05.07.2023 Instruments of Trade Policy#

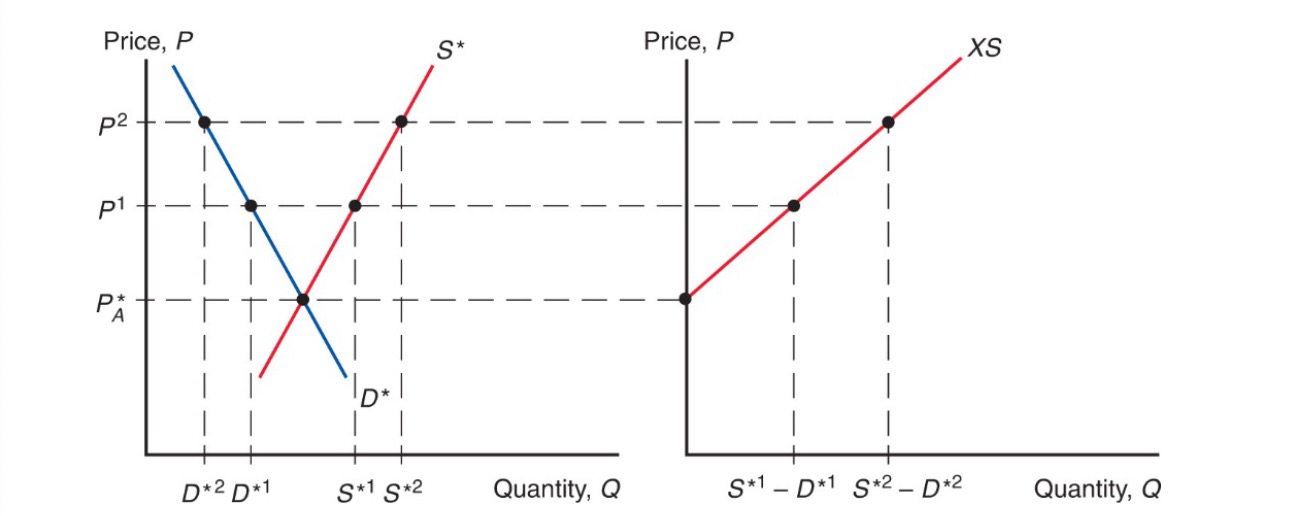

Summary of all options:

Tariffs#

Types:

specific tariff: per unit

ad valorem: as % of value

Situation in one-good and tariff:

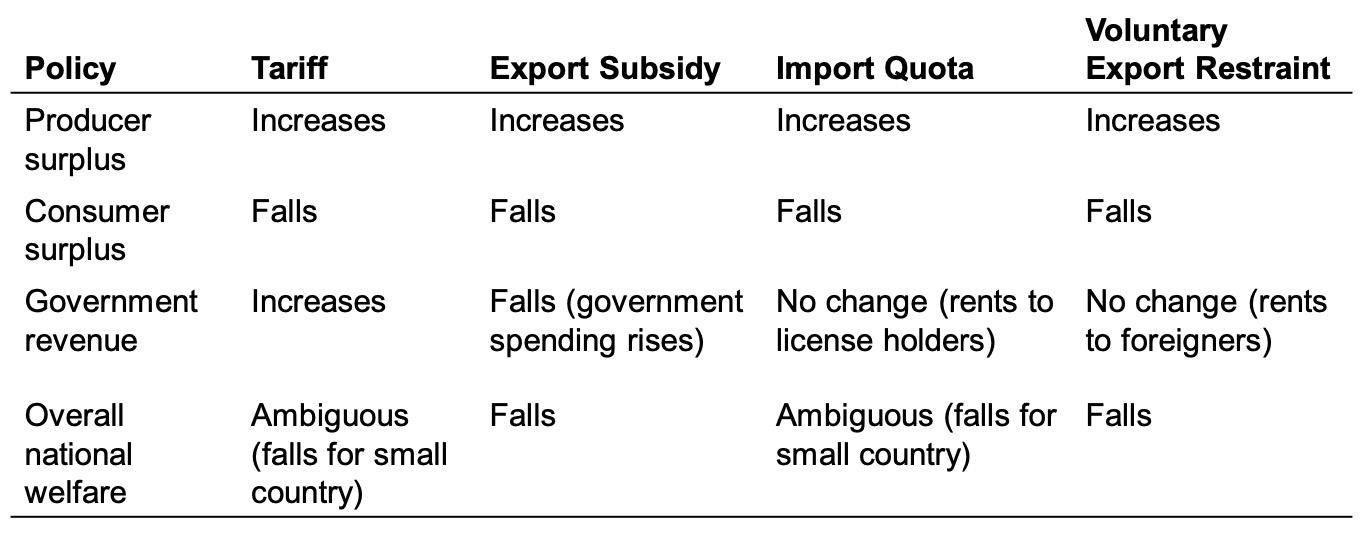

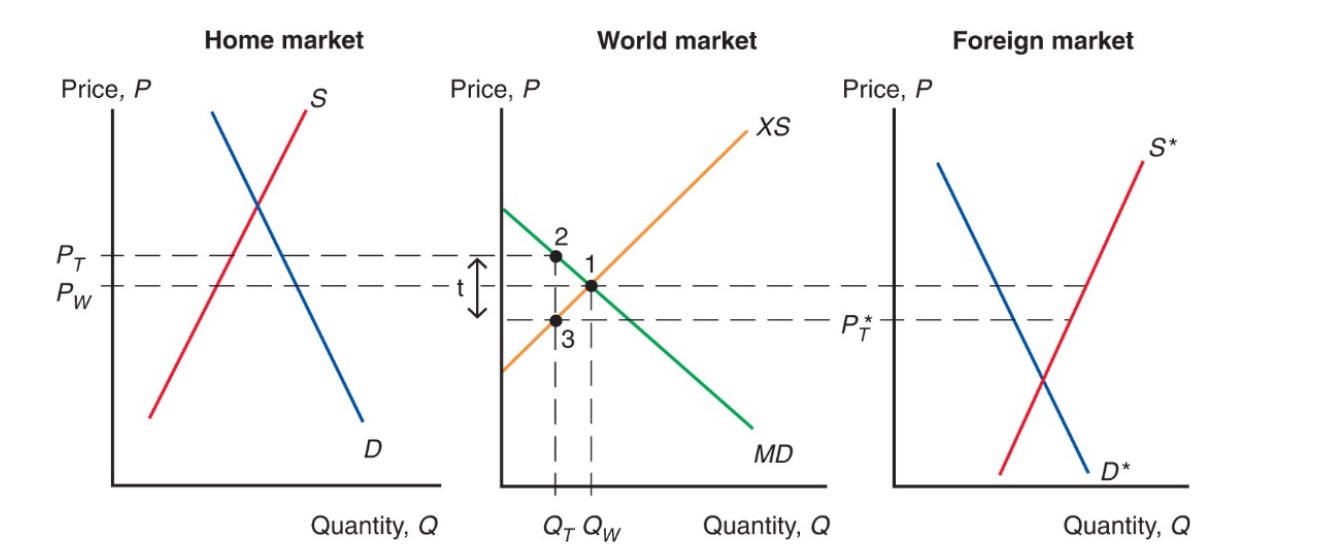

Import Demand Curve#

where foreign price less than home

\(MD = D-S\)

downward sloping (higher world price = less imports)

