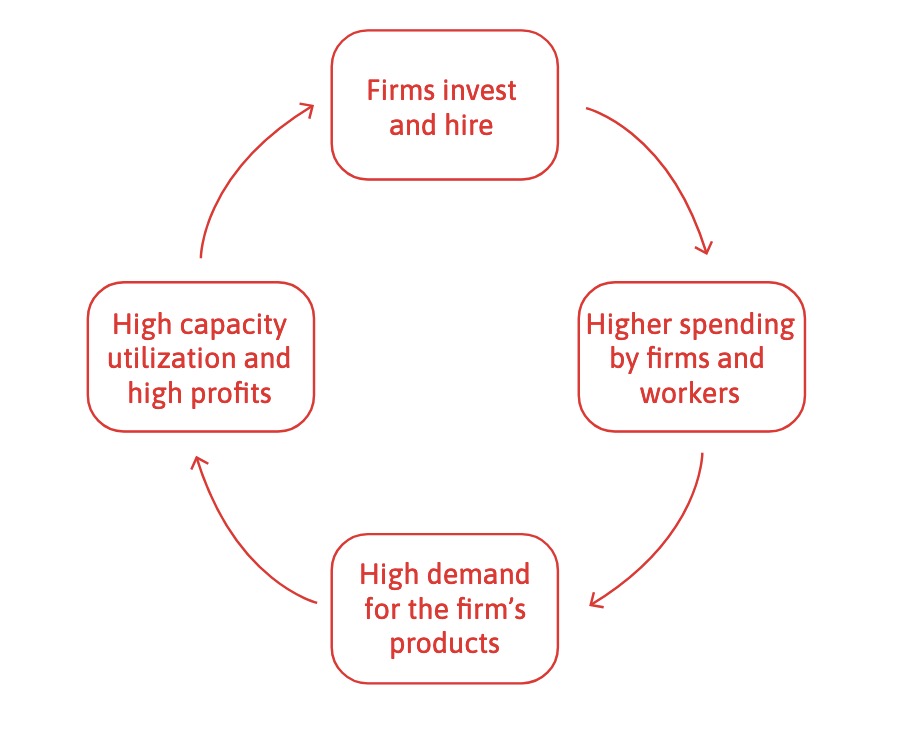

Investment = depends on expectations regarding BC

Contraction |

Expansion |

|---|---|

|

|

leads to self-enforcing business cycles

Investment: leading GDP, high volatility

Government Expediture#

Share of Government spending on% of GDP (\(b\))

