24.05.2023 Fiscal Policy#

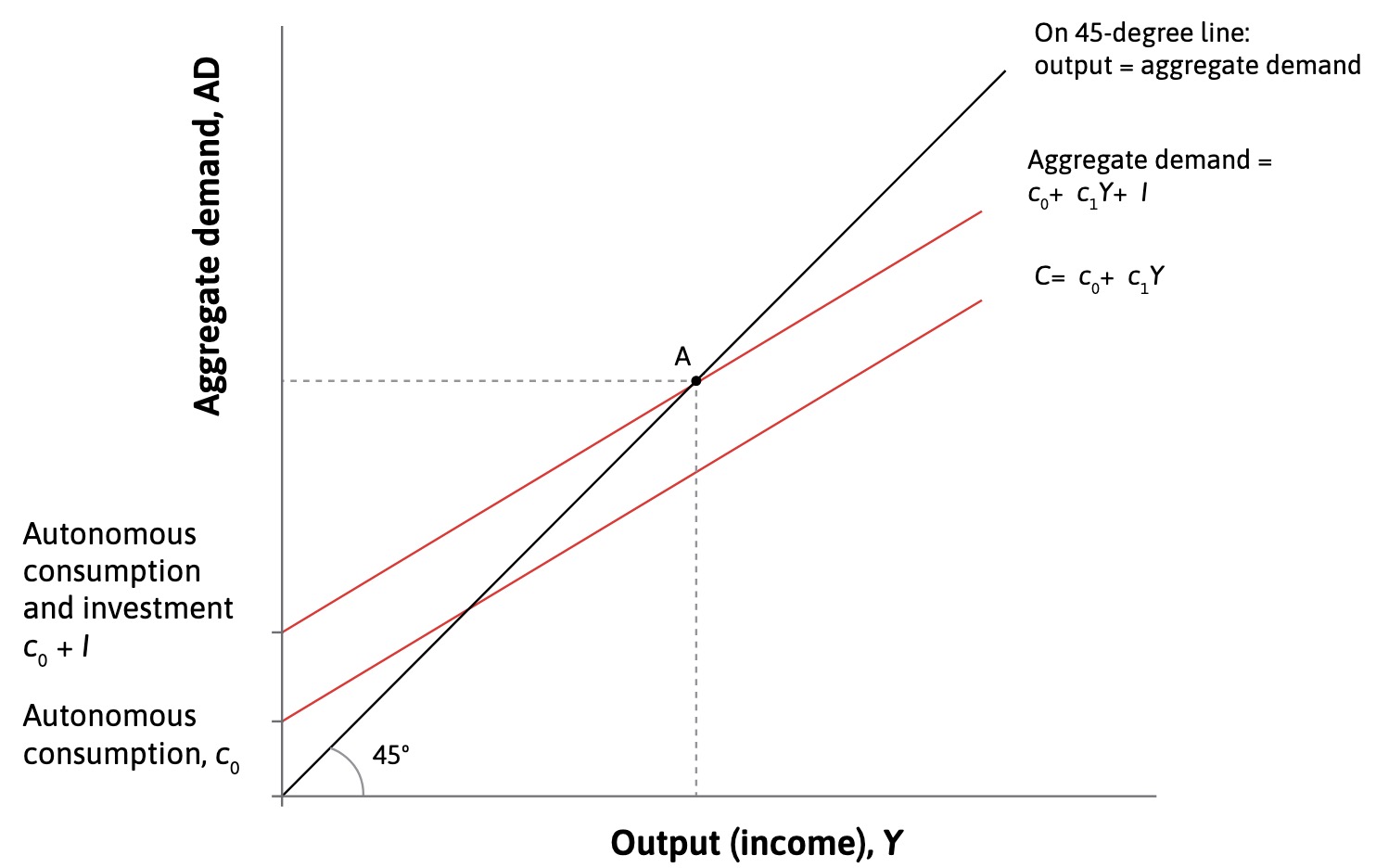

Aggregate Demand#

Aggregate Consumption

autonomous consumption = fixed amount based on future income

slope of function = marginal propensity to consume

additional consumption based on more income in period etc

45° Line where AD = Aggregate Output

