05.06.2023 Tutorial 2#

Wages#

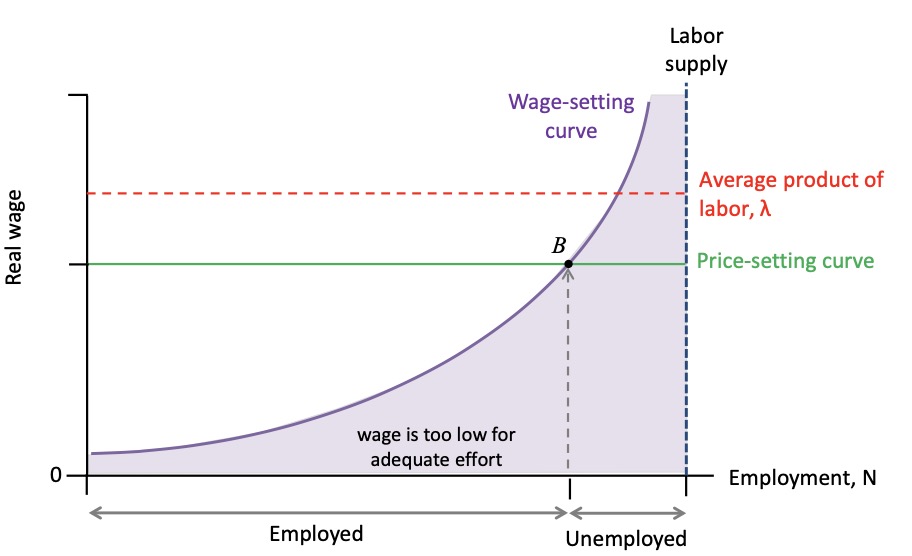

in Boom:

AD \(\uparrow\)

Firms hire more workers

Wage setting curve shifts \(\to\)

firms want more effort = more wages

price setting curve not (no increase in profits)

Smoothing#

Given

Lambda for optimal

I) Diff wr.t \(c_1\)

II) Diff w.r.t \(c_2\) $$ \frac{ dL }{dc_2} = \frac{ 1 }{1+p}\frac{ 1 }{c_2}

\lambda \big(\frac{ (1+r)*1-c_2 }{(1+r)^2}\big) \ \to c_2 = \frac{ (1+r) }{(1+p)} * \frac{ 1 }{\lambda} $$

III) Diff w.r.t lambda

Optiminzing c2#

a) Umstellen I nach Lambda

b) Using \(c_1=...\) in III

then: insert a in b

optimal

Optimize c1#

using II in III

input I (in umgestellter Form) in this

Optimal

Banks#

Profit of Bank

Profit of a commercial Bank: $\( \Pi = \frac{rL^S - r^p (L^S-D-e)}{e} -\frac{1}{2} \frac{L^S}{e}^2 \)$

r = lending rate

\(r^p\) = policy rate

\(L^S\) = credit supply

\(D\) = customer deposits

\(e\) = equity

\(\frac{ L^s }{e}^2\) = risk of losing credit money

the Interest rate and Leves of Competition

perfect competition: \(r\)

imperfect comp: \(r\)

Monopoly: \(r \uparrow\)

optimal Credit supply: Diff w.r.t \(L^S\) $$ \frac{ d \Pi }{d L^S} = \frac{ r }{e} - \frac{ r^p }{e}

\frac{ 1 }{2} * 2\frac{ L^S }{e} \frac{ 1 }{e}=0 \

\implies L^S = e (r-r^p) $$ => bank will charge above policy rate