varies across countries

depends on taxes / other income

finacable by debt / money print

Government Expenditure: less volatile than GDP, not dependent on expectations

Stylized Facts#

Volatile |

Correlation |

Persistence |

Leading / Lagging |

|---|---|---|---|

Investment = more volatile than GDP |

Consumption / Investment = correlated to GDP |

GDP + Investment = persistent |

Investment = leading GDP |

Inflation = less volatile |

Infaltion | GDP = no strong correlation |

G Exp + Employment = very persistent |

Employment = lagging GDP |

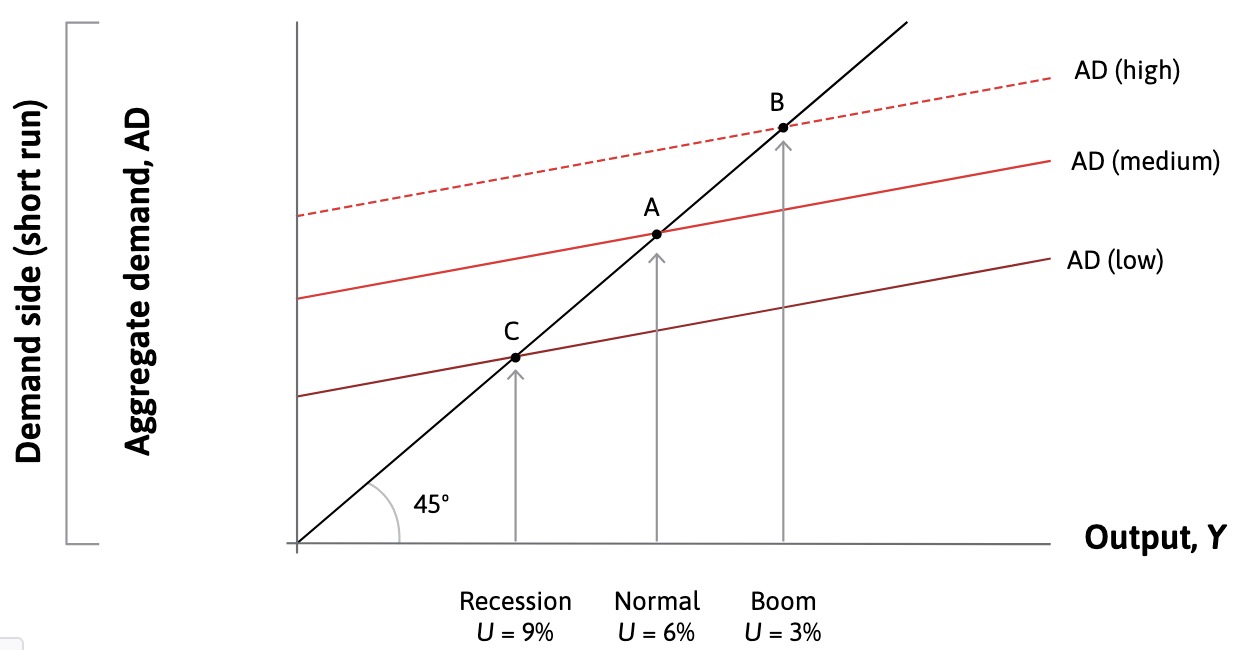

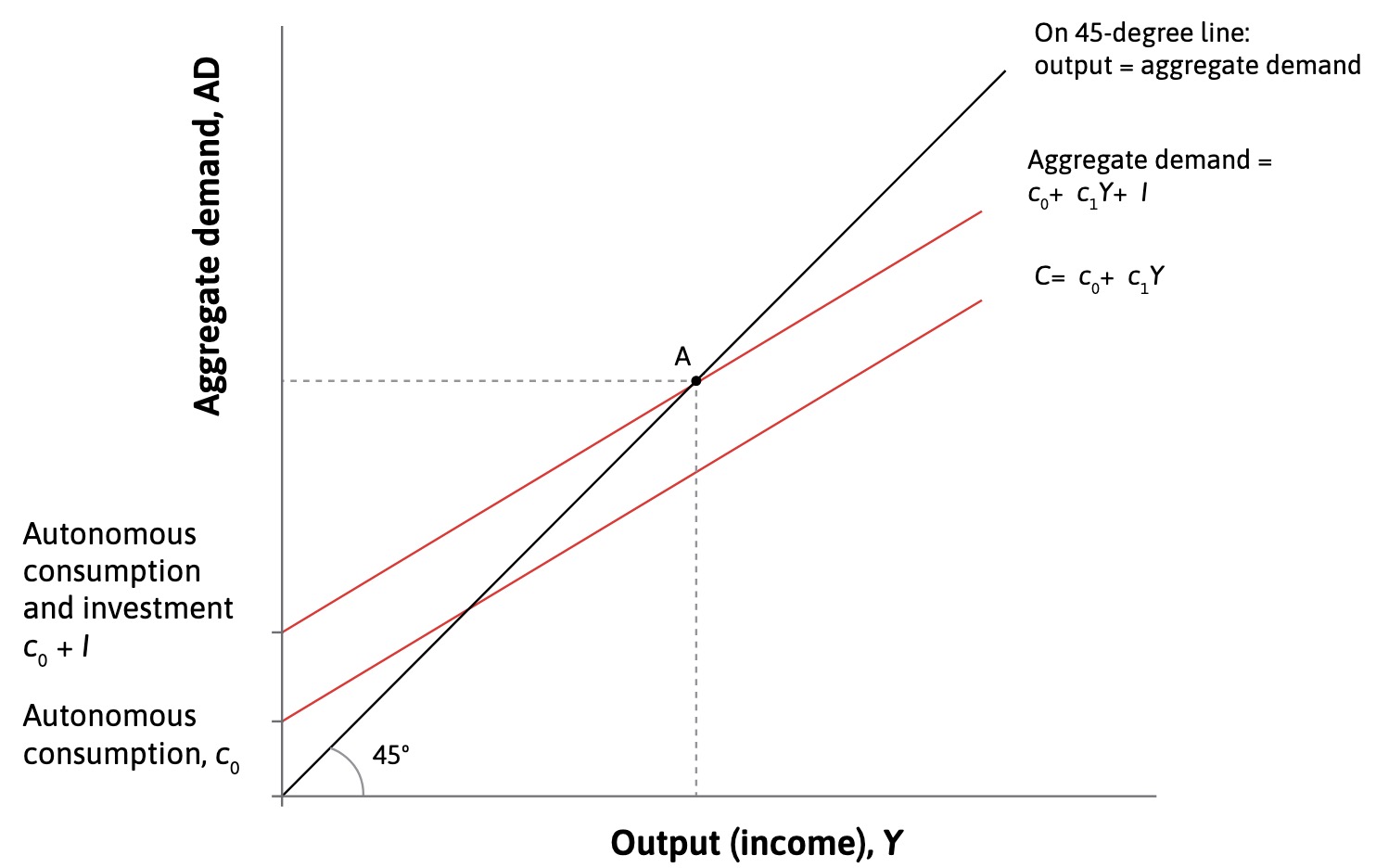

Multiplier Model#

Consumption Function:

autonomous consumption (from smoothing): \(c_0\)

income dependent consumption: \(c_1*Y\)

based on marginal propensity to consume

45° Line = Aggregate Demand = Aggregate Supply

Everything needed is supplied (at less than full capacity)

Change in Output / Income: never relevant, moves along the line

Change in AD: relevant, because it moves the line (e.g \(I, G, c_0\) change)

exampe: higher Investment

moves Consumption Line upwards

multiplied by after round effects

Multiplier: \(k = \frac{ 1 }{1-c_1}\)

Influences on the Multiplier Model#

Fiscal Policy = dampen Fluctuations in AD

Multiplier influenced by

Exports / Imports = make Stimulus more difficult

high credit constrained = more effective multiplier

Capacity of Economy

AD and Unemployment#

Connection of both Models

Supply Side: Labor Market Model

Demand Side: Multiplier Model

Assumption: \(N = Y\)

Government#

Role = Fiscal Policy in Crisis, when k > 1 (output gap)

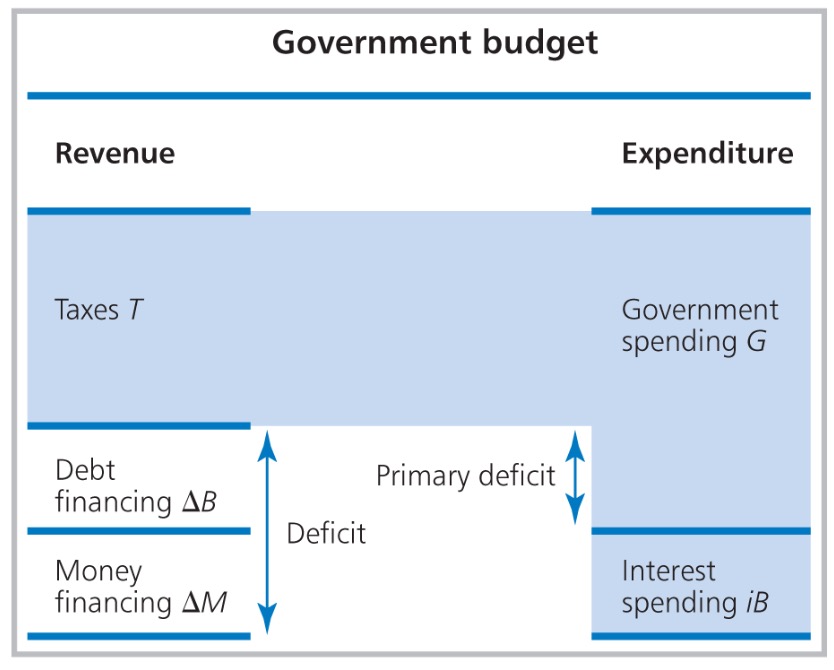

Budget Deficit: \(\Delta B = G+iB-T\)

Primary Deficit: \(G-T\)

Budget Constraint: \(T + \Delta B = G+iB\)