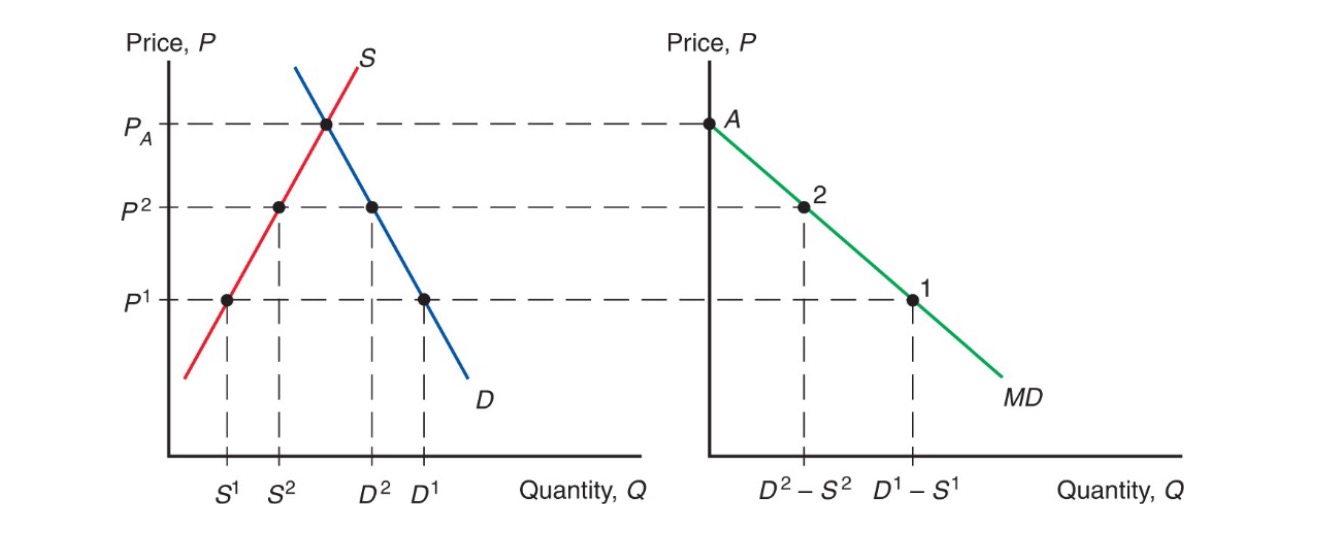

Export Supply Curve#

from perspective of foreign country

\(XS^* = S^*-D^*\)

upward sloping

Equilibrium: Import Demand = Export Supply

Effects of Tariff#

= Transportation Cost

unwilling to trade unless foreign price compensates tariff

\(P_t - t > P_t^*\)

higher price home, leser foreign

=> less traded, higher prices

tariff increase not completely on home price

of country small = no effect on world price = complete markup tariff

Amount of Protection#

effective rate of Protection: Change in value added for producers after trade policy change, depends on price change of good

Example:

before: 8000€ Cars with inputs 6000€ = 2000€ value added

After: 25% tariff increase

price now: 10000€ (8000*1,25) for car

factor prices same = 10000-6000 = 4000€ value added

rate of protection: \(\frac{ 4000-2000 }{2000}=100\%\)