state of normal economy

Investment: does not depend on output

added to AD Line

implicit assumption: underutilized capacity in economy

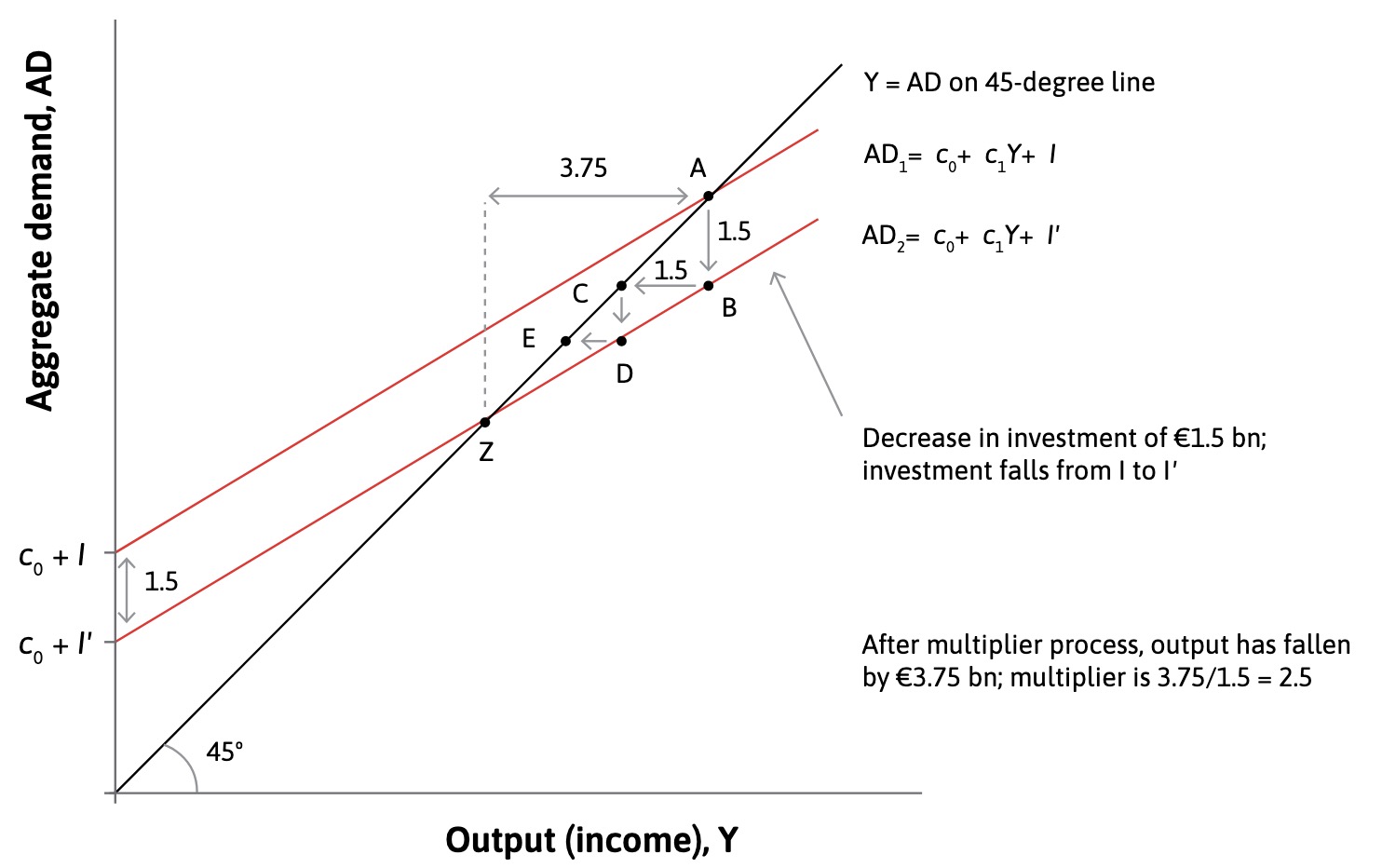

The multiplier#

A Decrease (or Increase) in Investments leads to a higher decrease in Income than the original