Important equations#

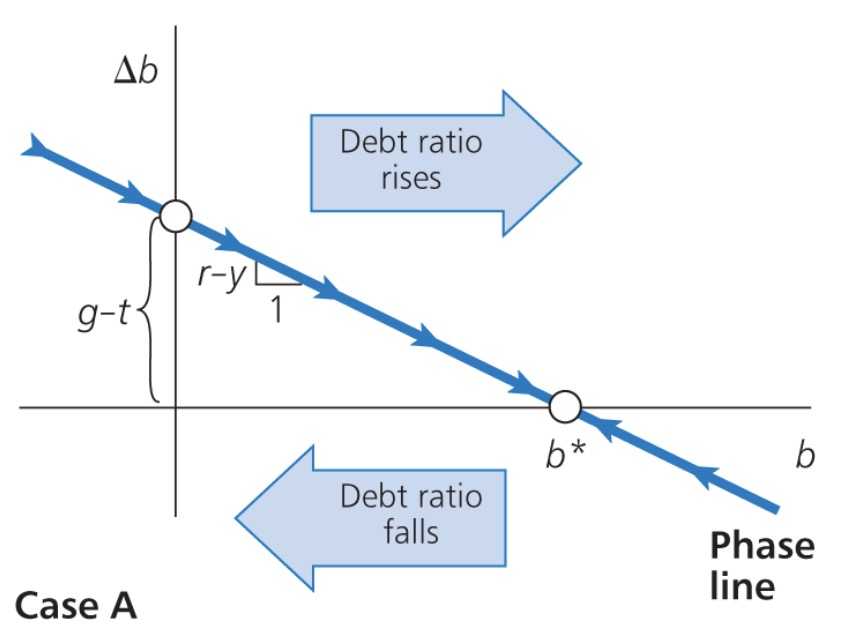

\(\Delta b = g-t+(r-y)b\) : debt ratio dynamics

\(b^* = \frac{ g-t }{y-r}\) : equilibrium debt ratio

\(b^* < 0\) = creditor

\(b^* > 0\) = debtor (should be at least)