Here: rate of protection > tariff rate

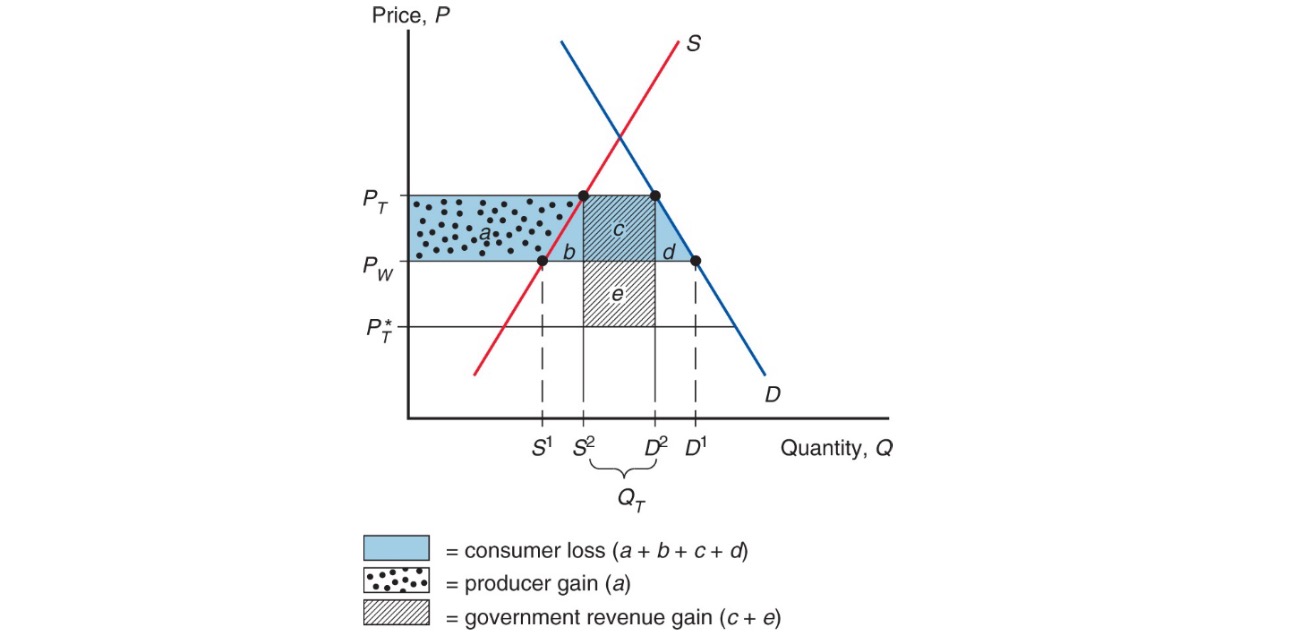

Cost and Benefits#

consumers = higher prices

producers = more profit

government = tariff money

d+e = efficiency loss

e = terms of trade gain (lower foreign prices)

