30.01.2024 Test Exam#

Parts of the Exam

Single Choice = 16 Points (8 Q., 2 Points per Q.)

Big Task with Subtasks = 24 Points

Drawing Task = 20 Points

= 60 Points

Mock Exam Solutions#

1. Task: Single Choice#

Problem Number) and Solution

I) 2

II) 1

III) 3

IV) 3

V) 4

VI) 1

VII) 2

VIII) 2 (asymmetric information problem learn more)

2. Task#

weird example nation with:

Supply of Labor: \(H = 50W\)

Demand for Labor: \(H = 2100-10W\)

H = quantitiy of Hours, W = Wage

a) Income Tax of 15$

Normal Equilbrium

After Tax

=> higher price, less quantity

Deadweight Loss = \(\frac{ 1 }{2}T * \Delta Q\)

b) poportional tax of 20%

before Tax = same

After tax:

Deadweight Loss

=> lower DWL in proportional tax scheme

c) taxing luxury goods

Pro:

higher equity (progerssive taxation)

lower inequality

War = nation assembly for common goal

Con

tax evasion

inefficient (Ramsey Rule)

3. Drawing Task#

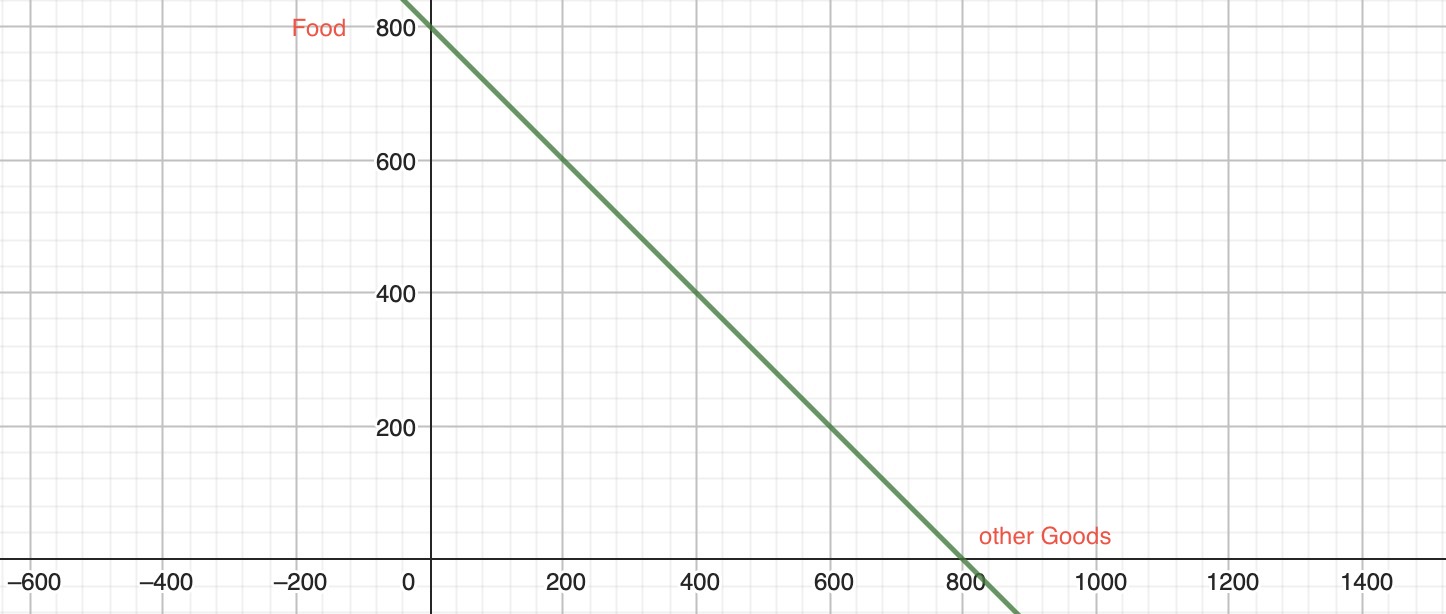

Julia:

Income = 800$

Two Goods = Food / other Goods (each 1$)

a) Simple Budget Constraint

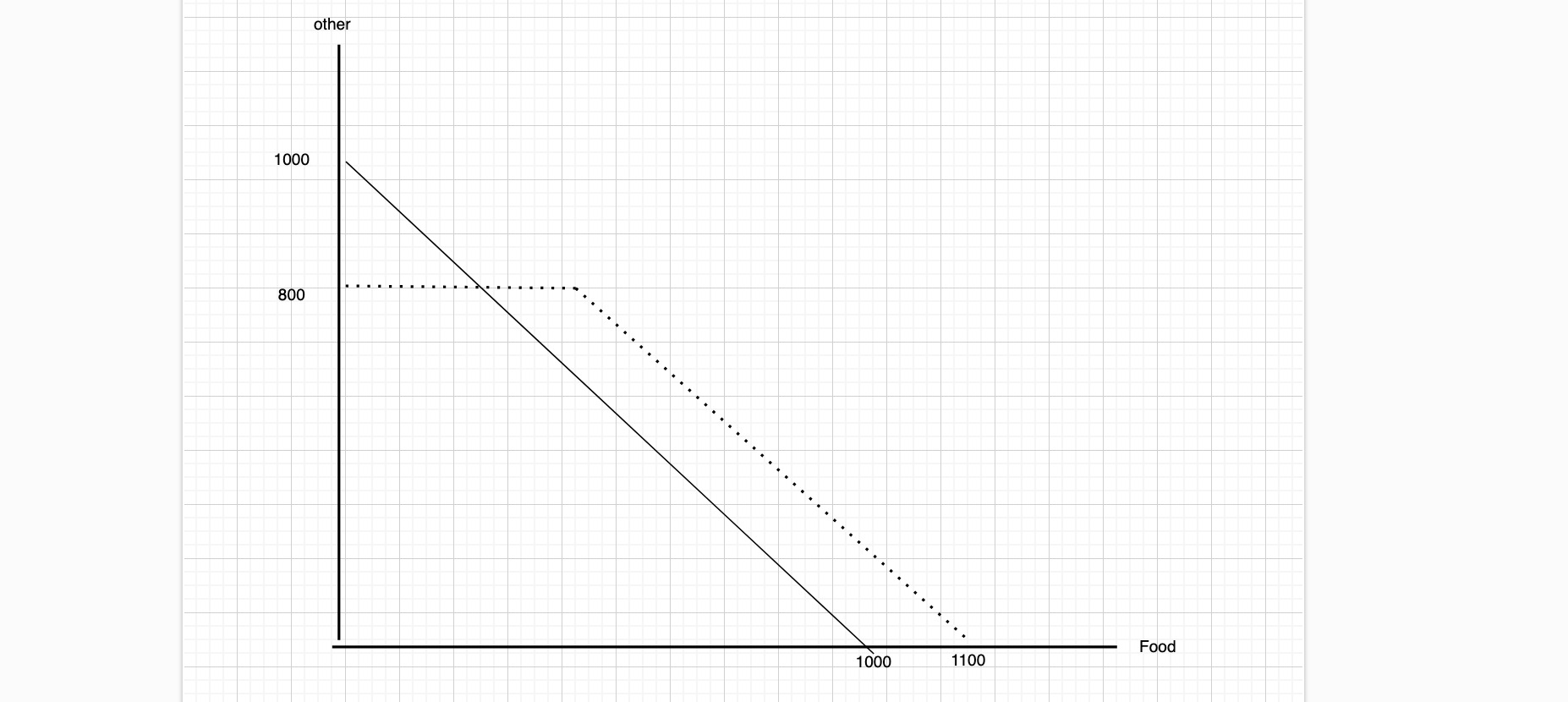

b)

Program A: 200$ Subsidy

Program B: 300$ Food Subsidy

inverse Scales!

c) indifference Curves

A = likes Program A more

B = likes porgram B more

C.= indifference

d) in kind welfare program worth 300$

Effects

if food same as bough before = no difference

if food not liked = bad effect

Exam Hints#

look strongly at:

Public Goods

Taxes