27.04.2023 Banks#

Chapter 10: Banks, Money and Credit Market

Money = medium of exchange for trade (requires trust)

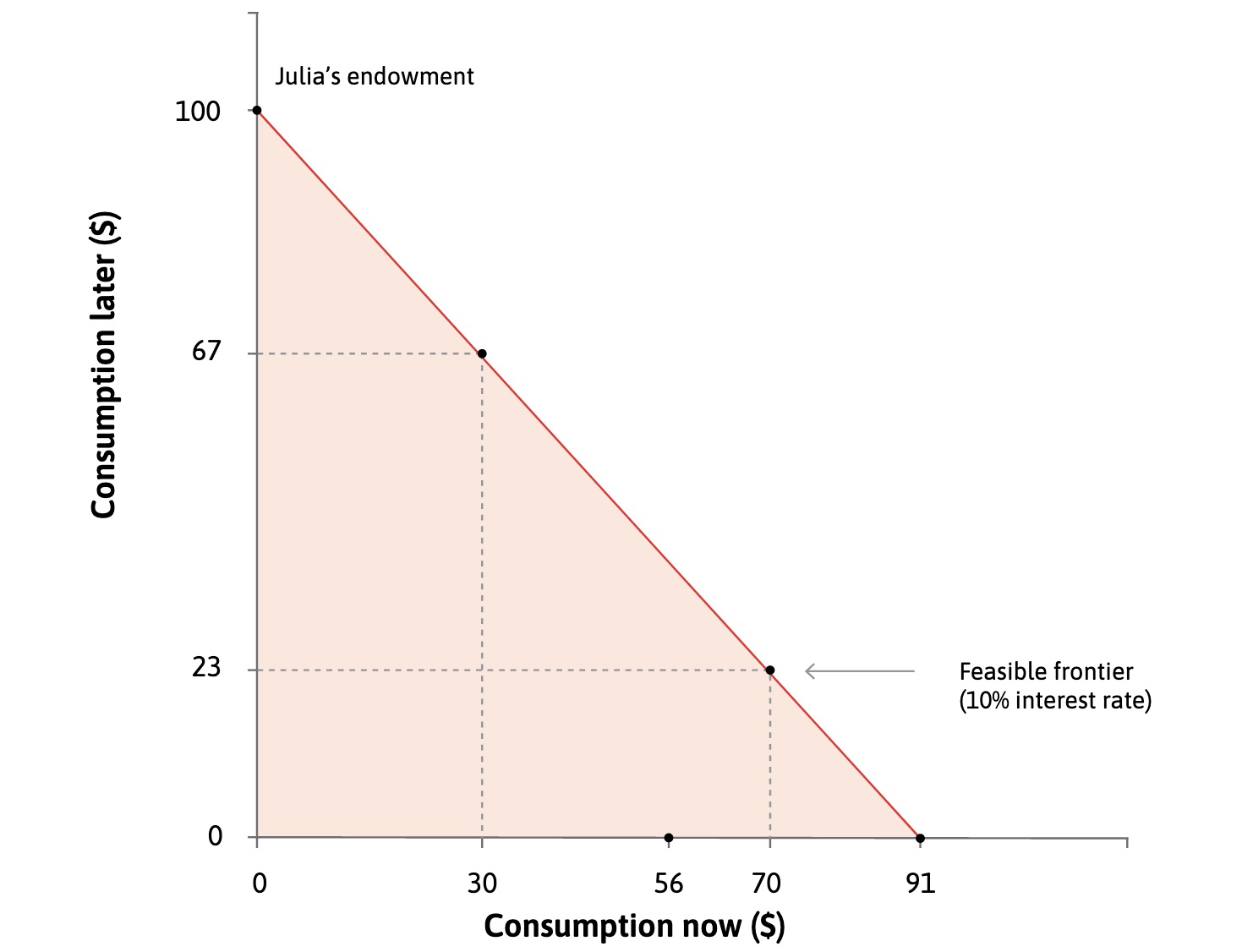

Intertemporal Optimization#

Borrowing brings consumtpion to Future

r = interest rate

tradeoff = 1+r

Repayment = principal + interest rate

\(91 (1+r) = 100\) , with r=10%