only possible for large countries

Problem: Retaliation and Wasteful activities

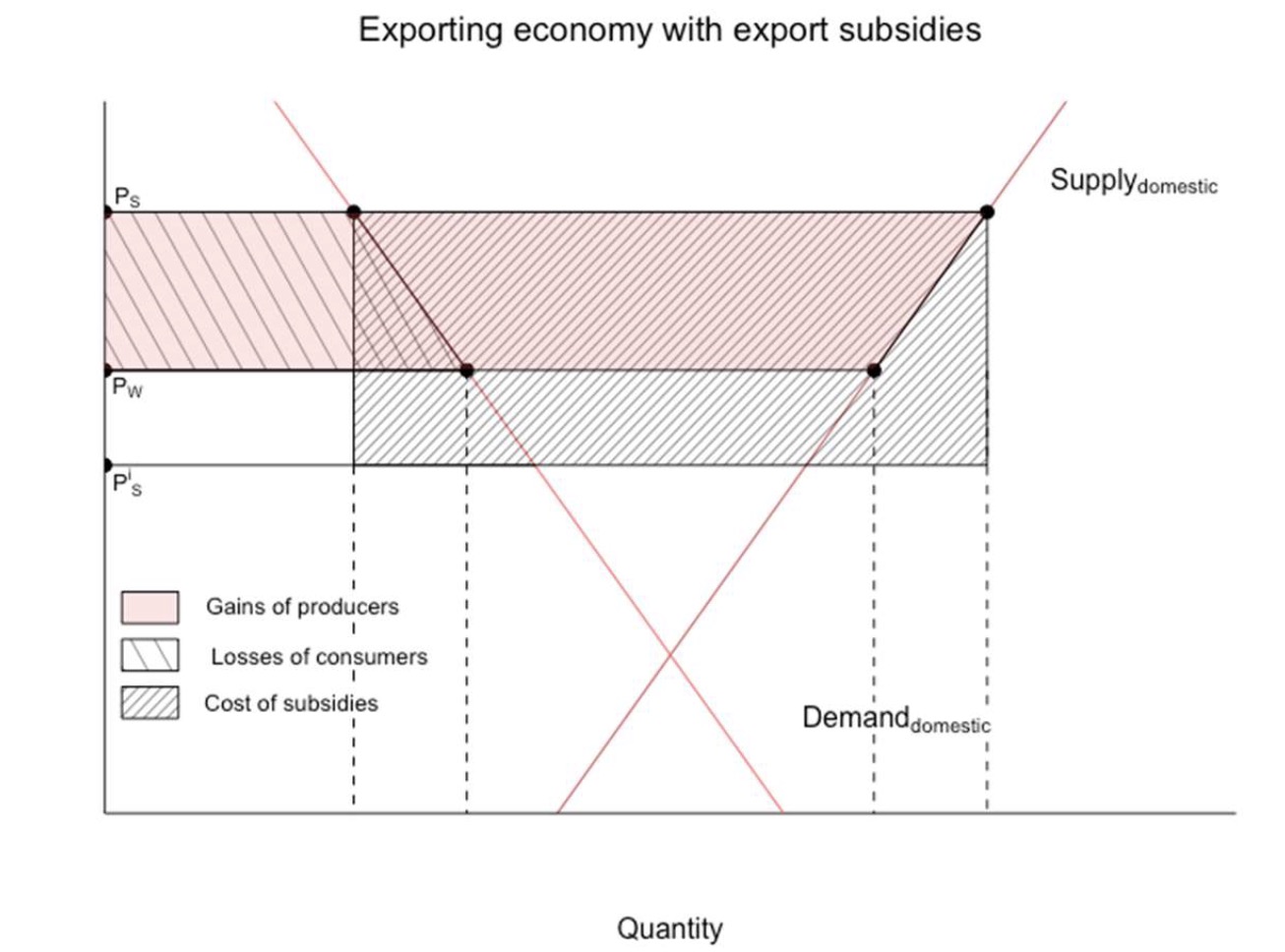

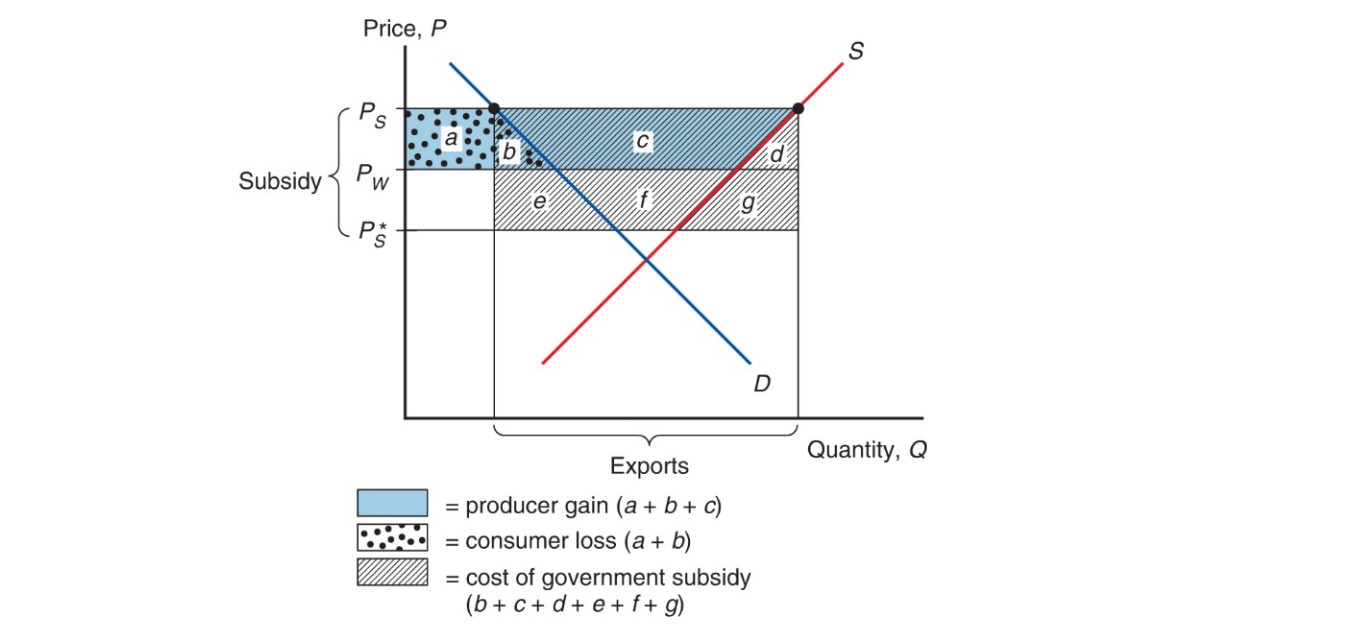

Export Subsidy#

Types: specific or ad valorem

less government revenue

lowers price in importing country: \(P^* = P_s-S\)