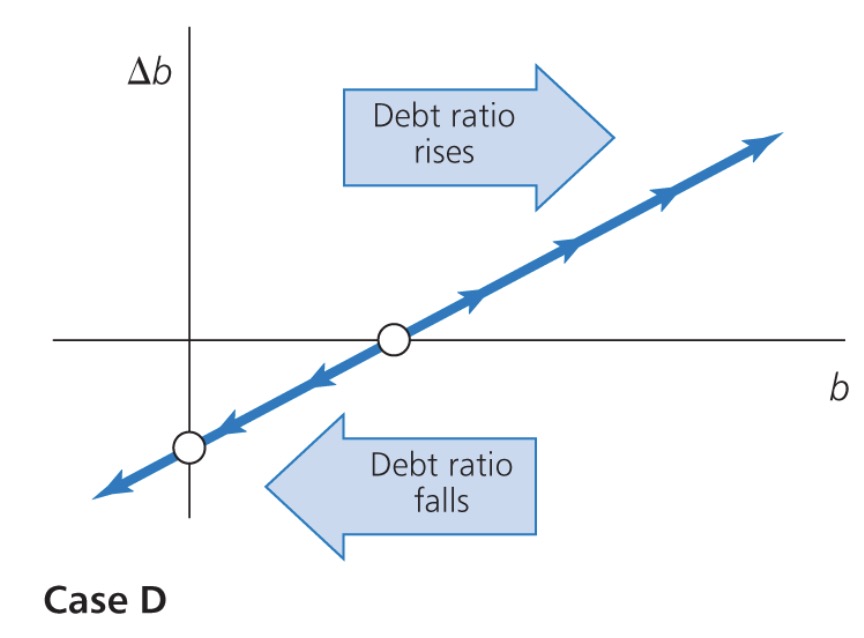

Phase Lines#

Stability of Debt

if \(r-y < 0\) (growth higher than interest) = repayment always possible

if \(r-y > 0\) (high interest rate) = debt spirals out of hand

stable creditor |

unstable creditor |

|---|---|

|

|

Default Risk#

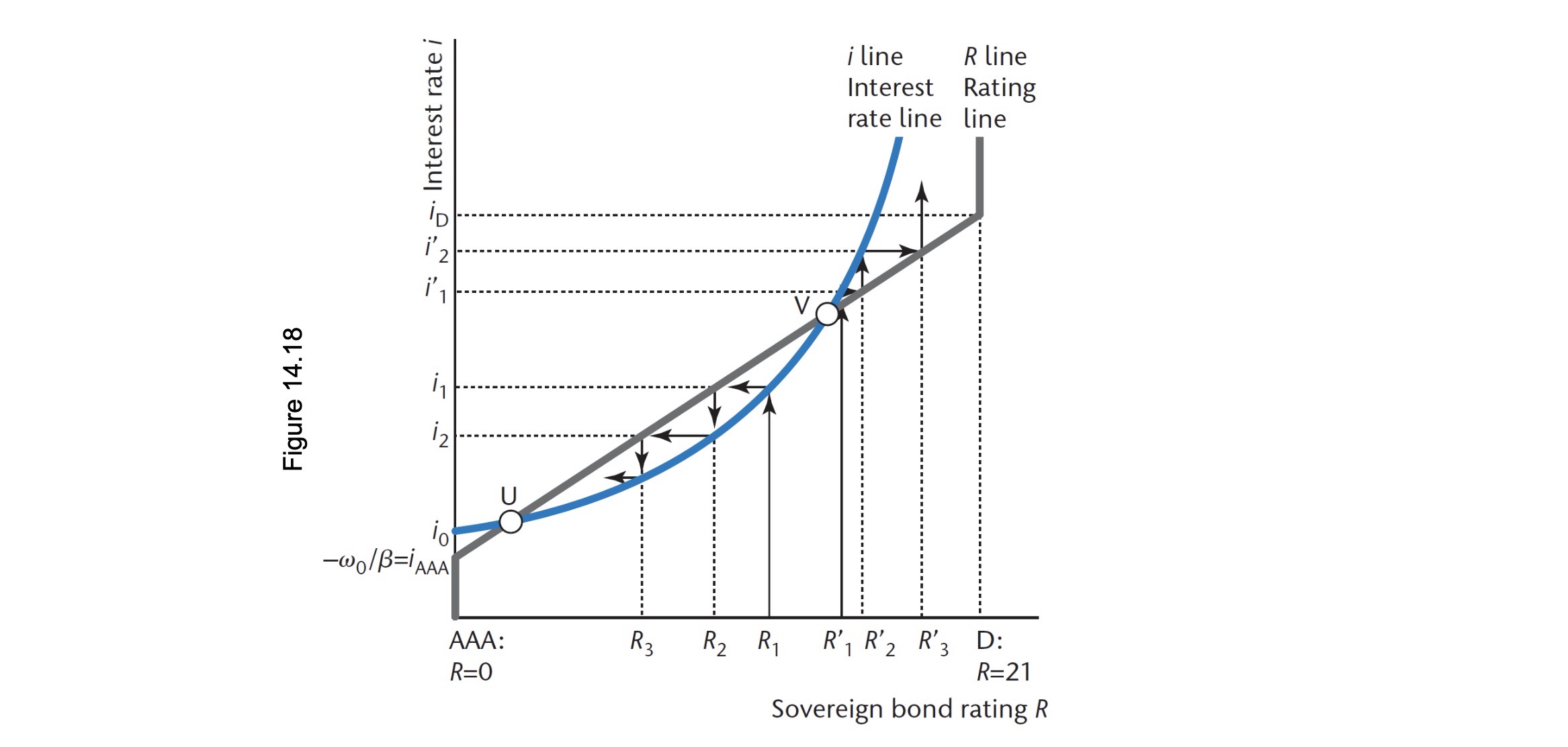

default probability: \(\omega\) (determined by credit agency)

\(i_0\) = riskless asset

Government Interest Rate:

Default Risk: \(\omega = \omega_0 + \beta i\) (Debt ratio and interst are in calculation)

Risk of Spirals: interest rate \(\uparrow\) = debt burden \(\uparrow\) = risk \(\uparrow\) = interest rate \(\uparrow\)

Bond Rating (R) and interest rate:

Inflation#

Inflation: increase in general price level

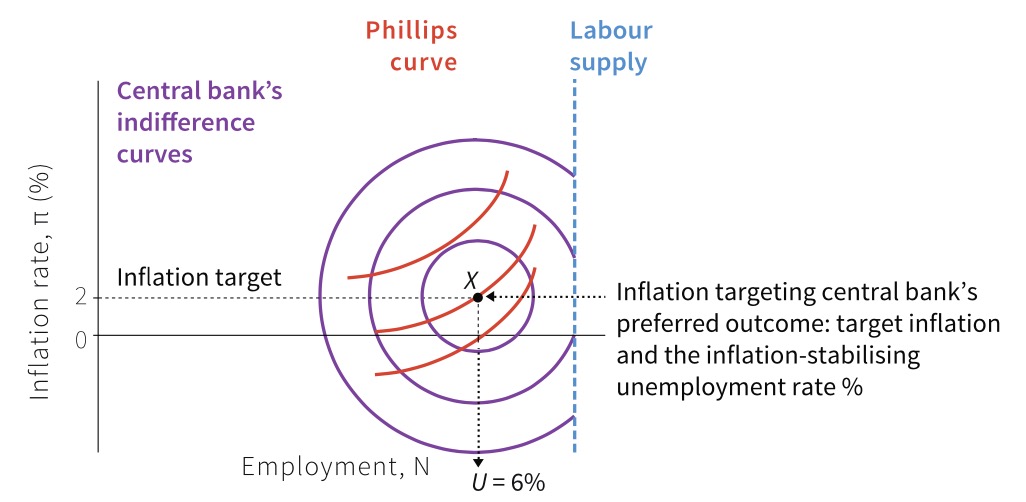

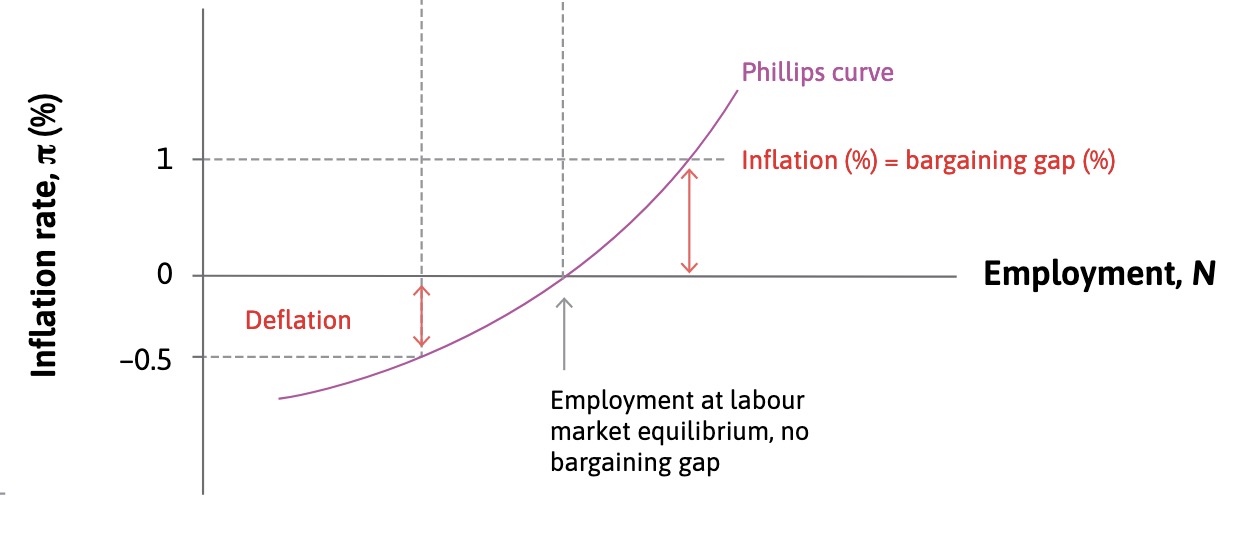

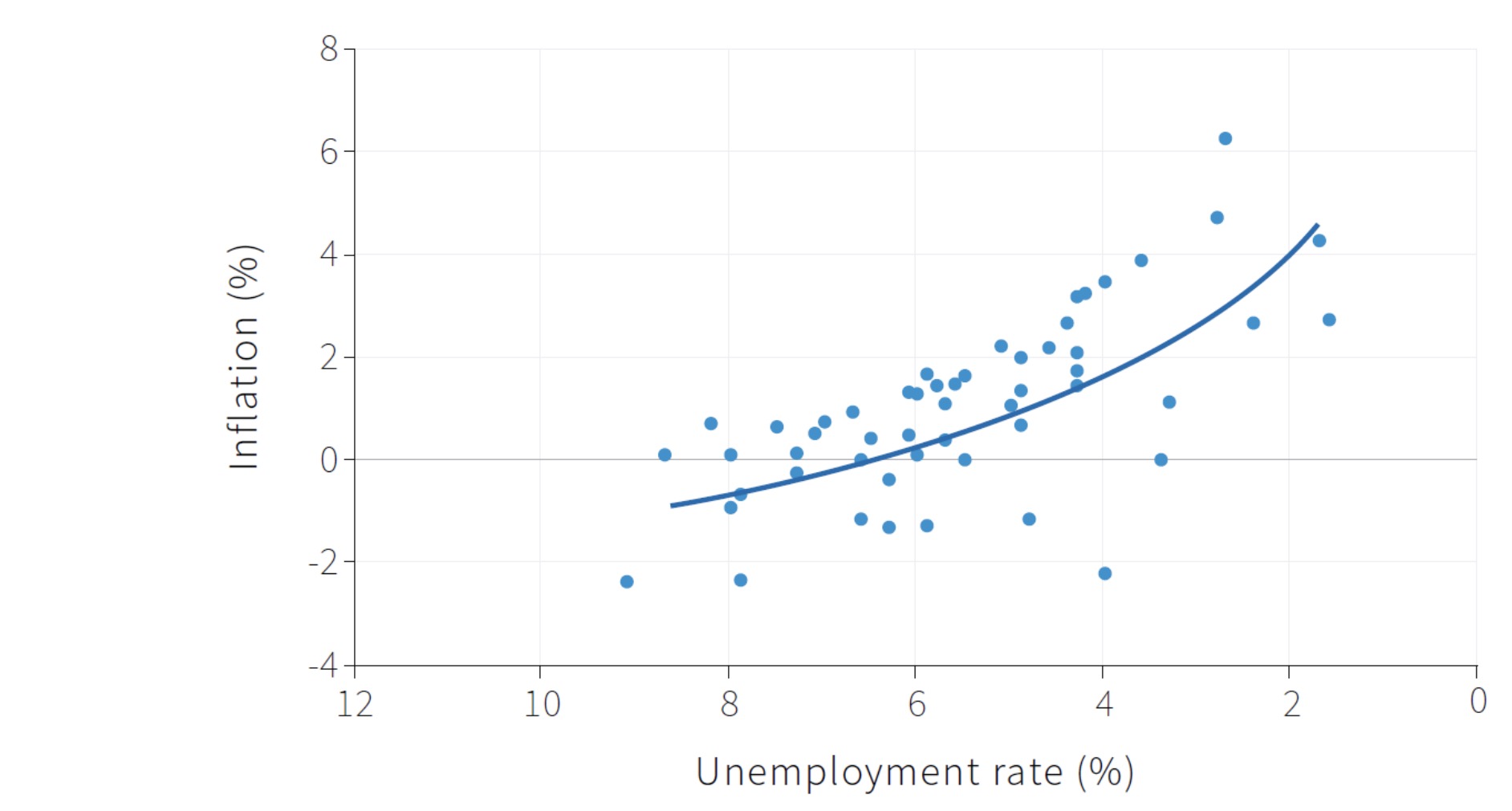

Philipps Curve#

Correlation between Unemployment and Inflation (inverse relationship)