Decisions#

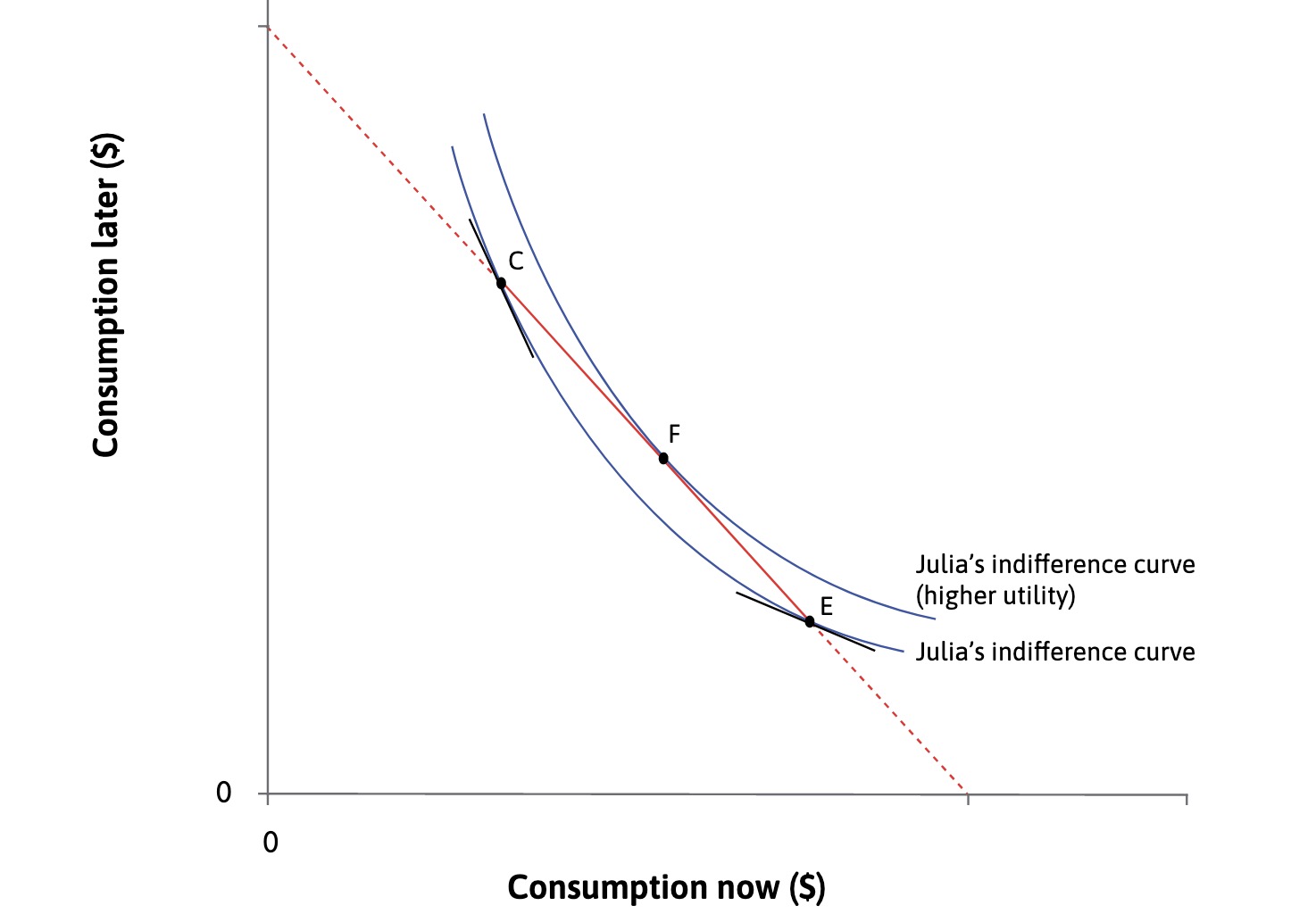

based on preferences of the consumer

individuals want to smooth consumption

overly high consumption in one period = costly

Impatience: Preference for present consumption

measured by discount rate

affected by desire to smooth consumption