higher price for home consumers

Import Quota#

Restriction of Quantity that may be imported

no government revenue

quota rents to license holders

rents to producers, cost to consumers

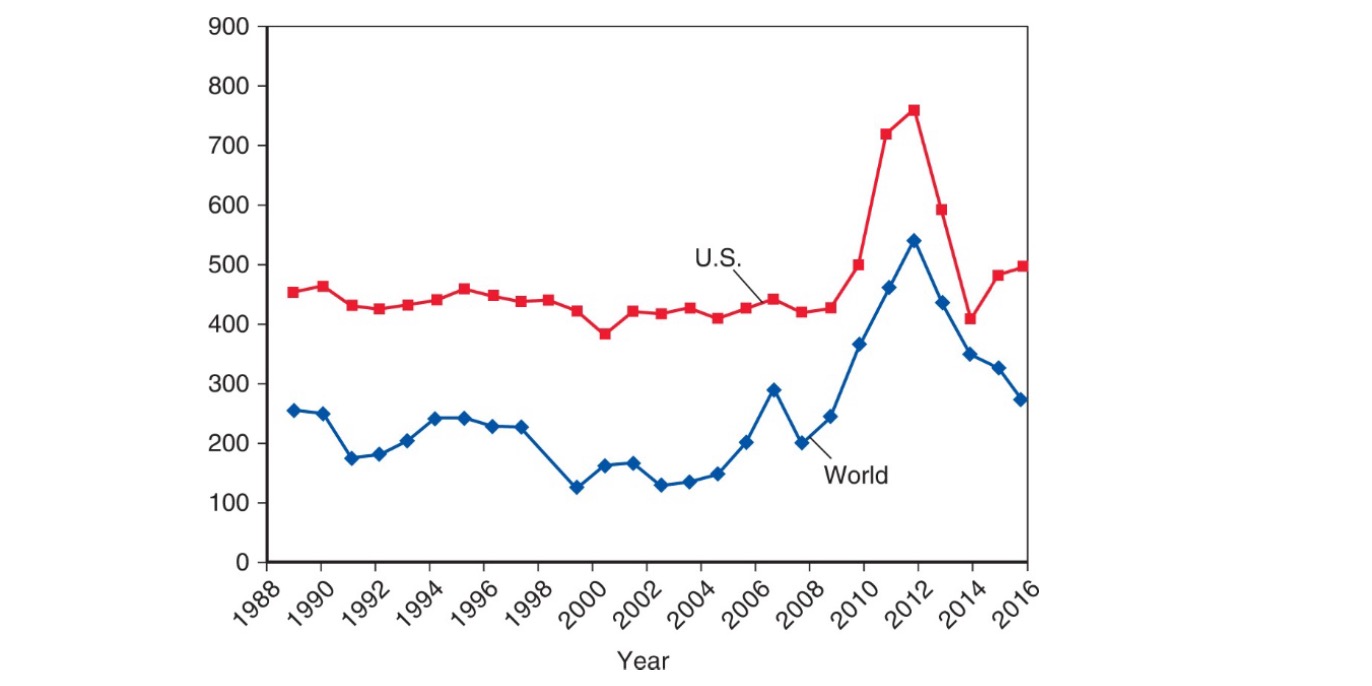

US Sugar Prices vs. World

Voluntary Export Restraint#

Voluntary Export Restraint (VER): quota imposed by exporting country on its exporting industry

due to pressure by Importing Country

Example: Japanese Cars in US Market

Price rose of japanese fuel efficient cars

rent to japanese firms

Local Content Requirement#

Local Content Requirement: regulation, that fraction of end product domestically produced

either value terms of unit terms

no revenues

home producers of inputs like import quota

home producers of outputs not as strict

price diff average between no quota and import quota

Exercise#

Free Trade Situation#

Country A $\( \begin{aligned} D &= 100-20P \\ S &= 20+20P \\ MD &= D - S = 80-40P \end{aligned} \)\( Country B \)\( D = 80-20P \\ S = 40+20P \\ XS = S-D = -40+40P \)\( Equilibrium \)\( 80-40P = -40+40P \\ \to P = 1.5 \ , Q_{trade} = 20 \)$