Higher unemployment = lower wages = lower prices = lower inflation

=> the philipp curve shifts with expectations of inflation! (staglfation)

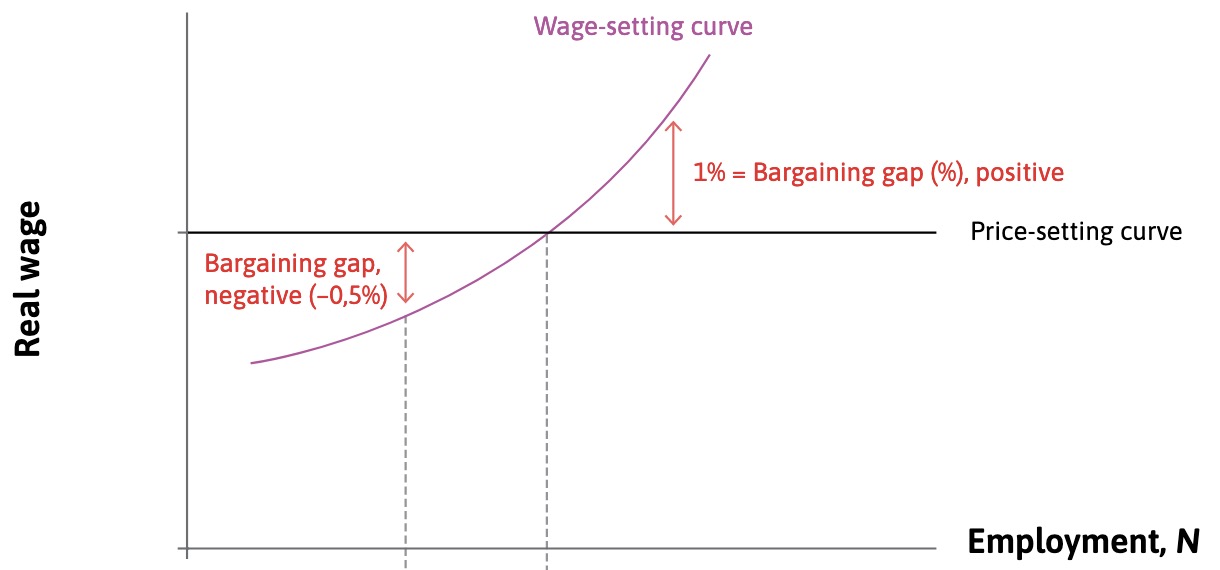

Bargaining Gap#

Difference between:

Wage firms want to offer for optimal effort (Wage Curve)

