10.01.2024 Tax Incidence#

Three rules#

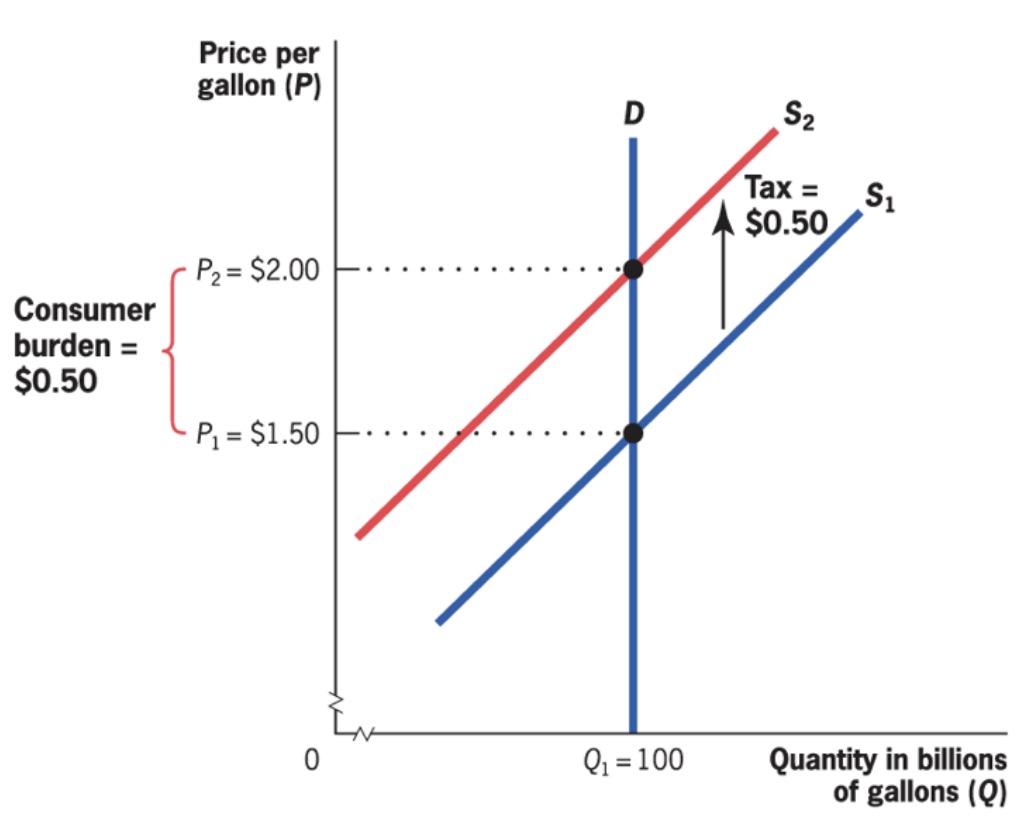

Statutory burden \(\neq\) economic burden

side of the market = irrelevant

parties with inelastic supply = bear taxes

Statutory and economic incidence#

Economic Incidence: burden of taxation measured by change in resources available

statutory incidence: burden borne by party that sends check to gov.

Example:

Calculation for Consumers:

Producers vice versa

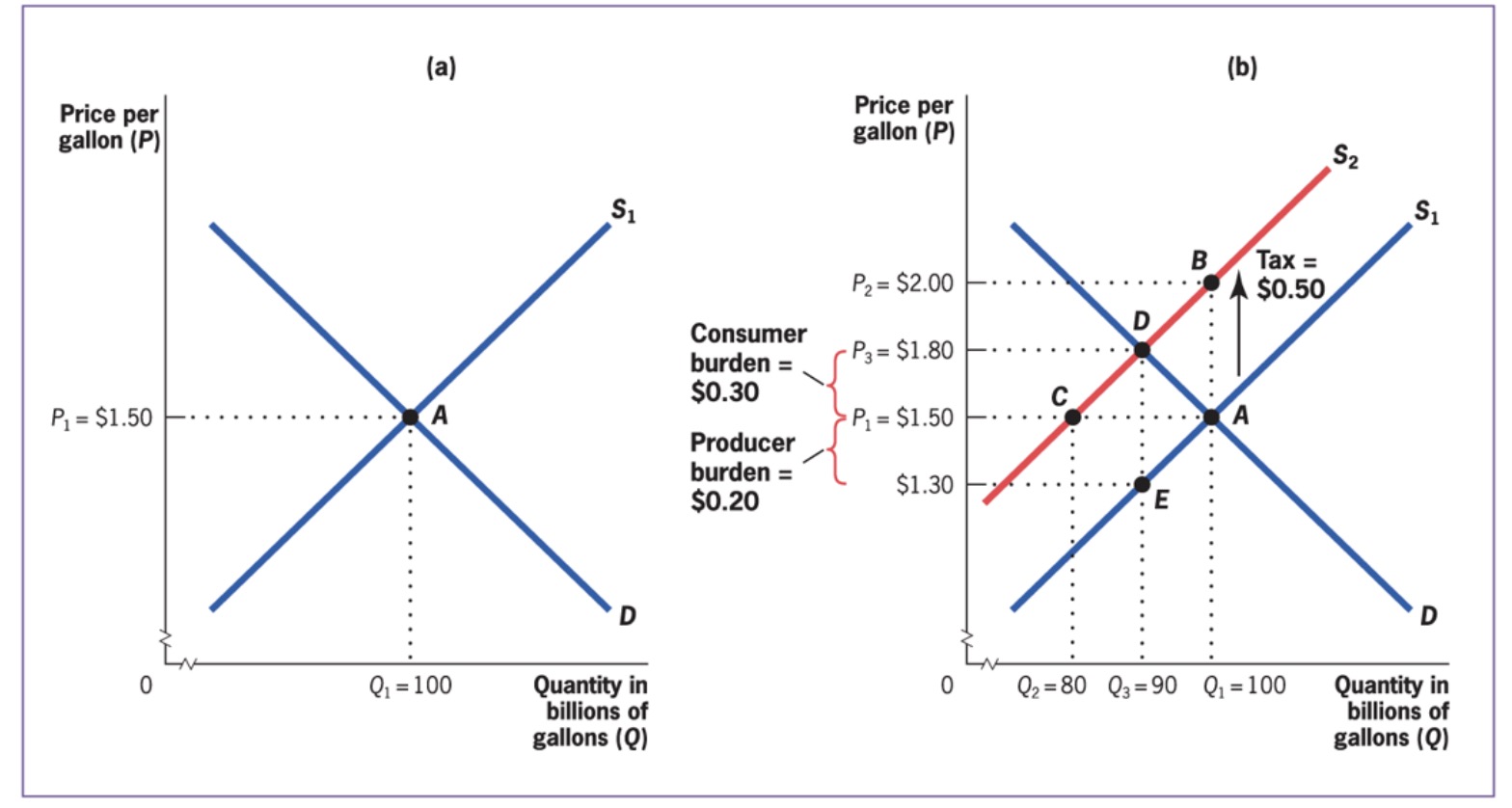

Tax Wedge: difference between consumers pay and producers receive

e.g consumers pay 1.8, producers receive 1.30 => wedge is 0.5 to government

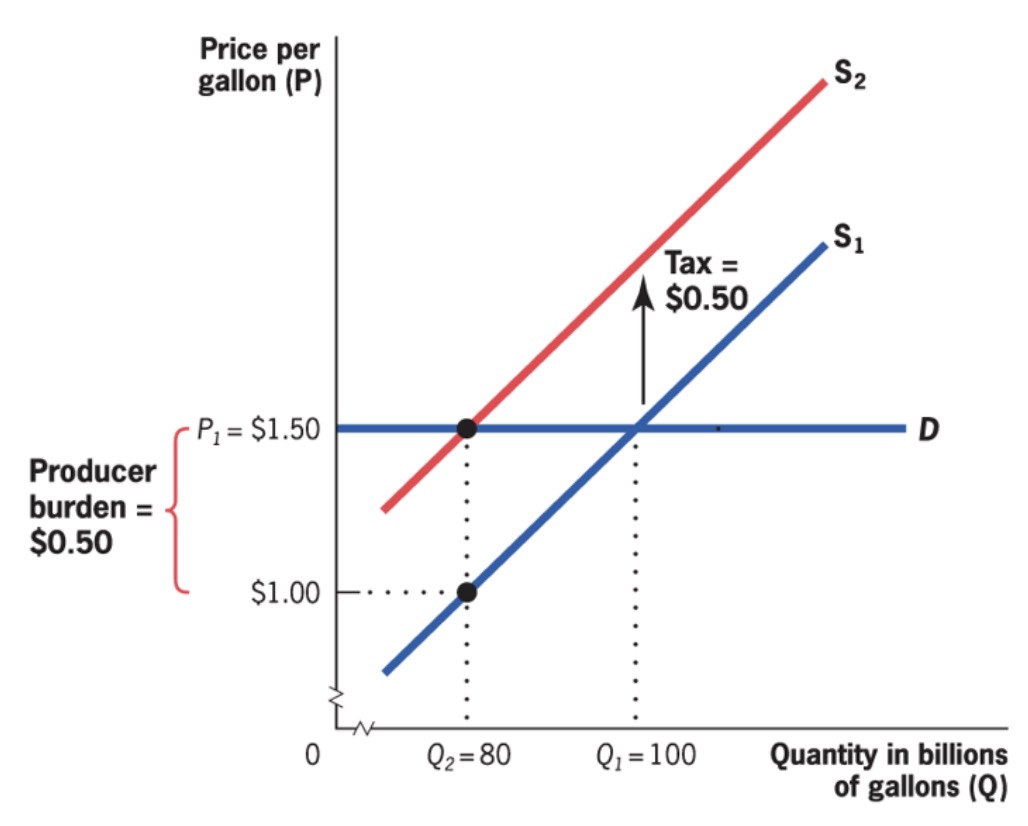

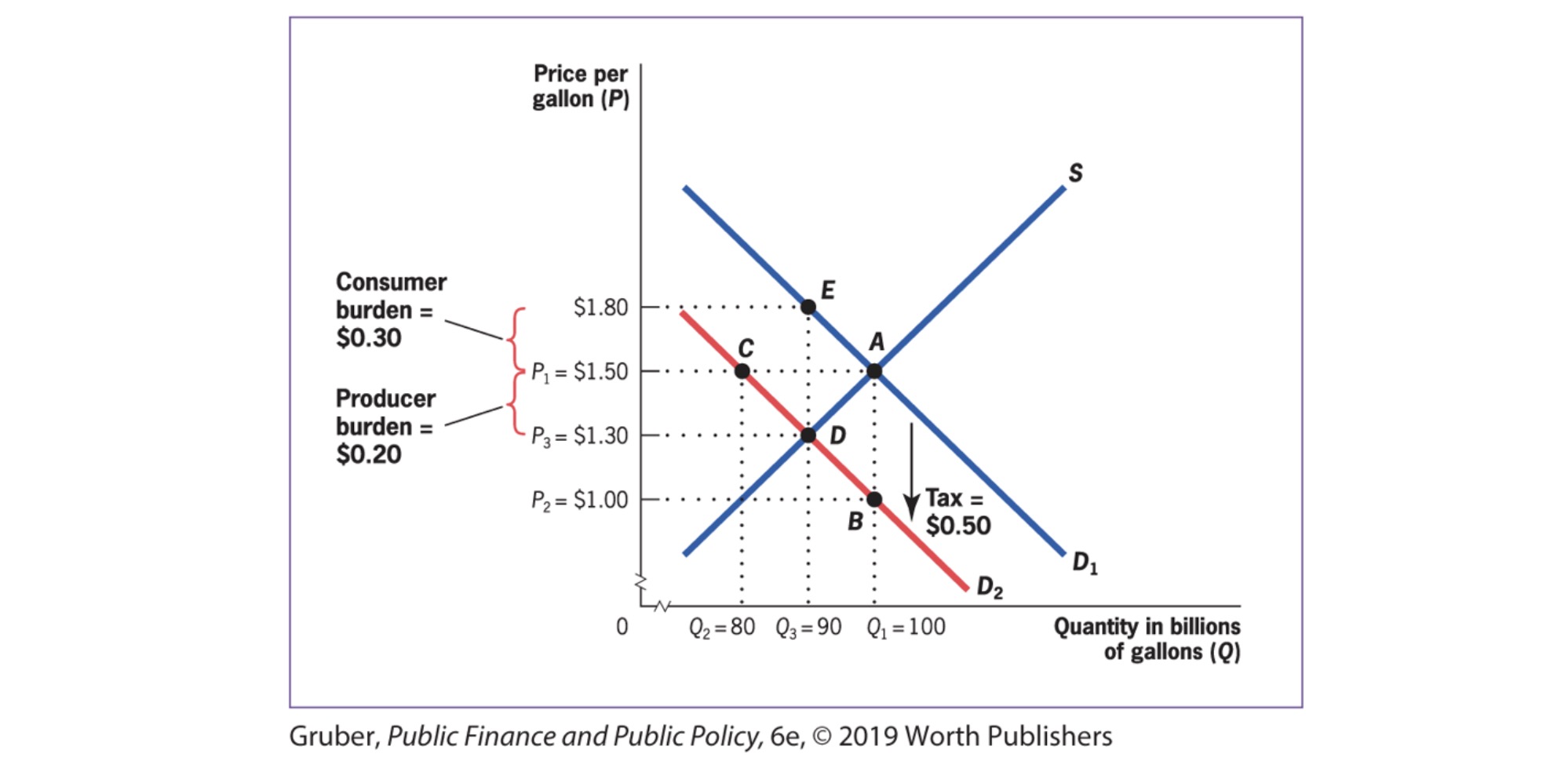

Tax Side does not matter#

Exampel from before, but other side

Gross Price: market price

After-Tax price: gross - tax