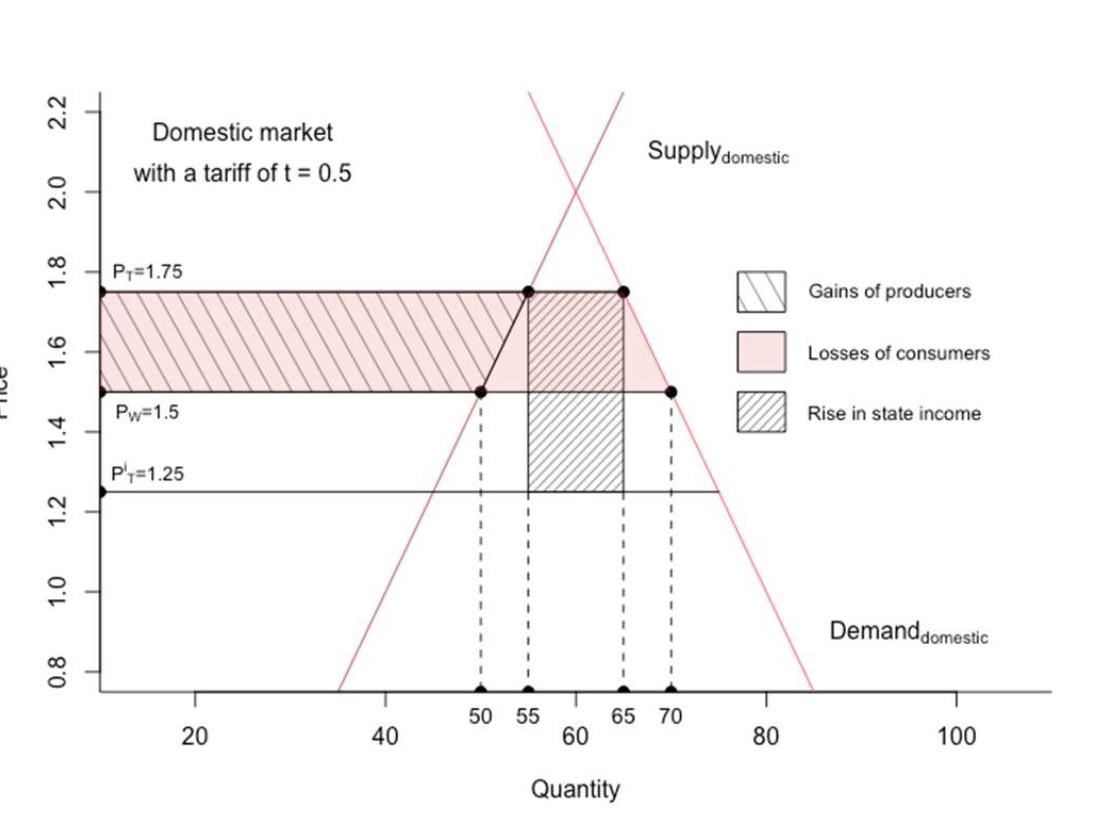

Tariff#

Tariff inhome country: \(t=0.5\) $\( MD = 80-40 (P+t) \\ XS = -40 + 40P \)$ Equilbirum:

Import Demand to the Left

less Imports / Exports from other country

higher price

world market price: 1.25 + tax = 1.75 home price

=> tariffs leads to sinking world prices, cancels out some of the tariff

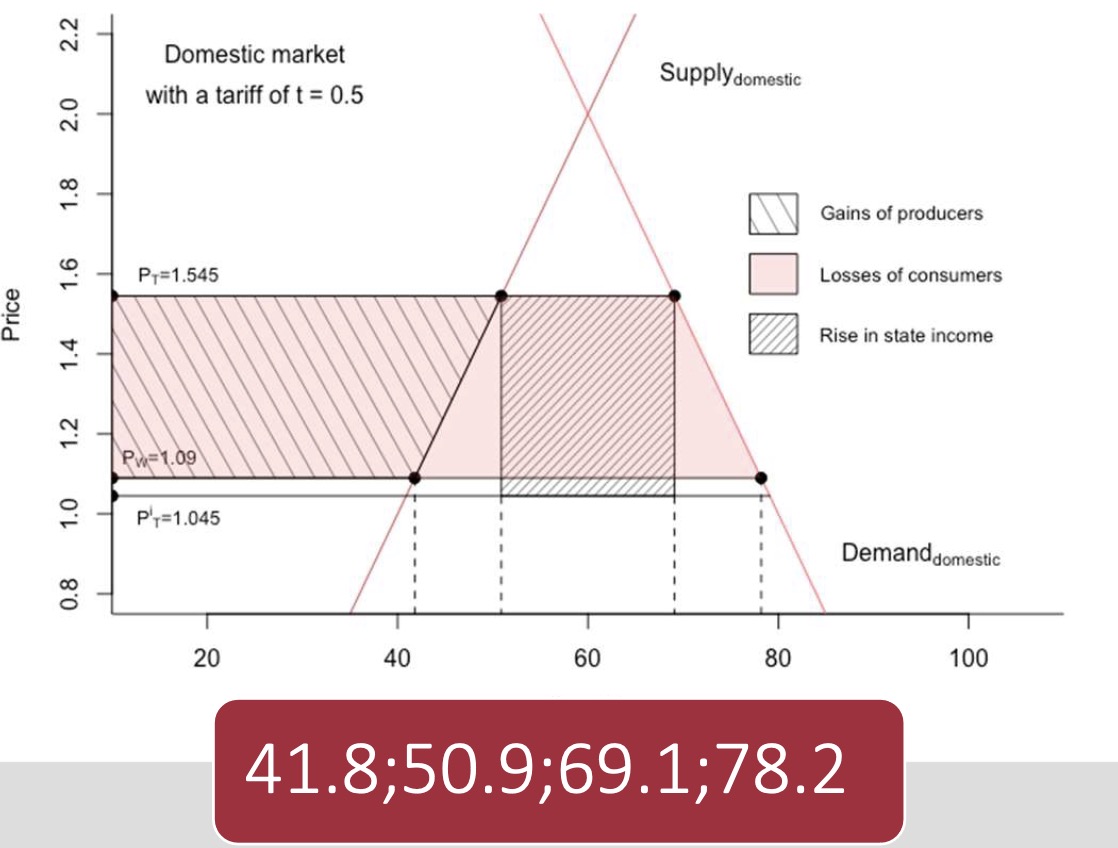

Tariff with big country#

Equilibrium without Tariff $\( 80-40P = -400+400P \\ 480 = 440P \\ \to P=1.0909, Q= 36,36 \)\( with Tariff \)\( 80-40(P+t) = -400+400P \\ 480 = 400P+40P+20 \\ 460 = 440P \\ \to P_{world}=1.045, Q=18,2 \)\( Price with tariff: \)P_{tariff} = 1.545$

=> small country shoulders most of the price increase!

Effective Tariff = nicht klausurrelevant

Surplus#

with original Situation

with small country

\(P_t-P_w=1.545-1.09=0,455\)

Zwischending = 9,1

Triangle: \(0.455*9.1 = 4,1405\)

Surpluses:

Government: \(0.5*(69.1-50.9)\)

Producer: \(41,8*0,455+4,1405\)

Consumer: \(69,1*0,455\)

Export Subsidy#

new Sitatuion

$\(

MD = 80-40P \\

XS = -40+40(1+0,5)P

\)\(

Equilibrium

\)\(

80-40P = -40+60P \\

P_{import} = 1.2, Q=32\\

P_{export} = 1.8

\)$