06.11.2023 Externalities#

Externalities: situation, where ones party action affects others, but is not compensated

Example: Pollution, Education

Externalities = market failure => government intervention

Externality Theory#

Types:

positive / negative (Pollution / Education)

from production / from consumption (Pollution / Smoking)

Example: Steel Company

Production of steel and sludge

1 unit of sludge for every unit of steel

sludge directed into stream, kills fish from fishers

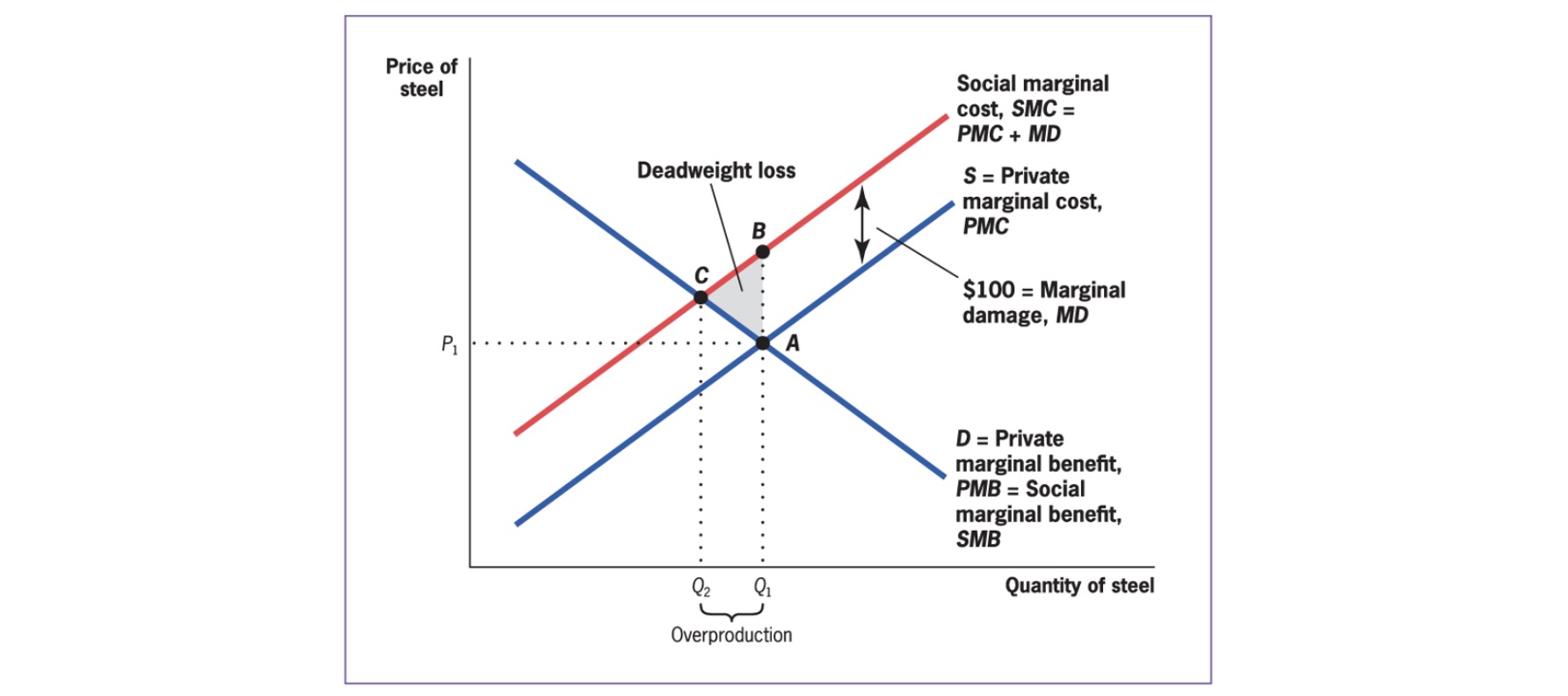

Externalities: SMC \(\neq\) PMC

Private Marginal Cost (PMC): direct cost to produce one good

Social Marginal Cost (SMC): PMC + costs imposed on others

Example:

Types of Externalities:

negative production: SMC > PMC

negative consumption: SMB < PMB (Private Marginal Benefit)