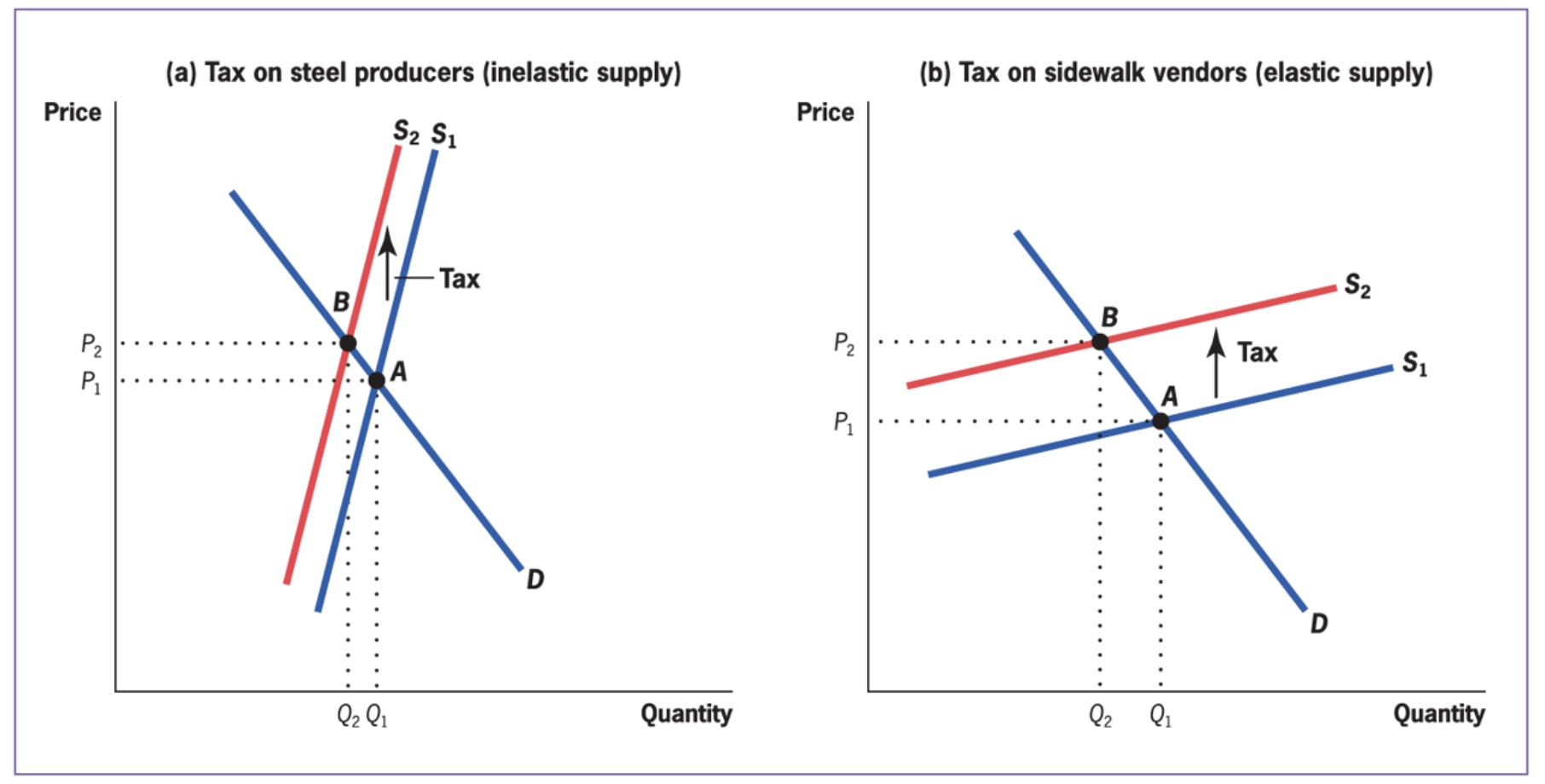

Elasticity#

inelastic demand |

elastic demand |

|---|---|

|

|

burden at consumers |

burden at producers |

Vice-versa for supply side

also applies for factor markets!

Balanced Budget Incidence#

Tax Incidence Analysis that accounts or tax & benefit

Hard to determine

analysis of tax benefits

General Equilibrium Tax Incidence#

partial Equilibrium tax incidence: tax effect on one market in isolation

general equilibrium tax incidence: tax effect on related markets

Vertically (within market)

horinzontally (across markets)

Issues:

elasticities differ in long / short run

spill over effects

easines to find untaxed subsitutes (tax scope)

Example: Tax on Restaurant

effects on other goods

Income Effect

Substitution Effect

Complementary Effect

e.g higher demand for movies as alternative time