15.11.2023 Cost Benefit Analysis#

CBA: Comparison of Costs / Benefits of public goods / projects to decide if they should be undertaken

Measuring Costs#

Example Costs:

Capital Costs

Operation C.

Maintenance C.

Non-Monetary C.

but very important:

Opportunity Costs!

Rents

Opprotunity Costs in imperfect markets#

Project Hours = 500.000

project wage = 25$

but real comp. wage = 20$

Discounting#

how to count costs over time? discount value

Choice of r = very important

1% UBA

7% US Government

Measuring Benefits#

Value of Time Savings#

Approaches;

Martket based = wages

time savee = valuet at wage

problems: nonmonetary aspects of job

survey based

hypothetical questions

embedding effect = difficulty to value things in larger context

people dont know their valuations

revealed preferences

market prices = reveal the individual preferences

bias problem

Types of Revealed Preferences

Hedonic Market Analysis = regression with a lot of controls

Natural Experiments = naturally occuring variation in prices, how much people want to wait

e.g.: different prices at gas stations, but longer queues

Value of Lives saved#

= most difficult issue

Approaches:

Market based (lifetime wages)

poorer people = worth less

older people = worth less

survey based (value of statistical life)

ask for willingness to pay for certain risk

revealed preferences

compensating differential = higher wages for deadlier jobs (coal miners)

Problems:

Information

Probabilities

Bias

Heterogenity

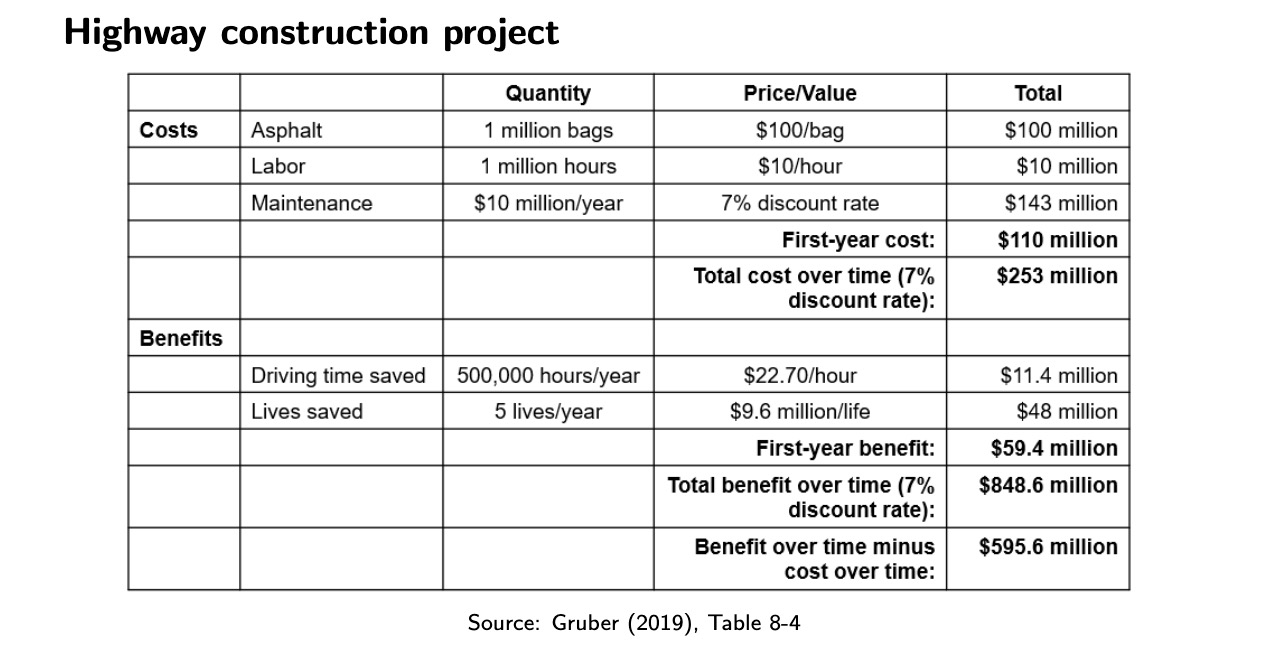

Example Project

Issues#

Counting Mistakes

Uncertainty (gov prefer certain projects = no risk = lower returns)

Distributional Concerns (Costs and Benefits to different people)

Alternative:

Cost-Effectiveness Analysis: projects with immeasurable benefits => most effective project for goal

Critique of CBA#

not part of the lectrúre, but very important (Wiki-Link)

Distribution

no account of dsitribution issues

only net-benefit for all people (Kaldor Hicks)

utilitarian approach (1$ for 1 million people worse than 2 million to one person)

Discounting

discounting value of benefits to future generations

ignore preferences of future generation

Marginal Utility

rich people = lower marginal utility

no symmetry in agents

Exercise#

Exercise 3: City of Metropolia

Example:

new Metro,

Commuters save 15 min driving time, 5 days a week, 50 weeks

Housing Price goes up 10000€

Discount Rate 5%

Math

Hours saved (valued today): \(15*5*50 = 3750 min = 62.5h\)

Present Discount Value: \(\frac{ 62.5 }{0.05}\)

set equal to house price increase: \(\frac{ 62.5 }{0.5}= 10000 \to 8\)

Value of hour saved = 8

Exercise 4

Country A: risk of death = 1/20000, Cost = 5000€

Country B: risk of death = 1/30000, Cost = 5600€

Value of Life:

Risk Difference \(\frac{ 1 }{20000}- \frac{ 1 }{30000} = \frac{ 1 }{60000}\)

Willingness to pay: 600$

Value of Life: \(\frac{ 600 }{1/60.000} = 36.000.000\)

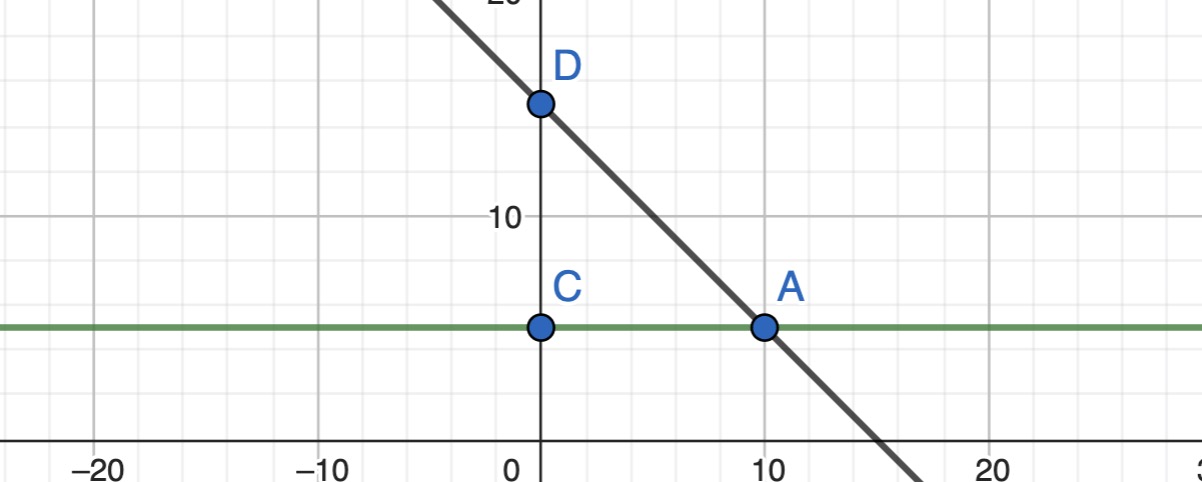

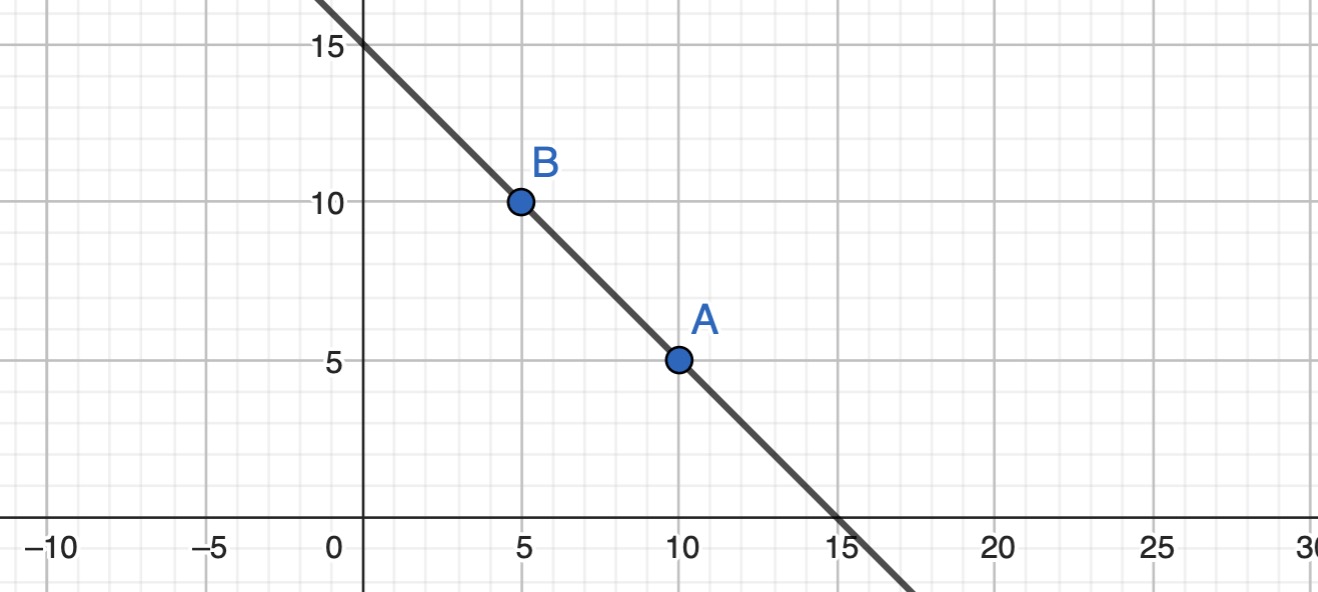

Exercise 5: Jellystone Park

City A: Price=5, Quantity = 10

City B: Price= 10, Quantity = 5

Calculate individual demand curve:

a*5+b = 10

a*10+b= 5

a*10+b = a*5+b-5

5a = -5

a = -1

-10 +b = 5

b = 15

=> -1x+15 = p

Consumer Surplus $\( \frac{ (Price_{intercept} - Price_{market}) * Quantity}{2} \)$

City A: \(\frac{ (15-5) *10}{2} = 50\)

City B: 12.5