…

Solution: internalize Externalities

private negotiation

government solutions

Private Sector#

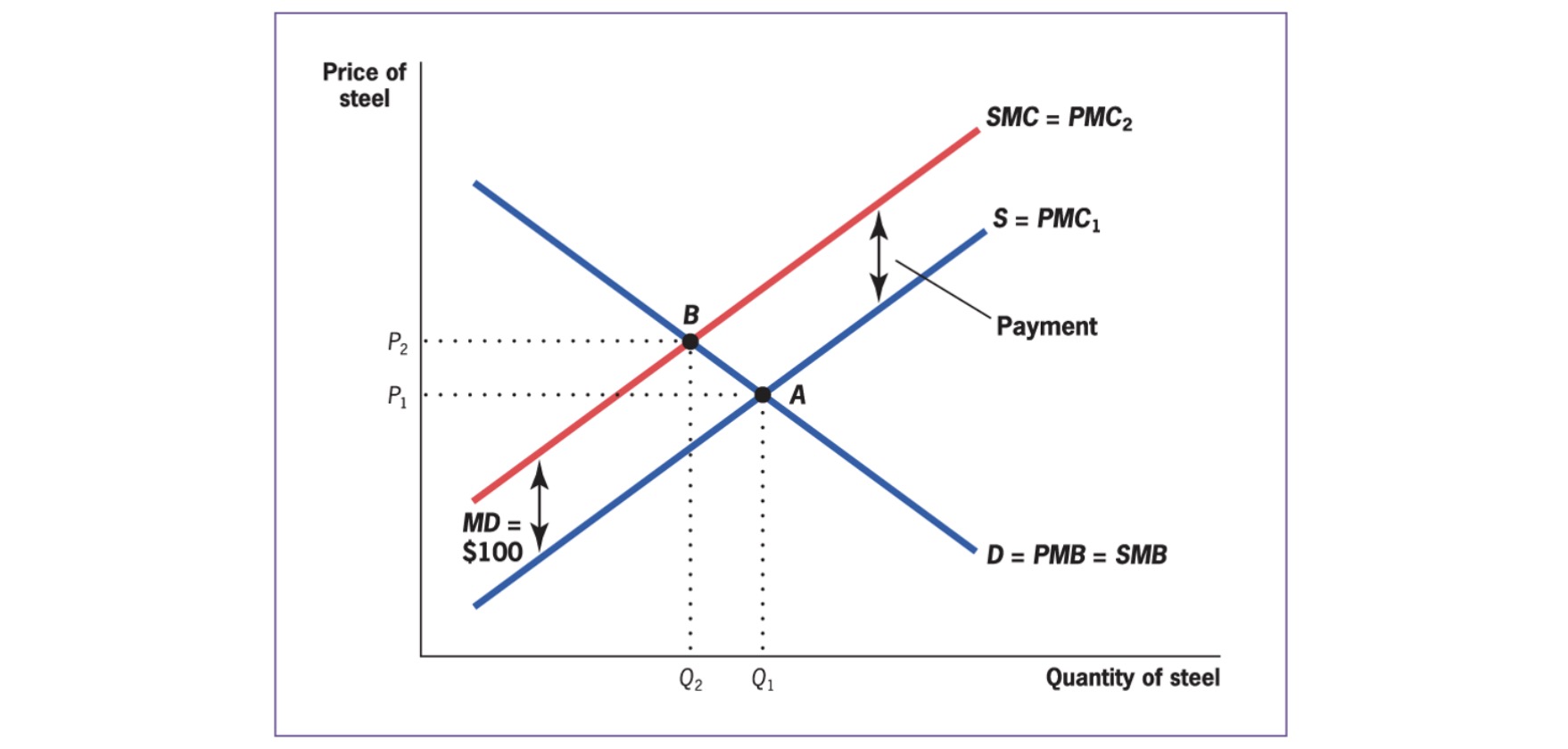

Coase Theorem: well defined property rights + negotiations => socially optimal market quantity

Example:

Fishers own the property rights

negotiate compensation with steel plant

Important: Efficient solution does not depend who owns the property rights!

Problems: (especially with many people)

Assignment Problem

who causes the damage?

how large is the damage?

Holdout Problem

shared ownership of rights = veto options

may demand enormous payments

Free Rider Problem

Transaction Costs / Negotiationg Problems

=> Coase only works with specific problems!

Public Interventions#

Instruments:

Taxation / Subsidies

internalize externality

correct tax = Pigou Tax

Regulation

regulate Quantities

complicated information needed

Price-Based Approach vs Quantity Based Approach

Distinction#

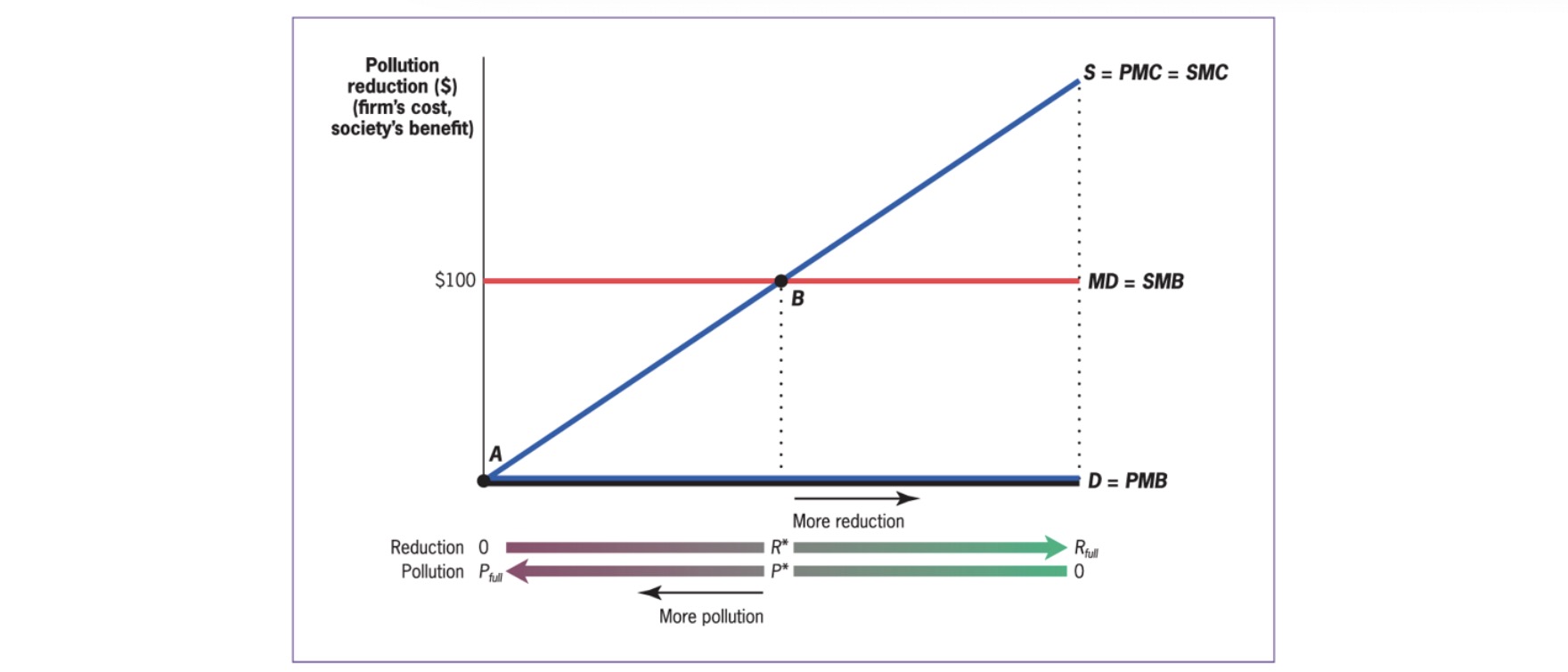

Right Amount of Pollution

A = free market

B = socially optimal: SMC = SMB

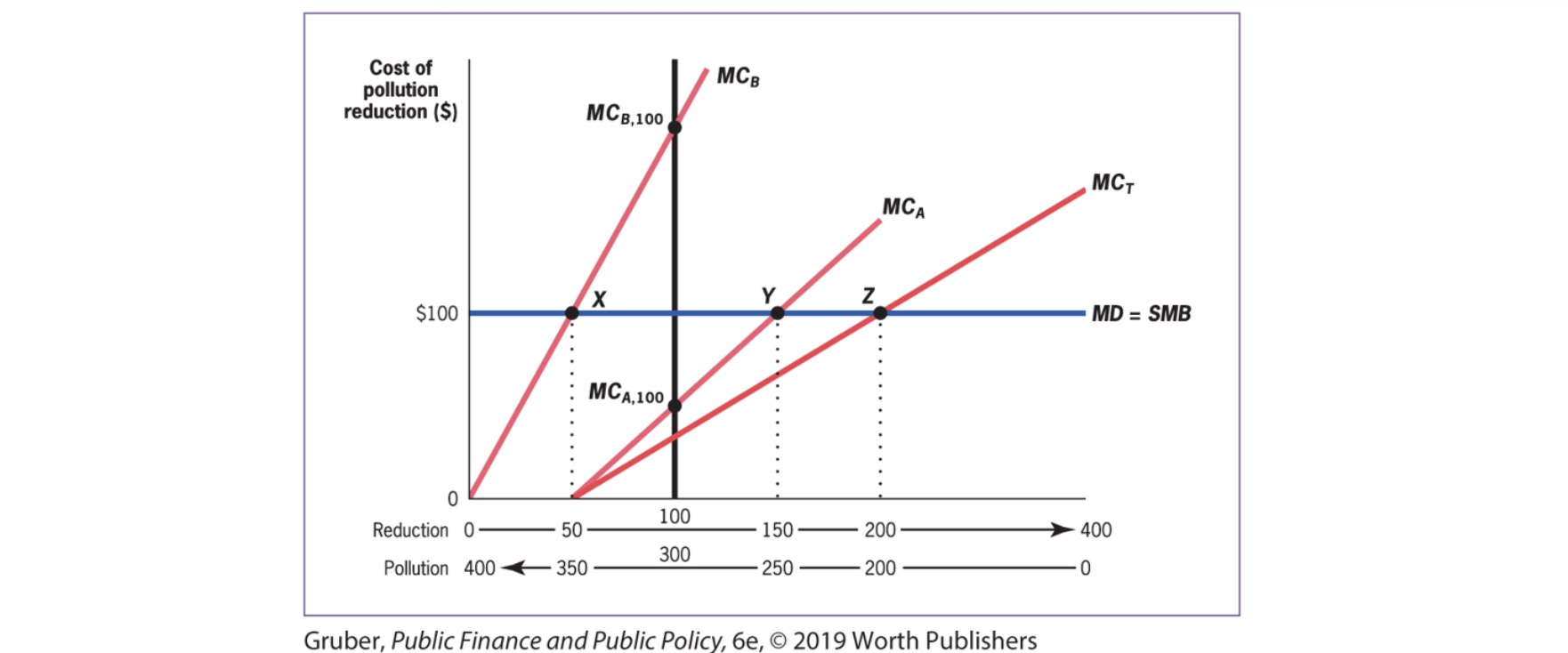

Example 1: Multiple Plants with differenct reduction costs

blue line = Tax (efficient)

black line = Regulation

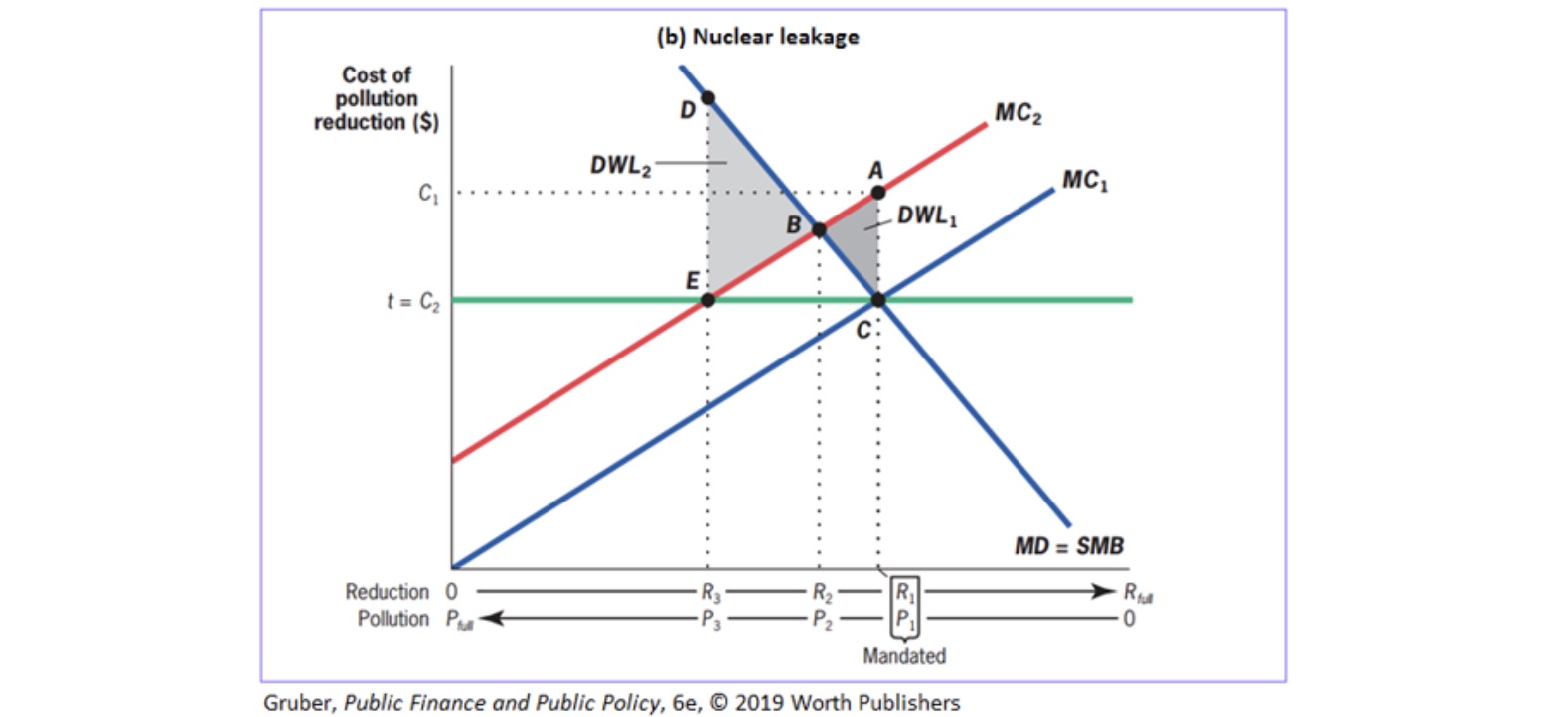

Example 2: unvertainty about costs

high SMB of Reduction => Quantity Based Approach (nuclear leakage)

Low SMB of Reduction => Price Based Approach (kg of carbon)

High SMB:

Assumption of MC1

C = Regulation and Tax

if real MC = MC2

E = Tax

A = Regulation

DWL Regulation < DWL Tax

=> when Quantity is important use Regulation, else taxes

Tutorial: Addition of Demands#

Vertical Summation = Add up at Quantity Q (Public Good)

Horizontal Summation = Add up Demands at Price P

Example Horizontal:

A: \(Q = 21-6P\)

B: \(Q = 6-3P\)

Addition of the Quantites at given Price $\( Q_1 + Q_2 = (21-6P) + (6-3P) = 27-9P \\ 9P = 27 \to P = 3 - \frac{ 1 }{9}Q \)$

Example Vertical

Solve indivudally for P (Demands from above)

A: \(P = \frac{ 7 }{2} - \frac{ 1 }{6}Q\)

B: \(P = 2 - \frac{ 1 }{3}Q\)

Sum up

Bike Paths Example#

individual Bike Path Demand

A: \(Q=24-4P\)

B: \(Q = 14-P\)

C: \(Q = 5-1/3P\)

Marginal Cost of one Path = 18

Version 1

town decides to tax evenly

asks residents, highest number answered gets build

\(MC = a+b+c\), here (a=b=c)

18/3 = 6 Cost Units

Demands at this Price (input P=6)

A: Q=0

B: Q=8

C: Q=3

=> Build 8 Paths

Version 2: Social Optimum

solve every Demand for P

sum Up => SMB

SMB = MC = 18, solve for Q

insert Q into individual Demand Functions