Wage for optimal markup (Price Curve)

=> inconsistent claims in output

possible Reasons:

higher firmpower = higher markup = lower PS

higher union power = higher wages = higher WS

more employment = WS \(\to\)

Inflation and AD#

Combination of

short run model (Multiplier Models)

and medium run (efficiency wage model)

Effect of Boom:

lower unemplyoment

WS curve to the right

higher wages + bargaining gap

higher prices

Wage price Spiral

AD |

Wage |

Phillips |

|---|---|---|

|

|

|

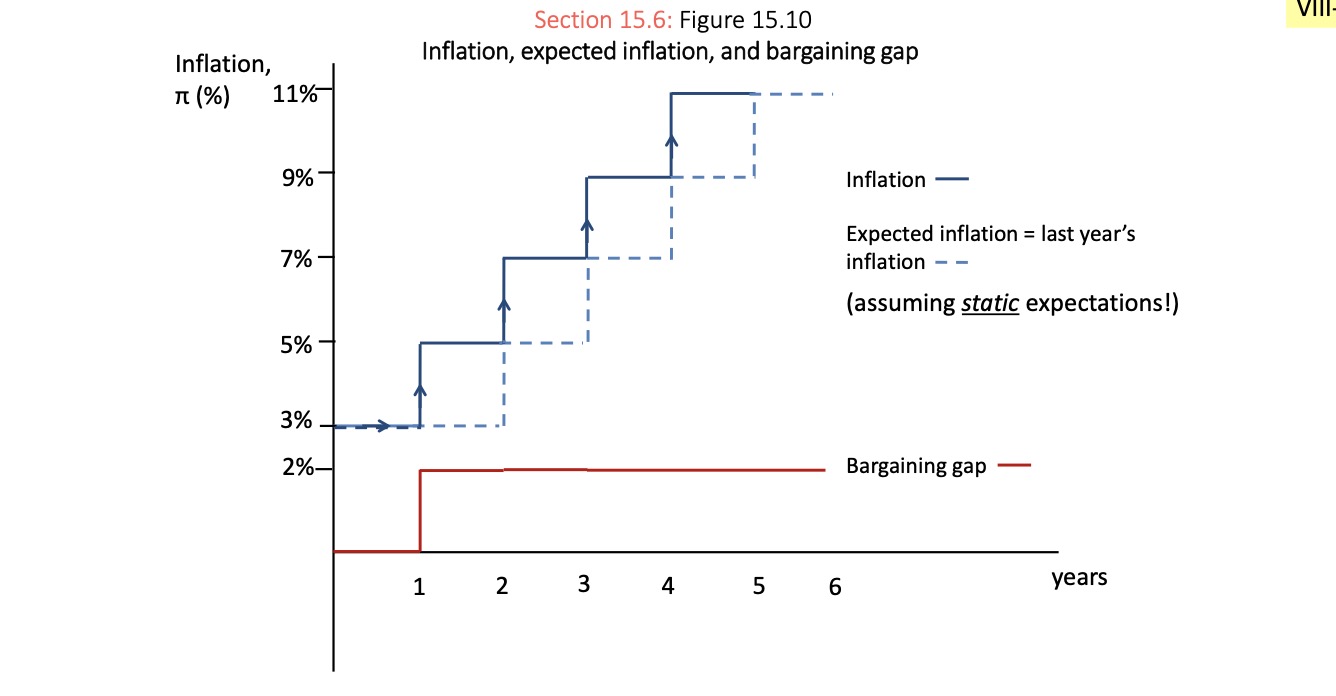

Expectations#

Friedman: Expectations are integrated into inflation => no long term suprise infaltion possible

Phillips Curve Tradeoff not possible!

Situation:

normal inflation = 3%, Bargaining Gap = 2%

workers demand wage rise of 5%

but inflation next year = 5% => demand 7%

depends on static expectaions \(\pi^e = \pi_{t-1}\)

Spiral of Inflation:

Monetary Policy#

Tools:

interest rate, influences

market interest rates (investments)

asset values

expectations

exchange rate

Quantiative Easing

Assumptions of effective MP:

independence

above zero bound

flexible exchange rate

own currency

Problems:

Trust needed

Fiscal Policy = can have opposing goals

Preferences of CB#

Loss Function: \(L = b(U-U^*)^2+(\pi-\pi^*)^2\)

Optimisation: \(U = U_n - a (\pi-\pi^e)\) (Phillips Curve with Expectations)

=> Surprise inflation = incorporated = not worth it

defines rule-based inflation targeting: