04.05.2023 Banks III#

last Lecture: Credit Market Failures

Wealth and Credit#

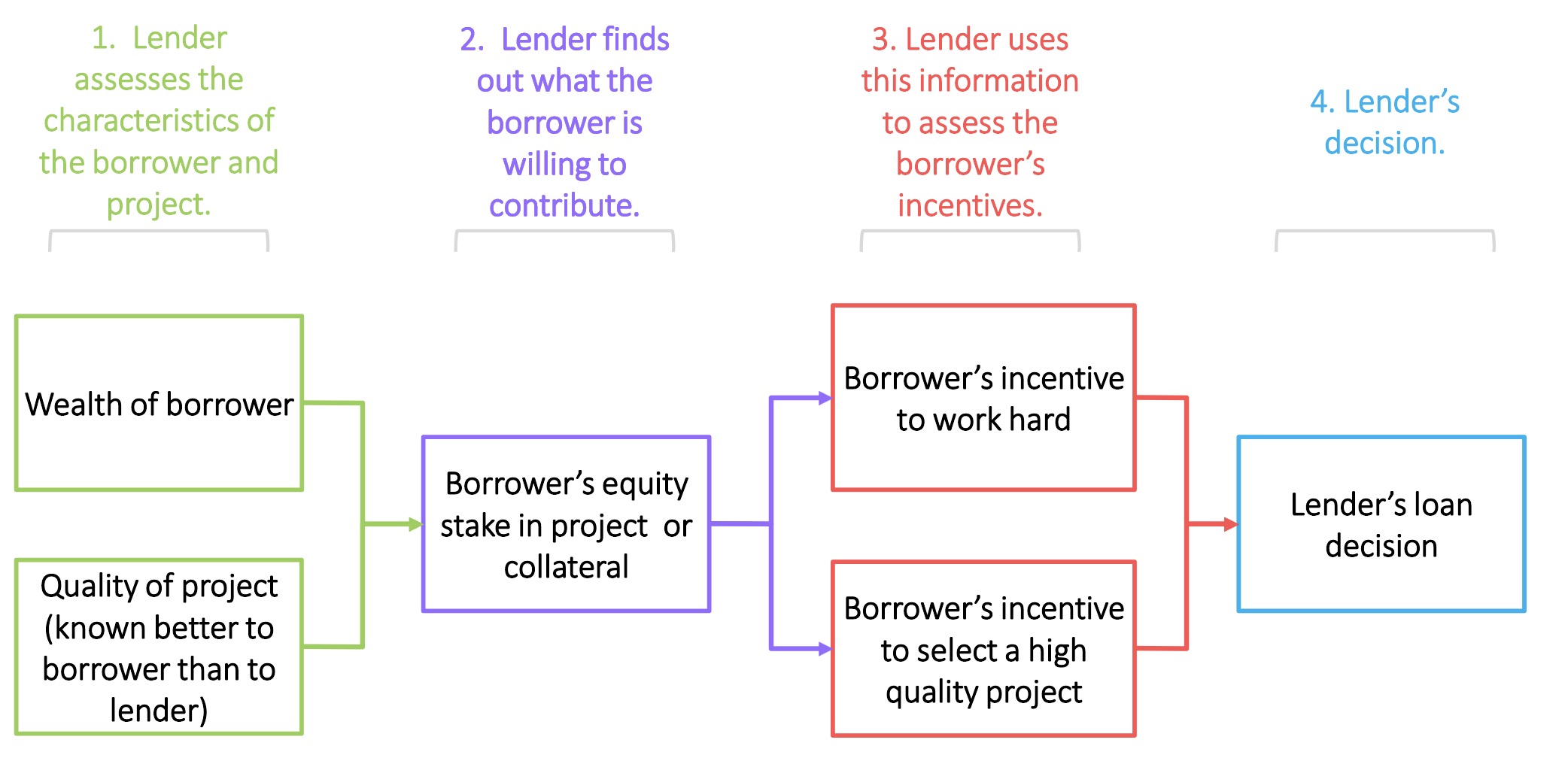

Decisions by the Banks and Lenders

Contributions by Lender

Collateral (Sicherheit)

equity (Eigenkapital)

reduces Risk for Bank => higher lending

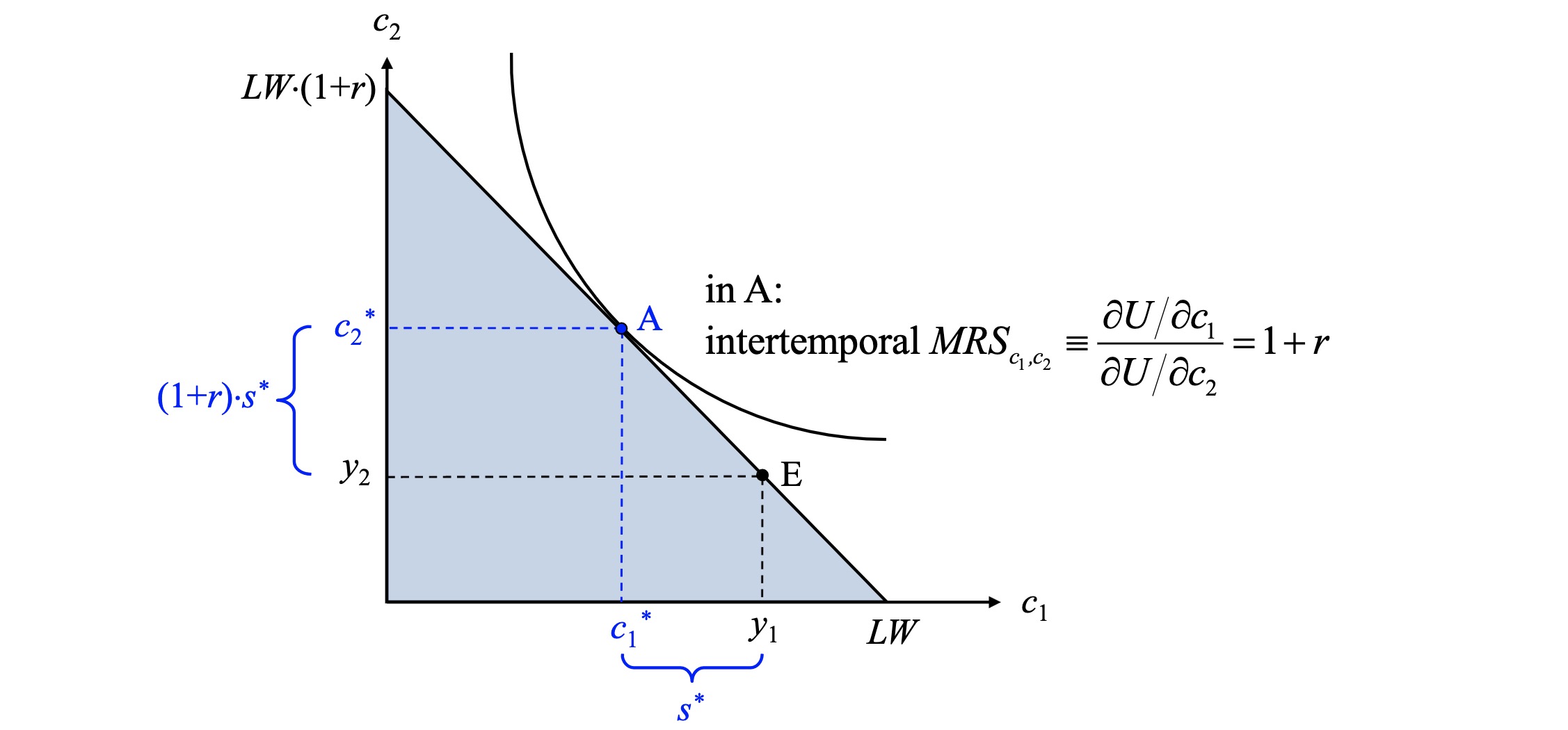

2 Period Model#

\(y_1\) and \(y_2\) (income now and then)