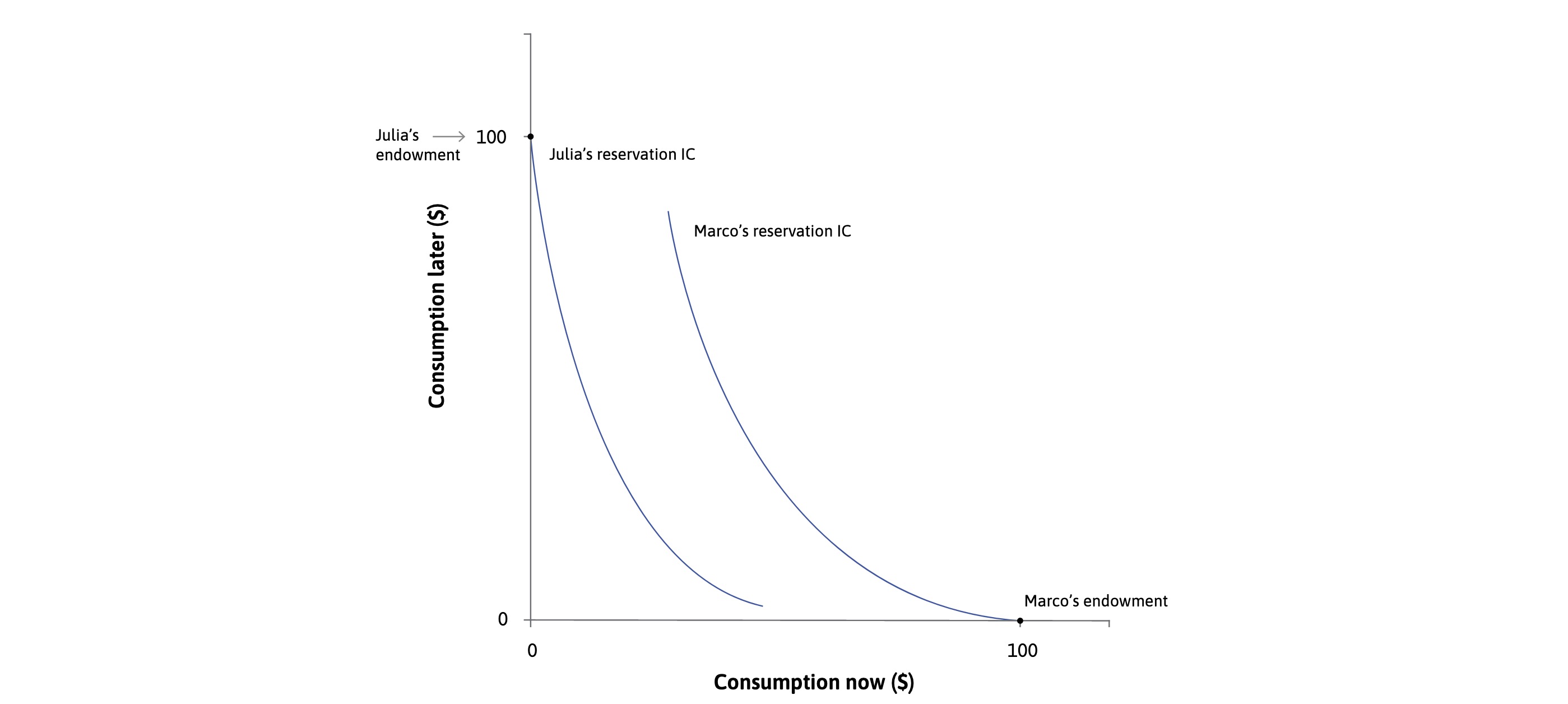

Equilibrium#

at Point where $\( MRS = MRT \implies 1+p = 1+r \)$ with different endowments

Julia = 100 in future (wants to borrow)

Marco = 100 now (wants to save)

Balance#

Assets = what person owns

Liabilities = what person owes

Net Worth = Assets - Liabilites

not impacted by borrowing etc.!

