20.12.2023 Taxation#

Ways of Government Revenue:

Taxation

Debt

Fees / Contributions (Sozialabgaben)

Sales of Government Assets

General#

Tax (Legal): Cash Payment to State from everyone

Tax (Economic): compulsory levy without specific service in return

Economic = more broad, also non-financial e.g jury duty

German Taxes#

Earnings (Lohnsteuer)

Income (Einkommensteuer)

Individual income tax

capital gains tax

Corporate Income (Körperschaftssteuer)

Wealth

Wealth Taxes (sadly do not exist currently)

Property taxes (Grundsteuer)

Estate taxes (Erbschaftsteuern)

Consumption

Sales Tax (Mehrwertsteuer)

Excise tax (Zigaretten, Alkohol, …)

Assignemt to Budgets of

Federal: excise taxes

State: grunderwerbsteuer

Local: grundsteuer

divided: Einkommensteuer (Gemeinschaftsteuer)

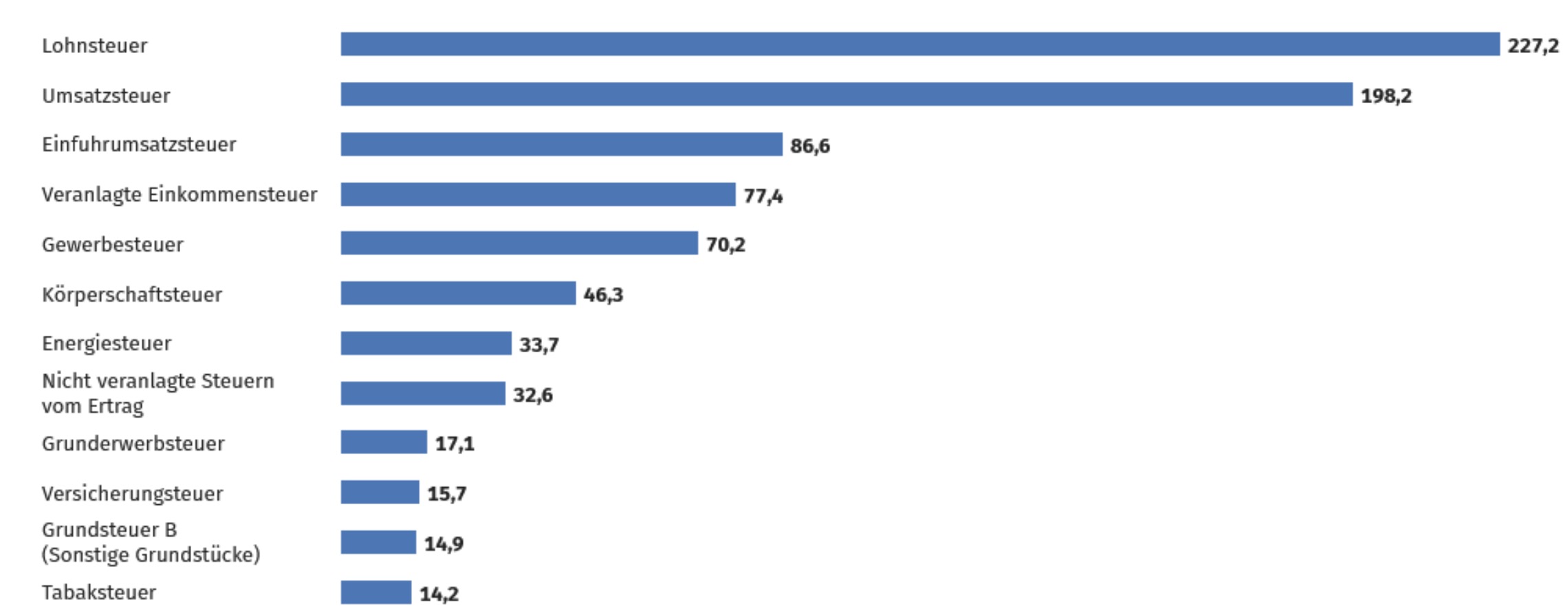

Revenues#

of different Taxes

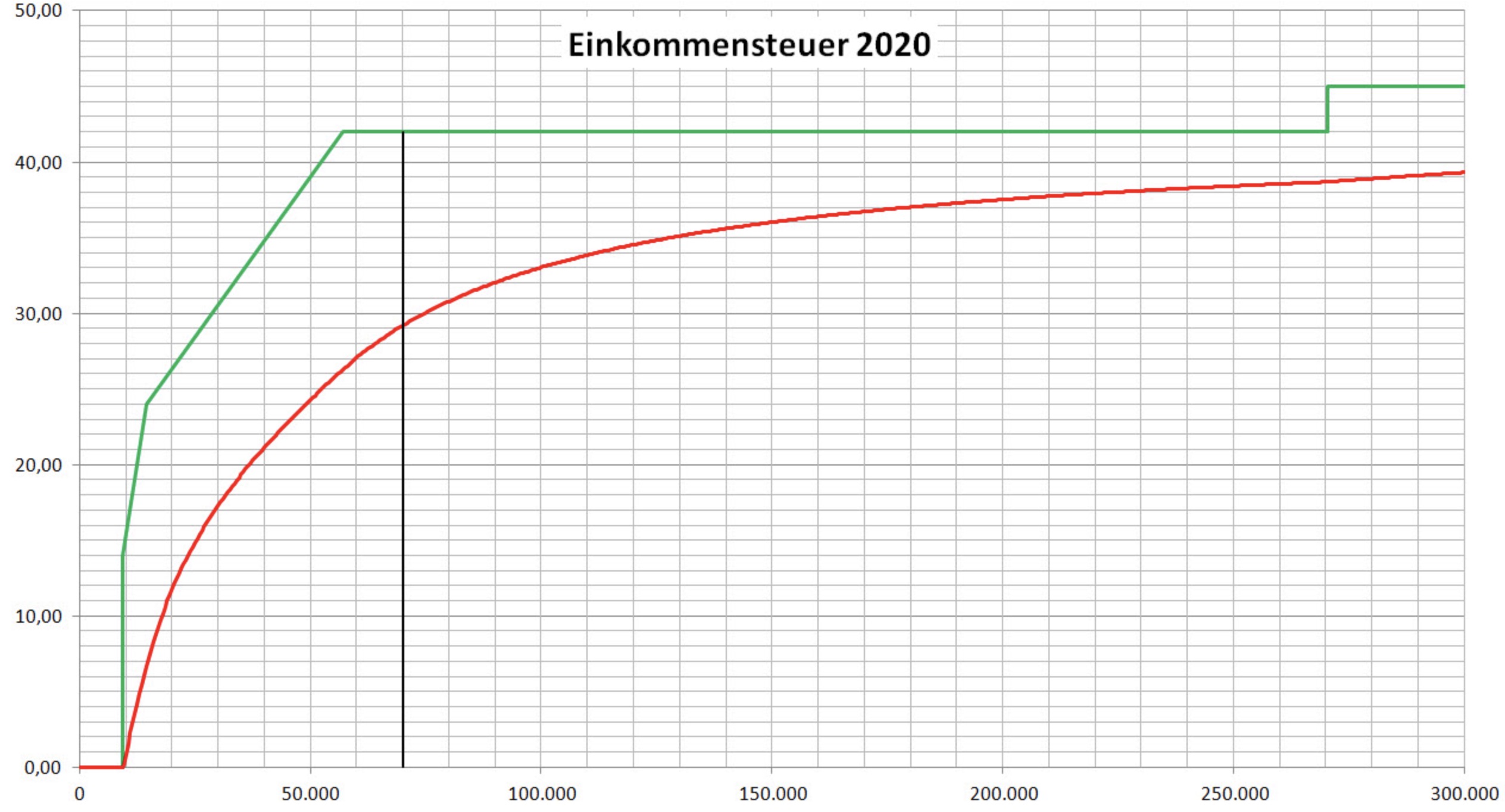

Effective Tax Rates on Income

Red = effective Tax, green = marginal tax

marginal tax rate: percentage of the next euro of taxable income paid

effective tax rate: percentage of total income paid

Fairness#

Principles:

Vertical equity: higher income = higher taxes

Horizontal equity: similar people = similar taxes

Tax Base#

what income should be taxed? (Exemptions etc.)

Haig-Simons: focus on individuals ability to pay

assess monetary gains of perks (e.g company cars)

leads to higher equity

Measurement

Total consumption + Wealth Increases

deduct

business expenses

undesired consumption (e.g medical expenses)

Exception: Reducing Taxes on Activities with external Benefits

charitable giving

housing expenditure

Reasons for charity deduction:

Crowd In of additional money (marginal effect)

but lower gov. Spending (inframarginal impact)

empirical: some crowd in

consumer sovereignty

But: most people do not reasearch

gifts without benefit to targe

Housing Subsidy

for positive externality (does not exist)

no more houses bought

just for rich people

Unit of Taxation#

Household Members / Individual / Spoues

German example: Ehegattensplitting

Add up Incomes of both Spouses

divide by 2 => then add exemptions etc

leads to:

marriagy subsidy

lower incentives for work (for low earner)

distort decisions

ignores children

other countries:

Individual (19 OECD Countries)

Family Splitting with number of kids (US, Norway, …)

like Germany = Luxembourg