\(c_1, c_2\) (consumption)

saving possible today

interest rate r

Constraint#

Consumption Possibilities $\( c_1 + s = y_1 \\ c_2 = y_2 + (1+r)s \\ \implies s = \frac{y_2-y_2}{1+r} \\ \)\( Lifetime budget constraint (LBC) \)\( \underbrace{c_1 + \frac{y_2-y_2}{1+r}}_{\text{present value of consumption}} = \underbrace{y_1+ \frac{y_2}{1+r}}_{\text{present value of income}} \)$

Preferences#

Consumer Preferences: \(U(c_1, c_2)\)

consumption smoothing advised

maximization

Equilibrium#

Example (Saver):

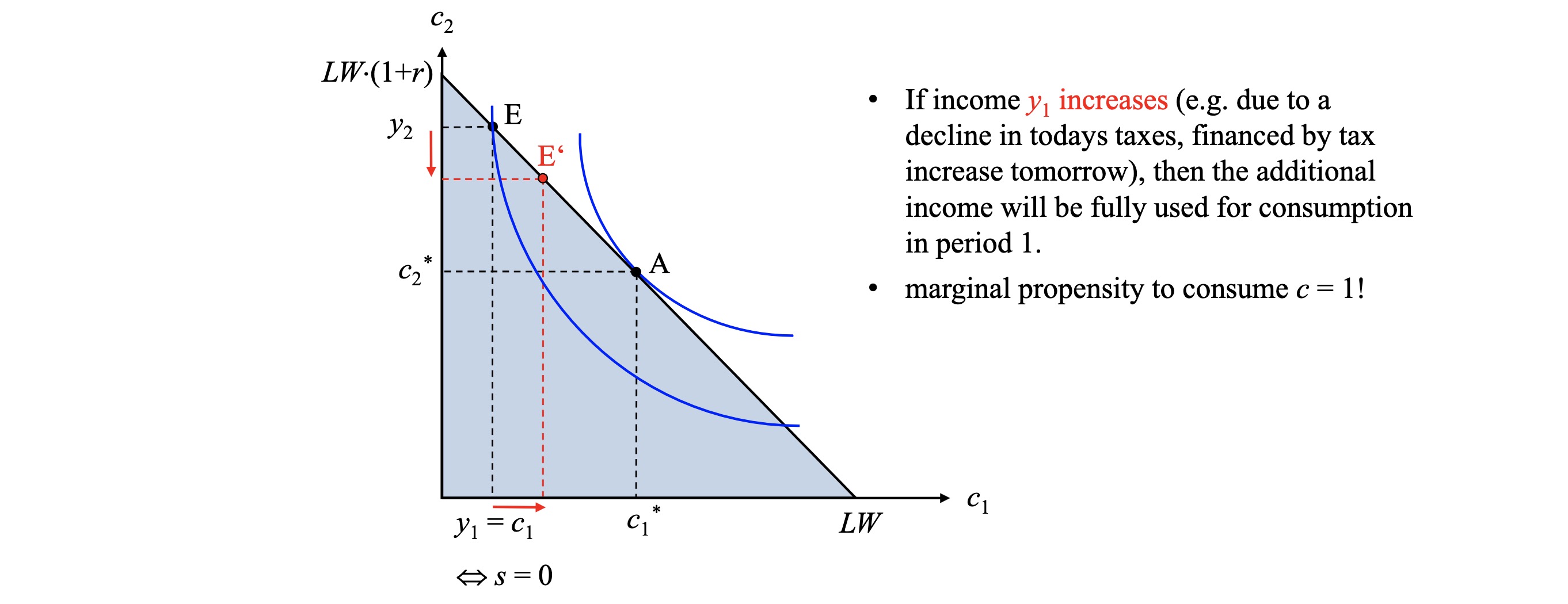

Problem: Credit-rationed borrowers (borrow limit)

not able to perfectly smooth from future to present

every possibility to borrow is used

every extra income is consumed today

=> marginal propensity to consume \(c=1\)

Roles of Banks#

Goal: maturity transformation: short-run to long run

Problem: Liquidity Risk

fractional reserves not enough for customers demand

panic -> bank run

Solution: Lender of Last Resort (LOLR)

Objectives of LOLR:

interdependence in banking sector (uncertainty spreads)

negative spillover effect

avoid moral hazard (Too big to fail)

Lending and Inequality#

inly some people are able to prfit by lending

credit rationing do not profit from borrowing