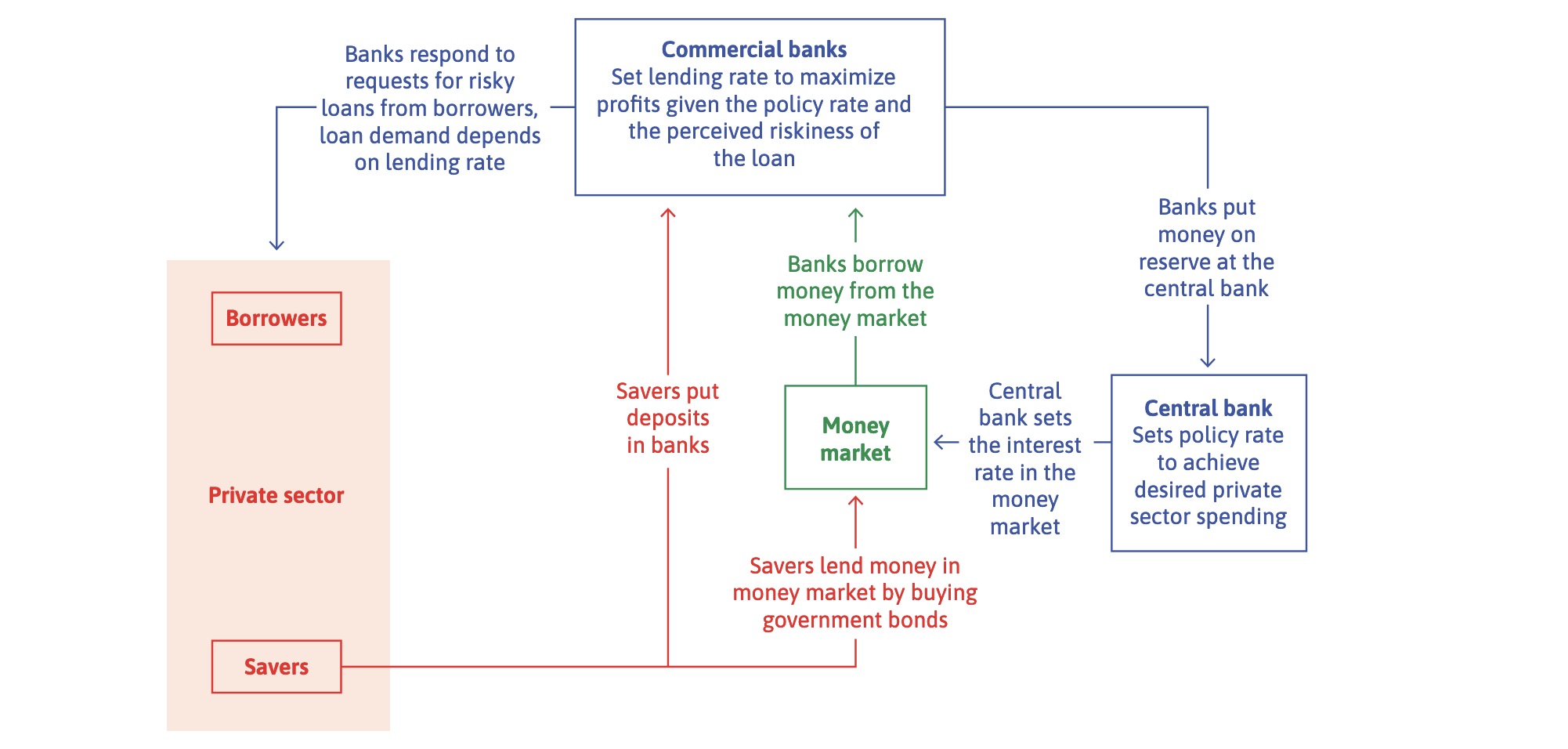

Banking System#

Definition

Bank: a firm that makes profits by lending and borrowing

Central Bank: bank owned by government with money creation monopoly

Structure of the System

policy interest rate = set by CB

bank lending rate = banks rate on consumer loans

banks set lending rate \(r > r^p\) policy rate and based on:

Risk of default

risk tolerance

amount of bank equity

degree of competition in banking sector

the higher \(r \uparrow \implies L^S \downarrow\) Liquidity Supply lower

Setting the Rate / Liquidity#

based on the interest rate

Formula for Rate $\( r = (1+ \mu^B) \ r^P ,\text{ with mark-up} = \mu^B \)$

Profit of a commercial Bank: $\( V_B = \frac{rL^S - r^p (L^S-D-e)}{e} -\frac{var(v)}{2 \tau}* \frac{L^S}{e}^2 \)$

r = lending rate

\(r^p\) = policy rate

\(L^S\) = credit supply

\(D\) = customer deposits

\(e\) = equity

\(\tau\) = risk tolerance

\(v\) = uncertain part of returns on loands

\(var(v)\) = riskiness of v

Terms explained:

\(rL^S\) = interest return on Loans

\(rL^S - r^p (L^S-D-e)\) = financing costs for credit not backed

\((\frac{L^S}{e})^2\) = Bank Leverage

\(var(v) * \frac{L^S}{e}^2\) = total risk of bank

Refinancing Options of Banks:

Interbanking Market

loans from CB

new deposits

Derivation

What is the optimal credit supply? $\( \frac{\delta V_B}{\delta L^S} = \frac{r-r^p}{e} -\frac{var(v)L^S}{\tau e^2} = 0 \)\( rewrite to determine the mark-up \)\( r - r^p = \frac{var(v)L^S}{\tau e} \\ \implies L^S = \frac{\tau e}{var (v)} * (r-r^p) \)$ logic: when to supply more?

higher risk tolerance \(\tau\)

higher equity \(e\)

larger proft margin (markup) = higher incentive to supply

higher risk = lower supply

Demand Liquidity#

credit demand of private sector $\( I = L^D = \bar{I} - a * r \)\( Equilibrium: \)\( \overbrace{\frac{\tau e}{var (v)} * (r-r^p)}^{Supply} = \overbrace{\bar{I}-a*r}^{Demand} \)\( solve for r \)\( r [\frac{\tau e}{var (v)}+a] = \frac{r^p \tau e}{var(v)}+ \bar{I} \\ \)\( leads to: \)\( r = \frac {\frac{r^p \tau e}{var(v)}+ \bar{I}} {\frac{\tau e}{var (v)}+a} = \frac{r^p + \frac{\bar{I}* var(v)}{\tau e}} {1+ \frac{a * var(v)}{\tau e}} \)$ Conclusions: interest rate increases:

with higher autonomous demand I : more competition for loans

with higher policy rate \(r^p\)

=> in exam: do math and get points