original negative investment = 1.5bn€

expected point afterwards = C

but households now have less money and this leads to ripple effects = Z

Determining the Multiplier

with \(c_1\) = marginal propensity to consume

Household Spending#

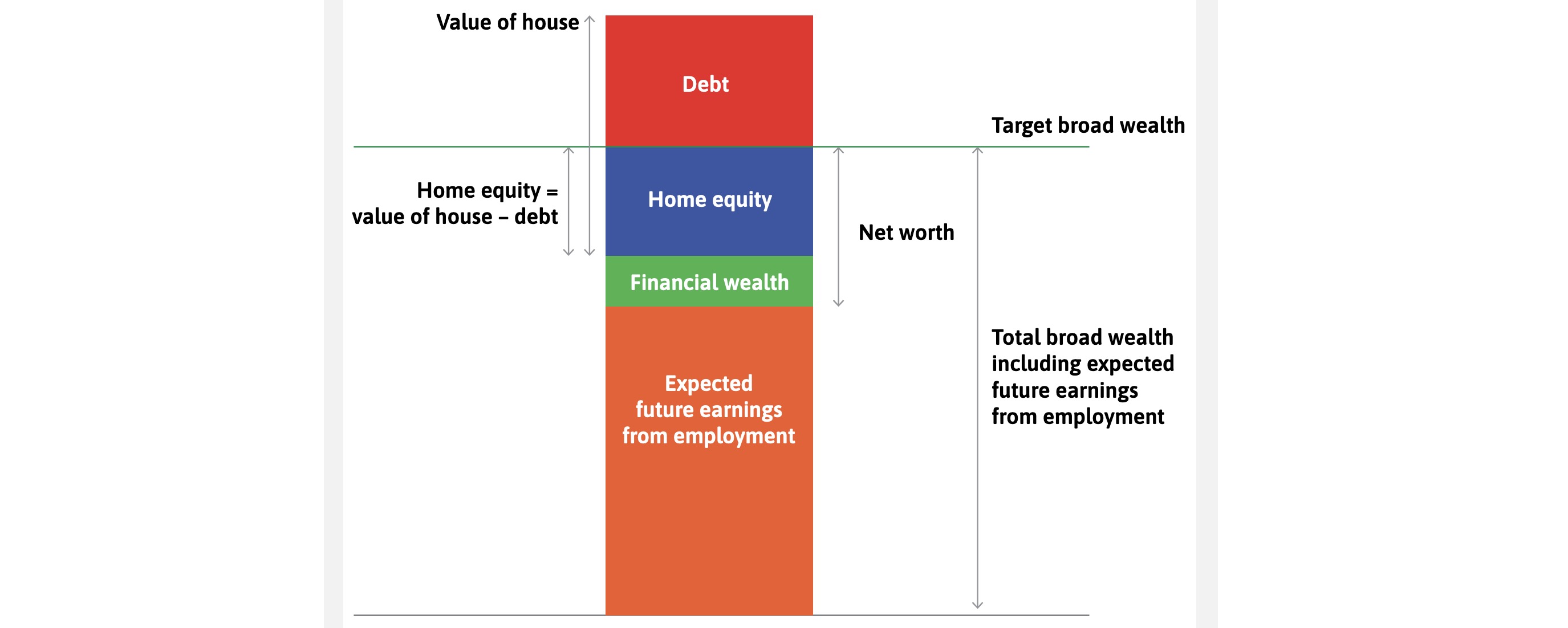

Has Target Wealth: level to maintain based on expectations

optimizes broad wealth: assets - debt, including future earnings

Paradox of thrift (Sparparadoxon): aggregate attempts of all households to increase savings during a recession does not actually increase savings

Autonomous Consumption declines => AD curve downwards

Income + Labor Demand declines => Recession

higher savings at lower income = absolute lower savings

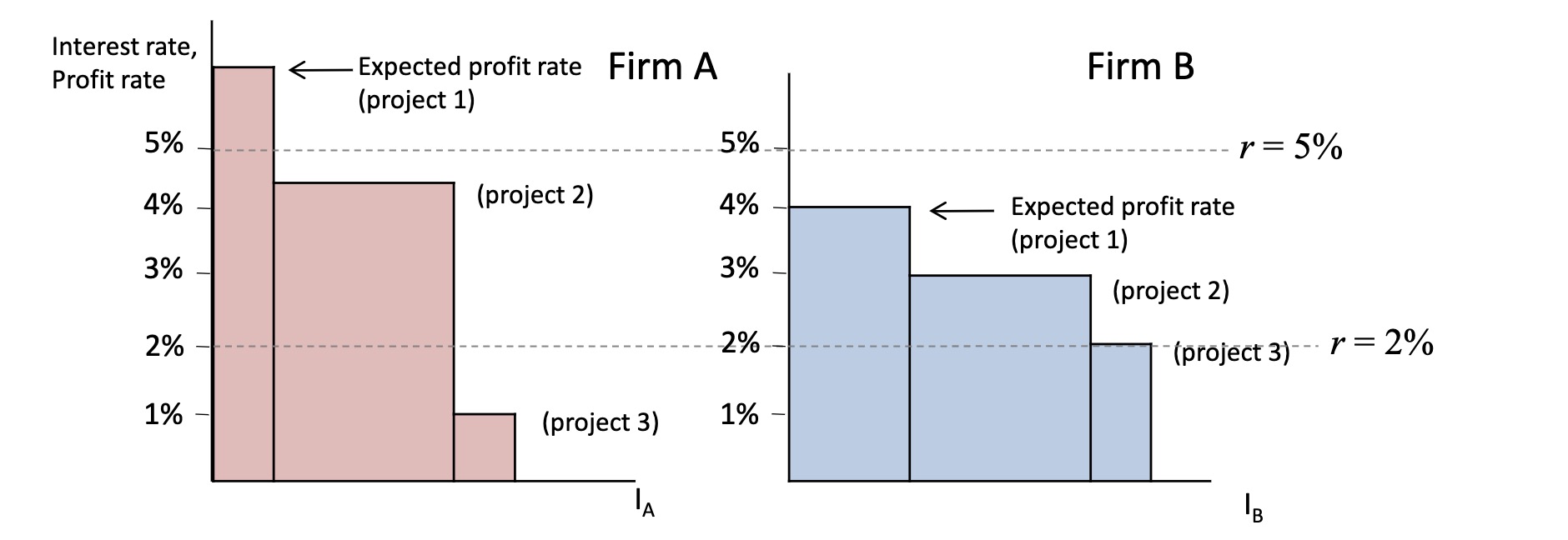

Firms Investments#

Decicsions depend:

Discount rate p of owner (opprt. cost)

interest rate r

profit rate of investment \(\Pi\)

Investment when: \(\Pi > p+r\)

Example: individual firms

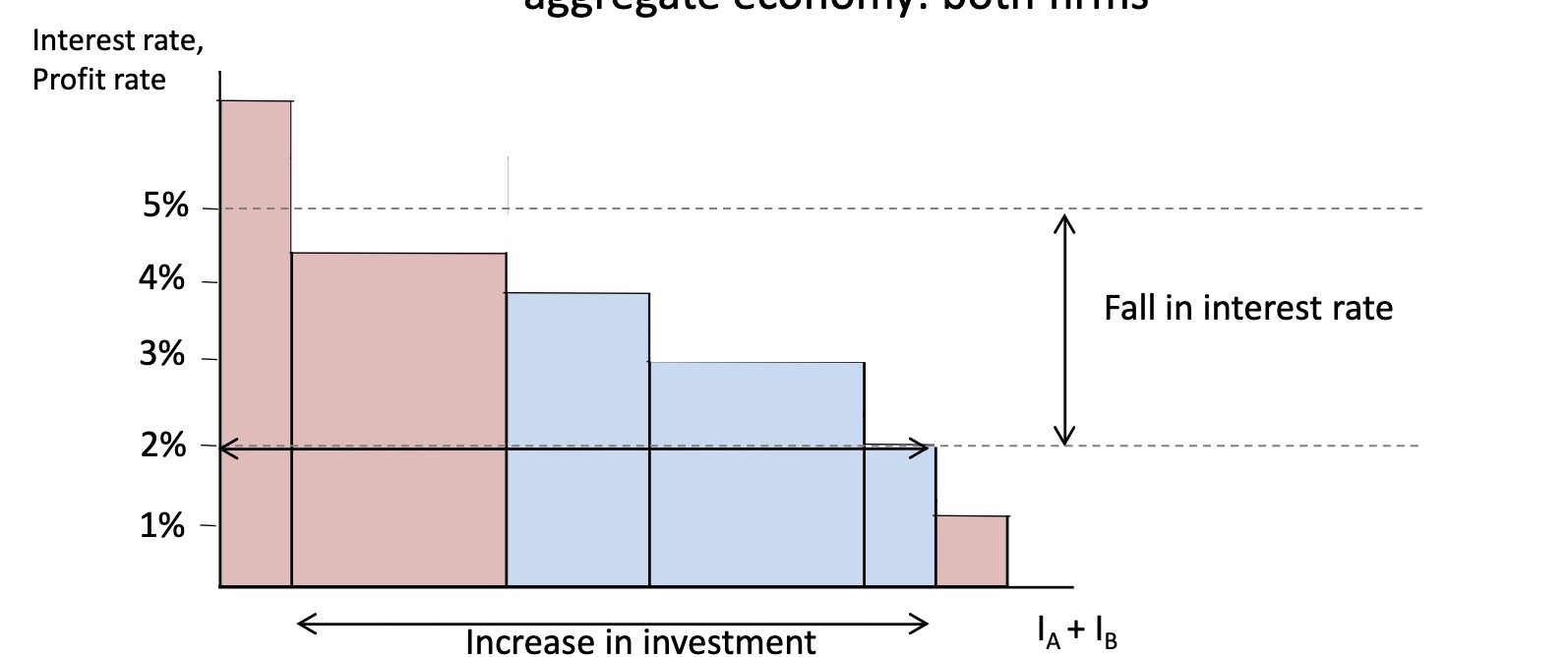

The Aggregate Economy: sinking interest rates = more Projects

Government and Imports#

Government Spending and Net Exports = shift 45° Line up

marginal propensity to import (m): fraction of additional dollar spend on imports of household

Net Exports \(= X-M = X-mY\)

Combined Formula

With t = Tax rate

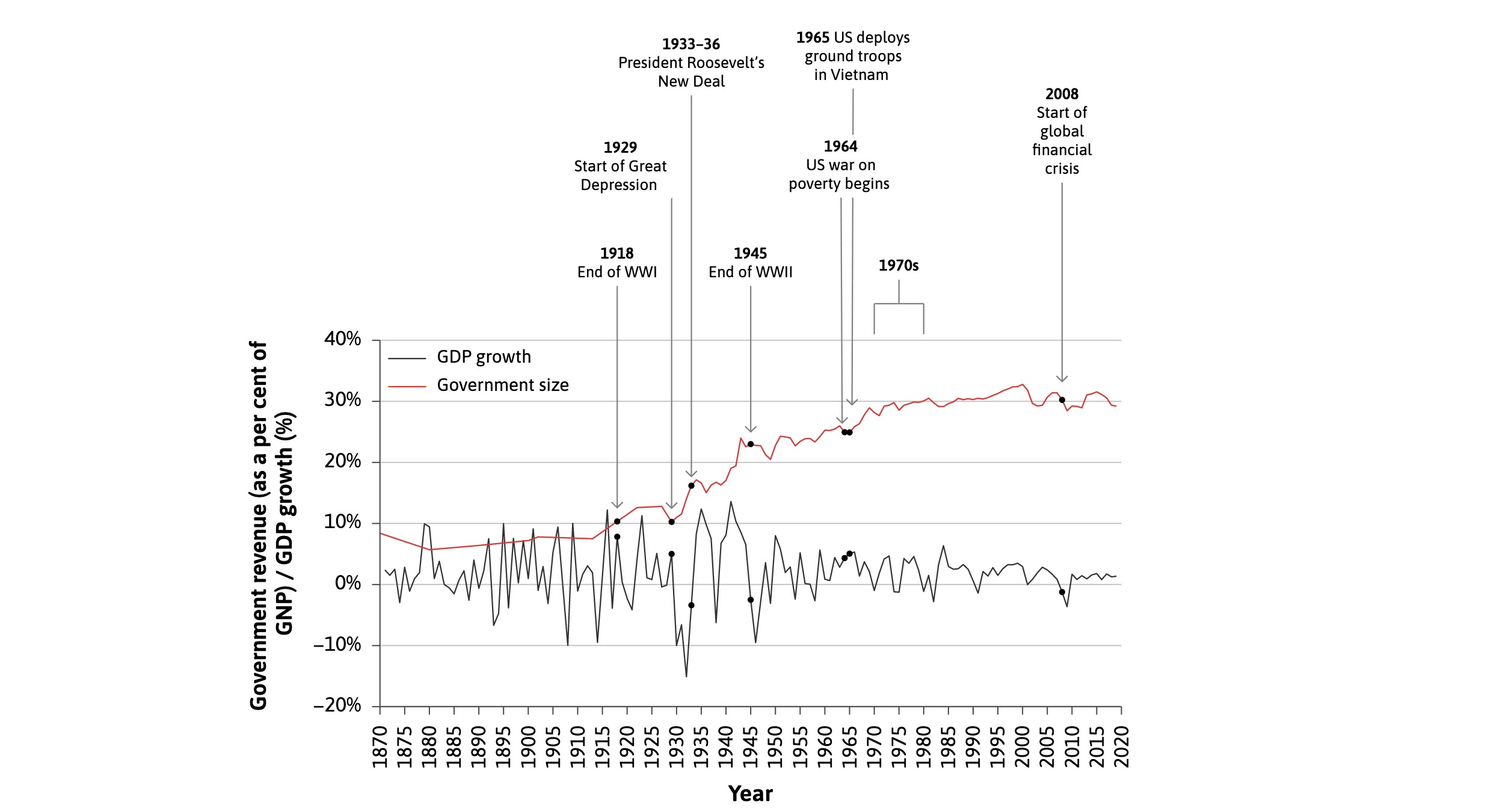

Fiscal Policy#

How does Government Policy impact Aggregate Demand and the Business Cycle?

=> severity of Business cycle shrinked with bigger government

Policy before Keynes#

after David Ricardo:

wages and prices adjust

no long-term disturbances

only role of government = avoid deficits

=> orthodox policy = austerity

Economics: Allocation of scarce resources

Policy after Keynes#

in the long run, we’re all dead

government intervention can provide benefits to society

due to the money multiplier

the effect of fiscal stimulus is more than the money used for it

Economics: study of how agents allocate resources and how those choices affect society

Government Role#

Stabilizing

non-cyclical expenditures (education)

income redistribution (consumption smoothing)

investments in recessions

Destabilizing

trough Austerity in Crisis

political business cycle

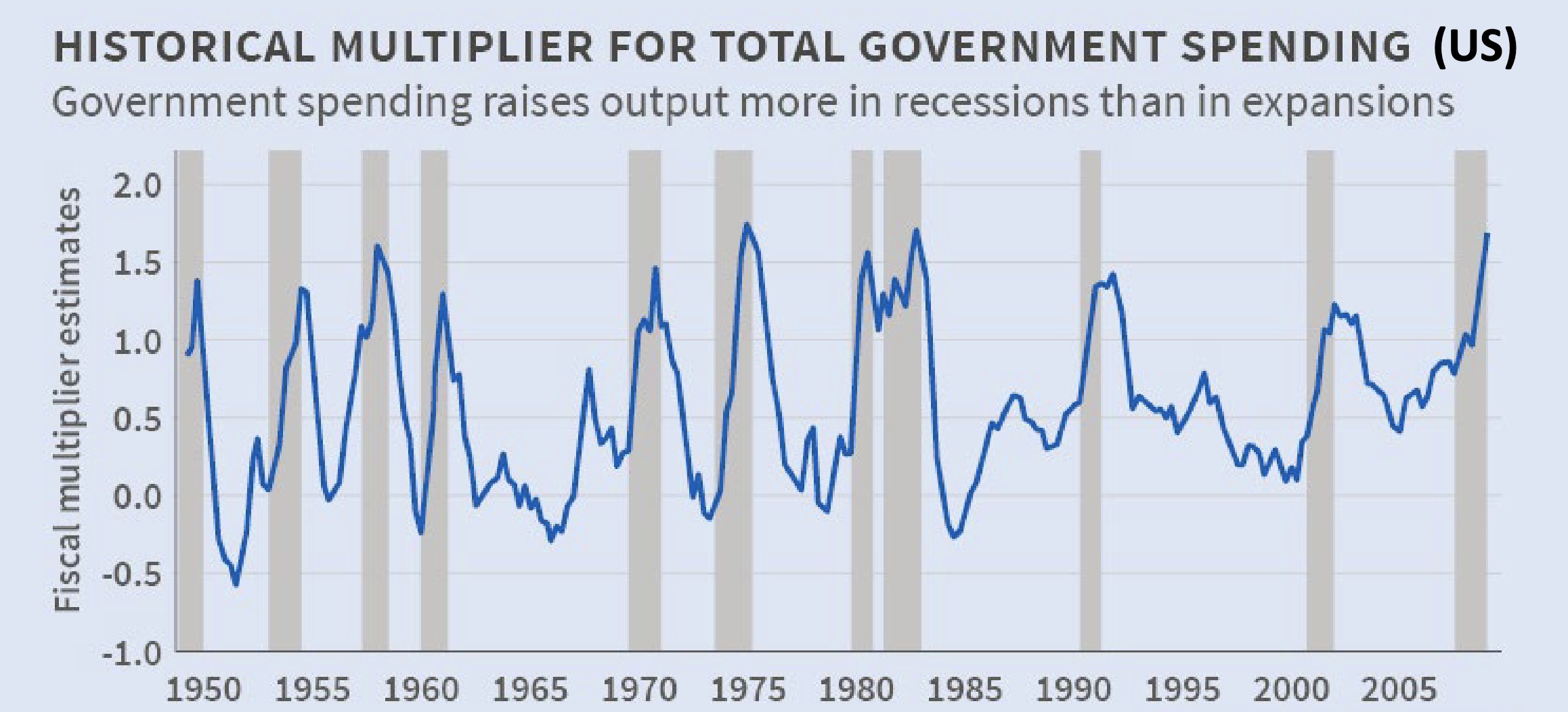

Depends on Multiplier:

empiric research suggests: multiplier in crisis is above 1 (even IMF says so) and austerity is therefore a very dumb idea…

The Multiplier over the business cycle:

in crisis: high because of anticipation and underused capacity

in booms: lower (but often above 1)

Governments finances#

Revenues |

Expenditures |

|---|---|

Income Tax |

social transfers |

Value Added Tax |

public investment |

Inheritance Tax |

interest |

Definitions:

primary budget deficit: revenou minus expenditures (excl. interest)

sovereign debt crisis: situation, where gov. bonds are deemed to risky, -> not abel to borrow

Instruments for sustainable debt:

running surplus (in booms)

