24.01.2024 Public Debt#

Governemtn Debt: amount gov. borrowed on financial markets

government deficits / surplus: yearly increase / decrease

Types of gov. debt:

Explicit: official debt given out by the financial ministry

implicit: explicit + promised payouts in the future (e.g pensions etc.)

Calculation#

Present Discounted Value:

but:

very hard to calculate

(heroic) assumptions about r and F

=> focus on debt

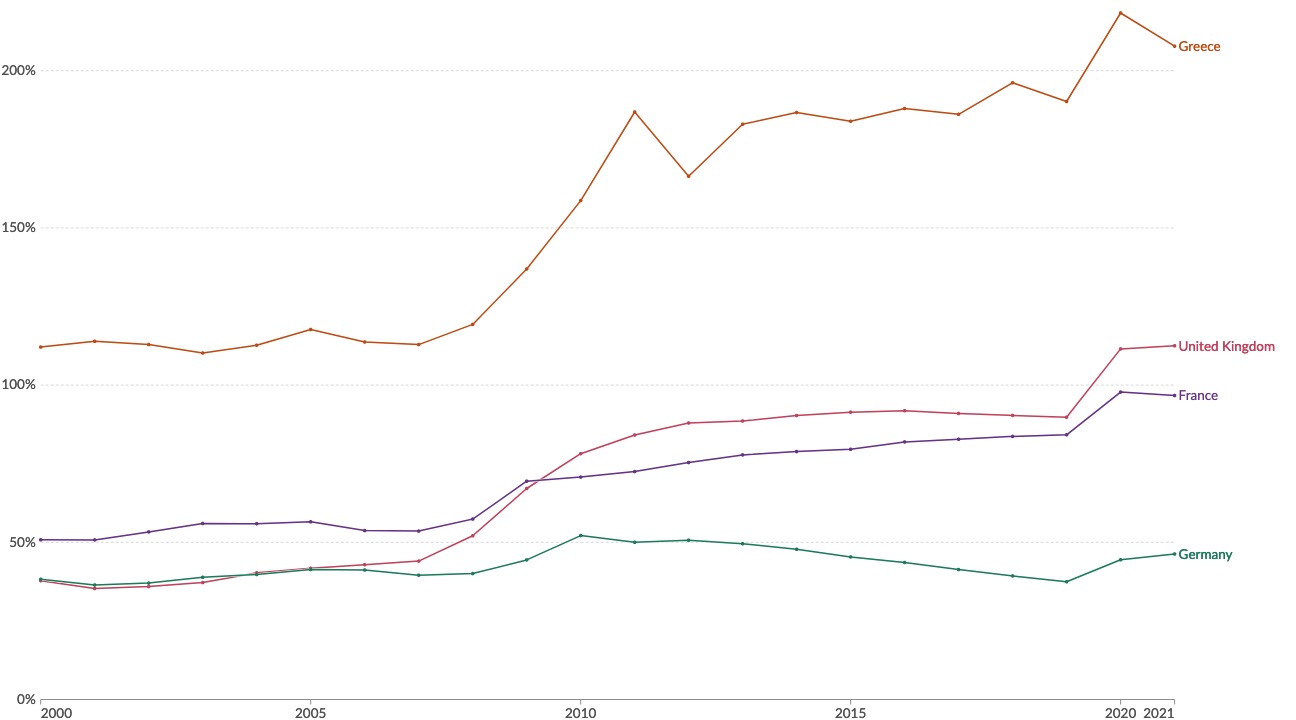

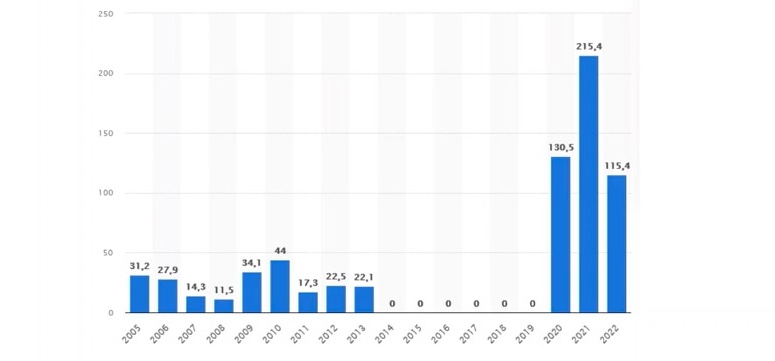

The Numbers#

Development of Debt

Net Borrowing on Federal Level

Debt Rules#

Stability and Growth Pact#

on EU Level

deficit =< 3%

Debt =< 60%

no systematic argument about numbers, just chosen randomly!

never really enforced, because Germany was first country to breach them

in SGP, differentation between

strucutral deficits: permament debt

cyclical deficits: due to changes in business cycle

also esacpe clauses due to disasters / external factors

Debt Brake#

on German level = balanced budget amendment

strucutral deficit =< 0.35%

cyclical deficit = depends on business cycle

exceptions allowed in emergeny (covid, Ukraine, …)

Ricardian Equivalence#

finance via taxes or credit = equivalent

consumers = forward looking

anticipate tax increases in future if debt increase today

higher savings today

also intergenerational

= bullshit theory

Effects of Debt#

Short Run: Stabilization

Automatic stabilization: automaitc policies e.g unemployment insurance

Discretionary stabilisation: policy actions taken in response (e.g Gaspreisbremse)

= good for the economy

Long Run: Negative?

limited private capital investment

less economic growth due to less private investment

Reality:

depends on capital markets

and what the debt is used for…

=> evidence is inconclusive