Tutorial 5#

1) Definitions#

Government Bonds: future payment obligation issued by government for funds

Principal: amount to be payed at end

Coupon: Interest

Interest Rate (of zero-coupon bond):

\[

i = \frac{ Principal }{price_{market}}-1

\]

2) Fiscal Budget#

\[

T+\Delta B = G+ iB

\]

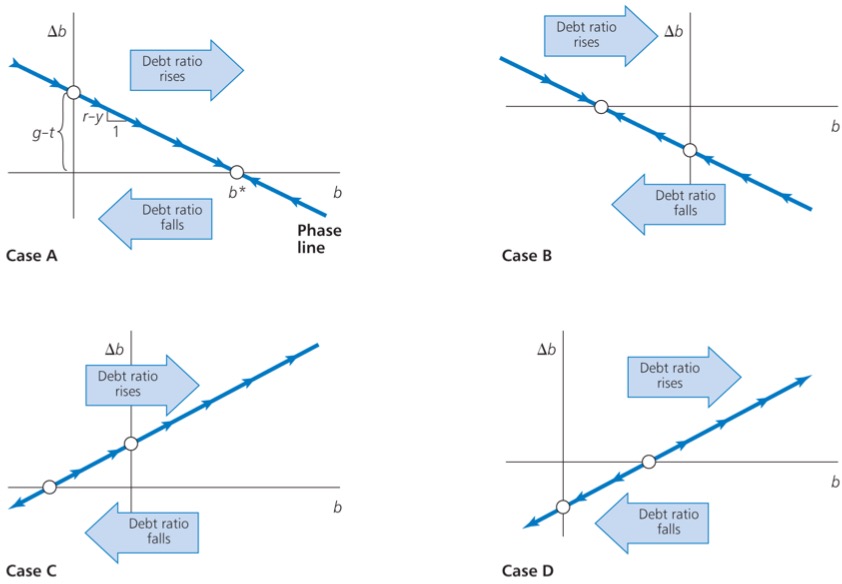

leads to: equilibirum debt ratio

\[

b^* = \frac{ g-t }{y-r}

\]

This determines the position and equilbrium here:

3) Sovereign Default#

Interest:

\[

i = \frac{ i_0+w }{1-w}

\]

Why is it equilibrium and true?

safe bond: \(price_{safe}=\frac{ payoff_{safe} }{1+i_0}\)

so safe : \(1+i_0 = \frac{ payoff}{price}\)

if return on bond is too high:

if \(i > \frac{ i_0+w }{1-w}\) means

expected return of risky investment > expected return of safe investment

investors would react