creating inflation

benefitting g > r

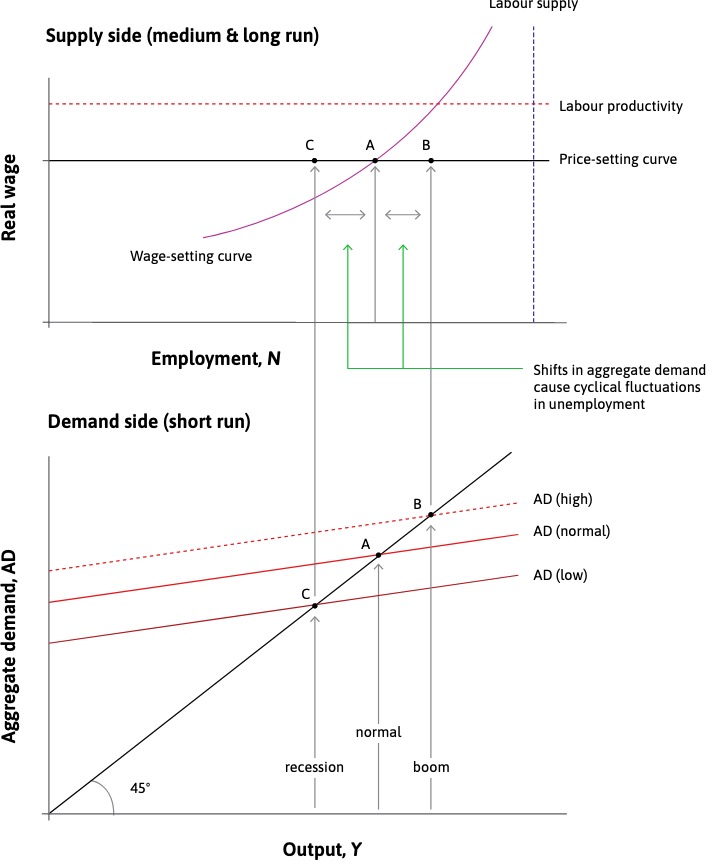

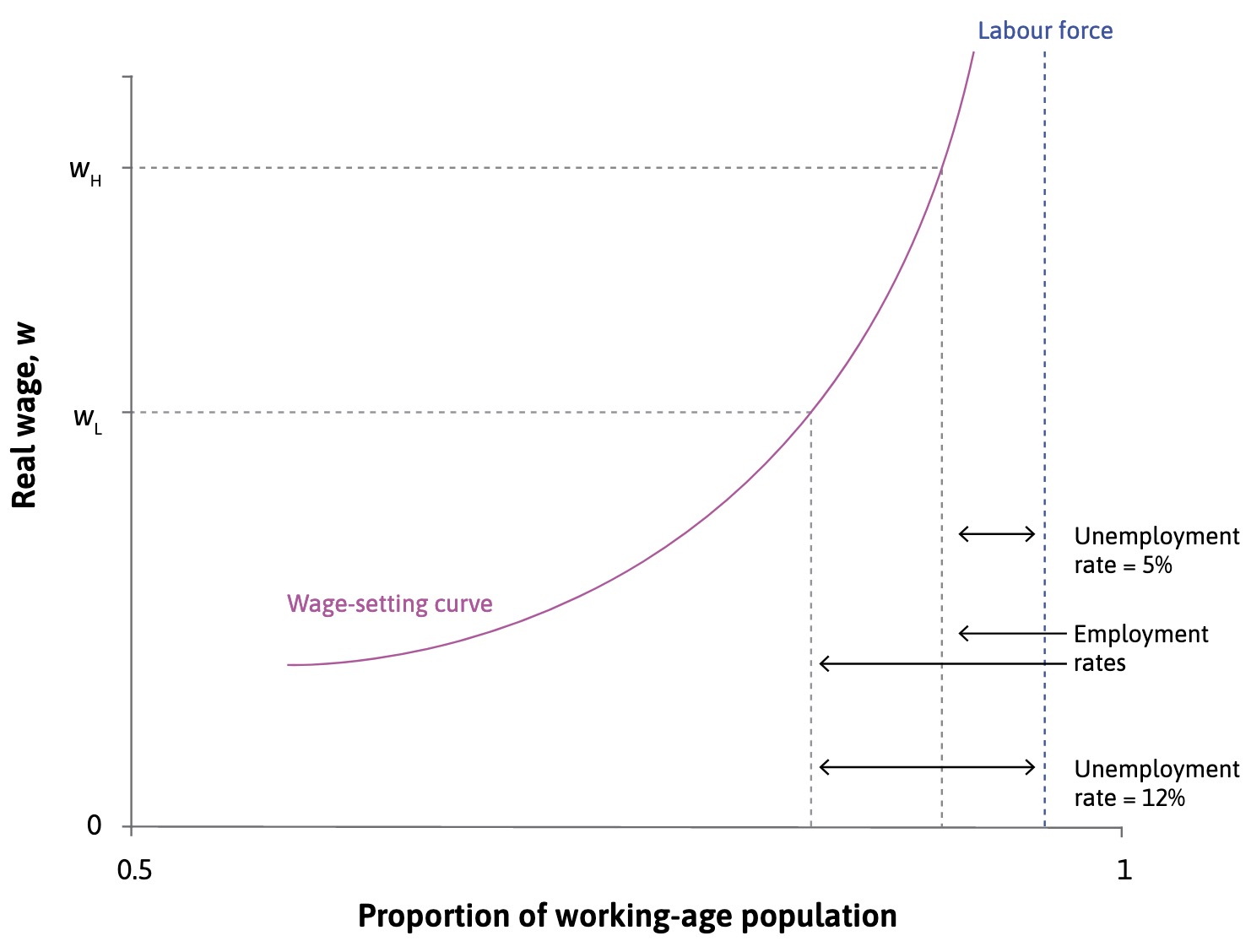

AD and unemployment#

Supply Side |

Demand Side |

|---|---|

labor market model |

multiplier model |

Medium-run: wages + prices change, all other const. |

short run: employment changes, al other fixed |

|

|

Connected by: production function

N = employment

\(\lambda\) = labour productivity

both connected:

shifts in AD: cyclical changes in employment (but not curve shifting anywhere)