17.01.2024 Tax Ineffiencies#

Tax system = balance equity and efficiency

without Taxes: Social Margin Benefit (SMB) = Social Marginal Cost (SMC)

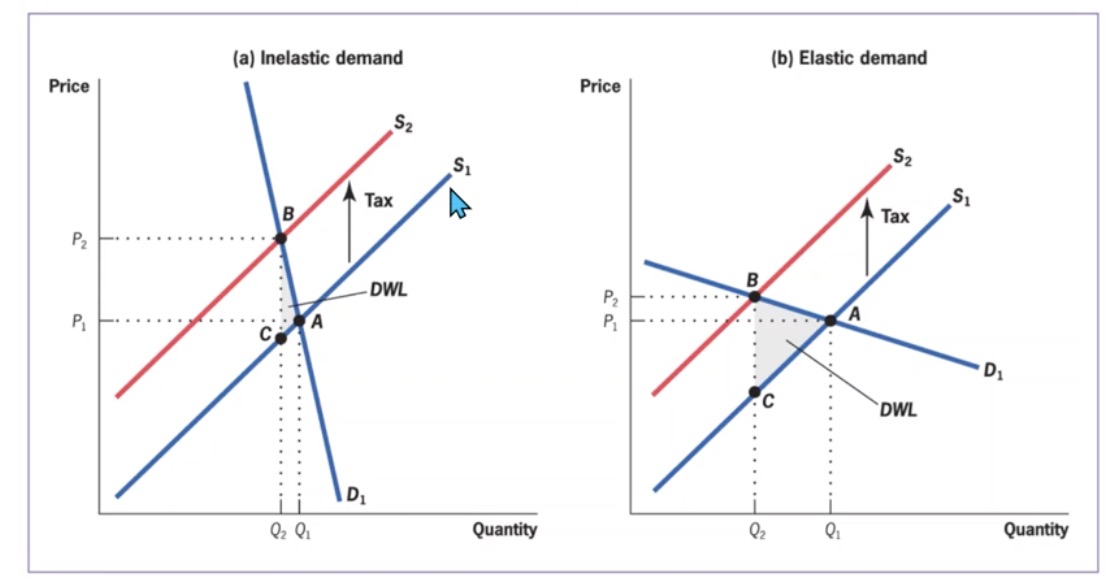

with Taxes: Deadweight Loss, depends on

Tax height

elasticities (inelastic = lower DWL, higher tax rev)

Deadweight Loss#

DWL Formula (not relevant!) $\( DWL = - \frac{ \eta_s \eta_d }{2(\eta_s - \eta_d)}\times \tau^2 \times \frac{ Q }{P} \)$

\(\eta\) = elasticities

\(\tau\) = Tax rate

Implications

effiency depends on preexisting distortions

e.g. taxing positive externalities = very inefficient

progressive tax system = higher DWL

higher tax rate for rich = higher DWL

low long running taxes > short high taxes (e.g war financing)

empirical: DWL is smaller than in theory!

individuals perceive taxes different

they are used much better than private!

Optimal Commody Taxation#

by Frank Ramsay: ratio of marginal DWL = marginal Revenue

Formula:

ratio \(\lambda\) = should besame for all goods

Example

increase taxation on B

lower on A

-> elasticity rule: good with higher elast. = lower tax

but not good for equity (caviar = high elast, wheat = low)

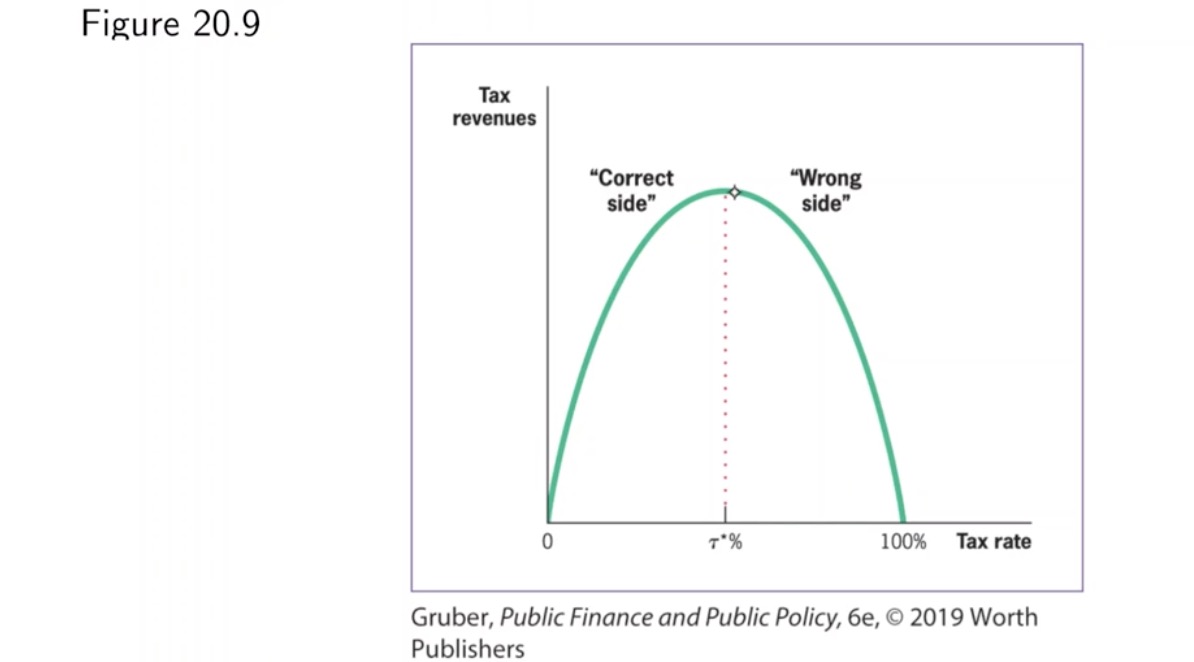

Optimal Income Taxes#

optimal syste,

total income in society = fixed

same utility function

After = everyone same income

Lafffer Curve = bullshit, not empirical!

What to include in Tax Policy

vertical equity = high tax on rich

behavioral responses

Formula: \(\frac{ MU }{MR} = \lambda\) same for all

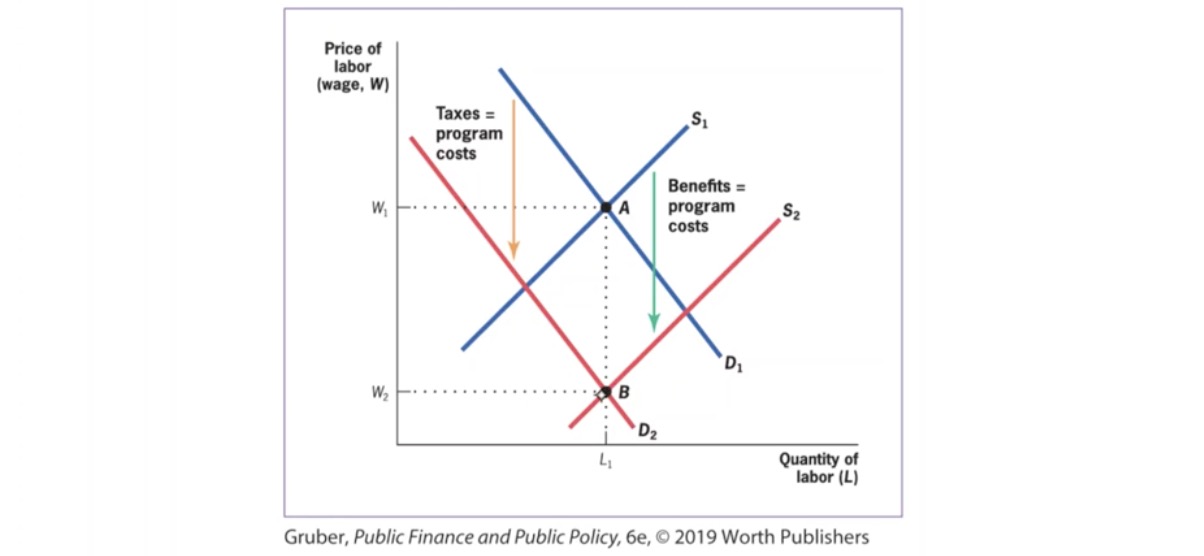

Tax-Benefit Linkages#

Earmarked Taxes: taxes collected and spent for specific purpose (e.g social insurance)

lowers inefficiency

benefits are distributed back

Example: benefits are valued same as tax loss